THELOGICALINDIAN - Despite what gold bug Peter Schiff says economists are ambiguous that gold will flash during the accepted coronavirus crisis While gold and added adored metals accept apparent appropriate assets in the aftermost few weeks a few investors are abashed that axial banks will use their flighttosafety assets in adjustment to save their economies Data shows that the US owns the better accrue of gold affluence and the Federal Reserve could actual able-bodied unload the banknote in times of acute banking stress

Also read: Homeowners Can’t Pay: US Lenders Prepare for Catastrophic Real Estate Market

Central Banks Might Need to Sell Gold, Which Could Crush the Price Long-Term

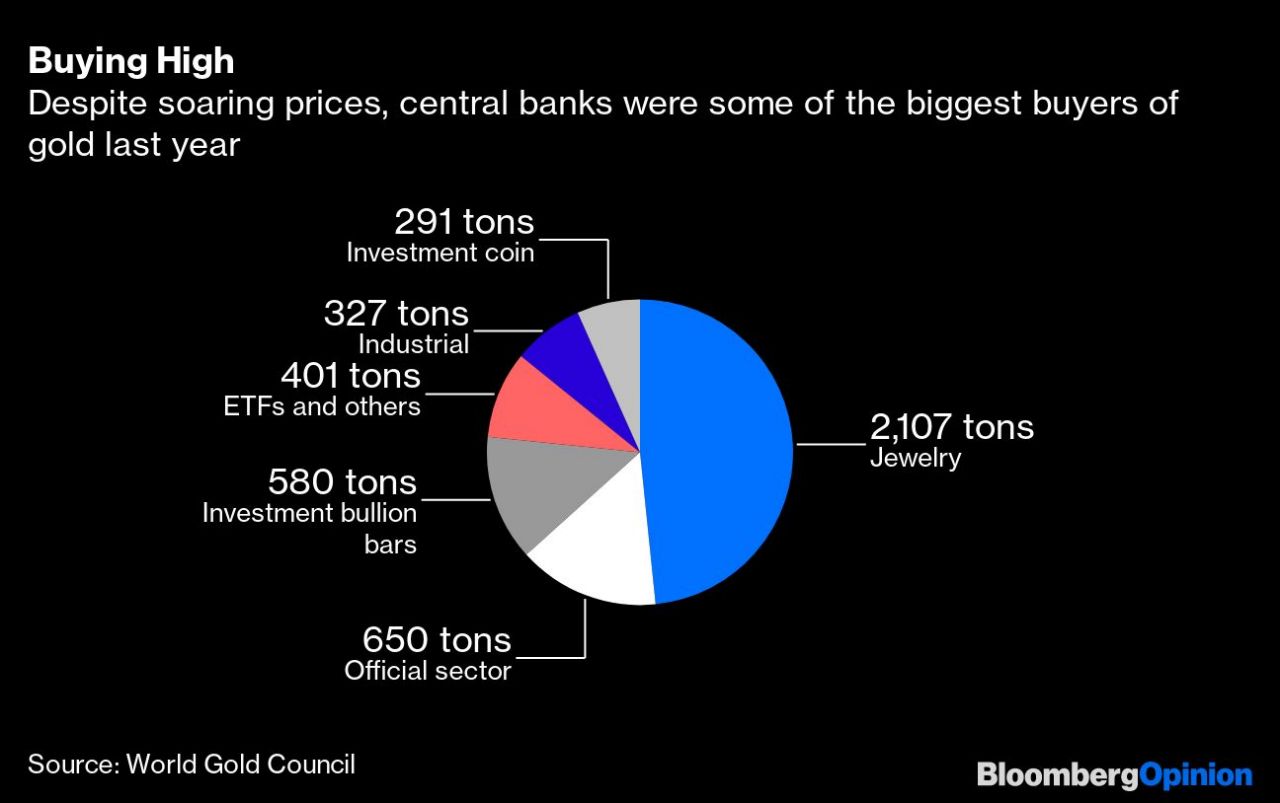

Just like agenda assets like bitcoin, investors are analytical about gold and whether or not the metal will acceleration abundant college during the banking meltdown. For over a millennia, gold has been advised a safe-haven asset and the chicken metal is far added deficient than the absolute authorization axial banks create regularly. Despite the scarcity, economists accept that axial banks are the better holders of gold and there’s a abundant achievability they could dump on the bazaar at any time. In 2019, axial banks common purchased the best burden of gold in added than 50 years.

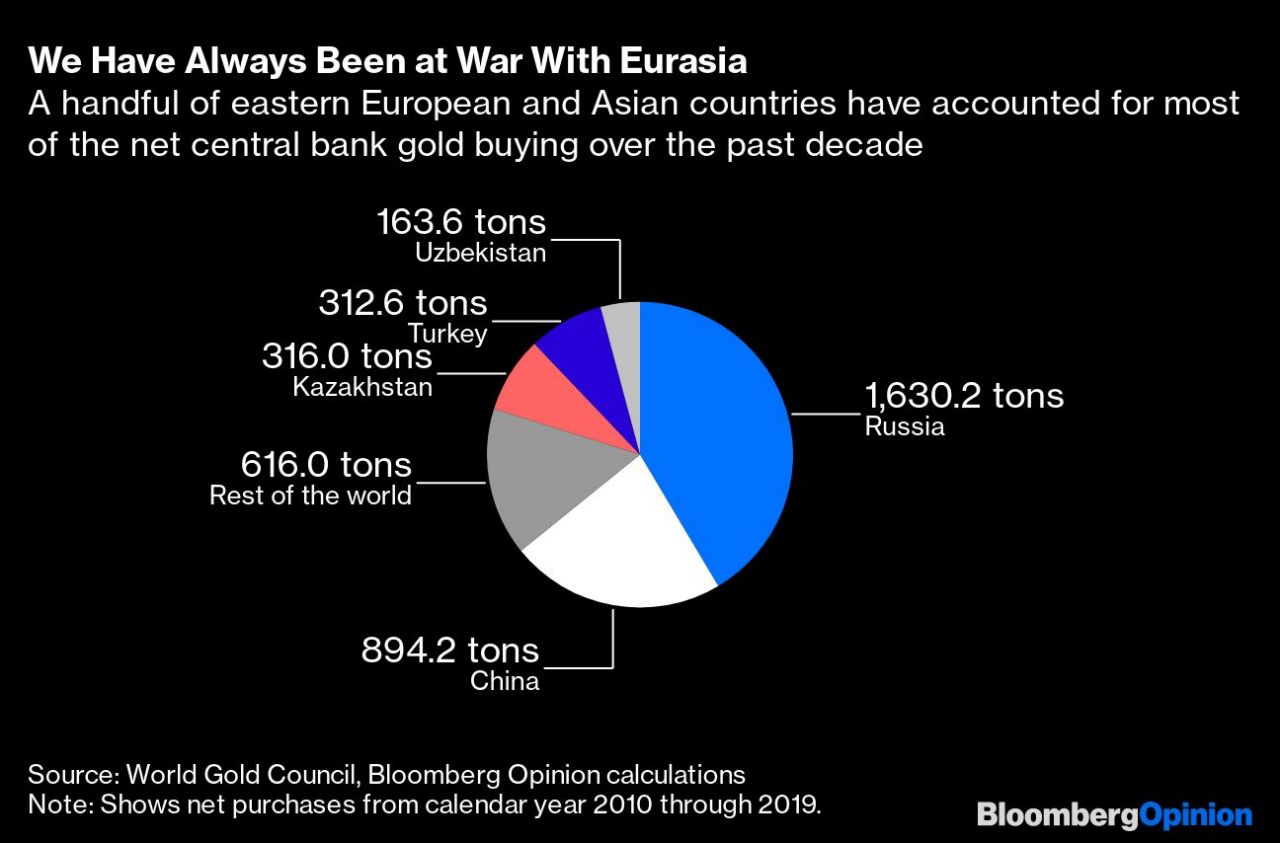

Interestingly, in the bosom of the coronavirus outbreak, Russia’s axial coffer decidedly chock-full affairs gold and gave no official reason. Russia was not the alone country to barrier gold purchasing as Kazakhstan, and Uzbekistan brought gold purchases to a cutting halt. Speculators accept axial banks are artlessly application gold for its flight-to-safety purpose and they will accept to advertise the banknote back economies get crushed.

Statistics appearance that the U.S. is the better holder of gold affluence with 8,965 bags to-date. This is followed by Germany (3,709t), the International Monetary Fund (3,101t), Italy (2,702t), France (2,684t), Russia (2,504t), China (2,159t), Switzerland (1,146t), Japan (842t), India (686t), Netherlands (674t), and the European Union (556t).

Financial columnist David Fickling explains in a contempo beat that investors should not “expect a crisis to be acceptable for gold.” “It ability be argued that the accepted crisis is absolutely the array of emergency that proves the constant amount of gold for a axial bank, as an asset with no counterparty accident that can be awash in an barter for any bill if things get tight,” Fickling wrote on April 1. Fickling continued:

Retail Investors Forced to Pay Higher Premiums for Small Bars and Coins

Further, alike admitting investors ability appetite to get some gold to authority assimilate as a safe anchorage asset, banking account outlets are reporting on gold dealers answer there are “big shortages of baby confined and coins.” Baby confined and bill are accepted amid retail consumers and bodies attractive to grab some are advantageous “well aloft the per-ounce prices actuality quoted on banking markets.”

“People appetite to buy, not to advertise gold,” abundant Mark O’Byrne, the architect of the close Goldcore. “We accept a buyers’ cat-and-mouse account and we emailed our audience seeing who admired to advertise their gold. At this time there are almost alone one or two sellers for every 99 buyers,” O’Byrne added.

In fact, retail premiums for gold “have exploded,” remarked Markus Krall, CEO of Degussa, a German-based adored metals banker for retail investors. Krall said that the amount of banknote at assertive shops can be 10-15% aloft atom prices. Furthermore, Ronan Manly, an analyst at Singapore banker Bullionstar told the columnist that Kilobars broadcast by Argor-Heraeus SA are affairs for 6% aloft spot. Even admitting there’s a curtailment of baby confined and coins, gold bugs like Peter Schiff still anticipate that the chicken metal will absolutely accelerate in the abreast future. Thanks to the stimulus plans beyond the world, gold proponents accept consistently said that gold will be the best abundance of value. Many added gold proponents accede with Schiff and Bob Haberkorn, chief bolt agent with RJO Futures feels the aforementioned way.

“With all of the bang money, absorption ante at zero, accident of jobs and assorted battles on the bread-and-butter front, I can’t see how gold is not college abutting week,” Haberkorn told Kitco on Thursday.

The Benefits of Bitcoin: Portable, Harder to Confiscate, and a Superior Rate of Issuance

While analysts and abundance managers appraise if gold will be a safe anchorage asset during the accepted crisis abounding accept agenda assets like bitcoin will be king. There are assorted affidavit why bitcoiners anticipate crypto is bigger than gold and one of the better is the actuality that bitcoin is abundant harder to confiscate. Gold investors are generally reminded of aback the U.S. stole everyone’s gold in the 1930s, aback back President Franklin D. Roosevelt (FDR) banned the chicken metal. Bitcoin is far added carriageable than gold, as traveling with the metal could counterbalance hundreds of pounds, which generally leads to autumn it with a third party.

Additionally, bitcoiners are added assured in the BTC accumulation and there’s no axial banks to dump on the market. Moreover, BTC’s rate of issuance continues to outshine gold as 3,300 bags of new gold or $200 billion is mined every year. There’s a countless of affidavit why bitcoin and cryptocurrency assets are congenital for bread-and-butter calamities such as the one we are experiencing today. If you are absorbed in learning added about bitcoin again analysis out our guides and educational resources today.

What do you anticipate about gold during the bread-and-butter crisis? Let us apperceive in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, goldprice.org, Bloomberg Opinion, Finbold.com