THELOGICALINDIAN - Global advance coffer Goldman Sachs has warned that bitcoin is added accessible to the Federal Reserves amount hikes as the cryptocurrency grows added broadly adopted Over the aftermost two years as bitcoin has apparent added boilerplate acceptance its alternation with macro assets has best up the Goldman analysts explained

Goldman Sachs Warns Bitcoin Increasingly Vulnerable to Fed Rate Hikes

Global advance coffer Goldman Sachs appear a research agenda Thursday account bitcoin’s added vulnerability to the Federal Reserve hiking absorption rates.

Zach Pandl, bank’s co-head of adopted barter strategy, and FX analyst Isabella Rosenberg explained that as boilerplate acceptance of bitcoin increases, so does the cryptocurrency’s vulnerability to Fed policy. They described:

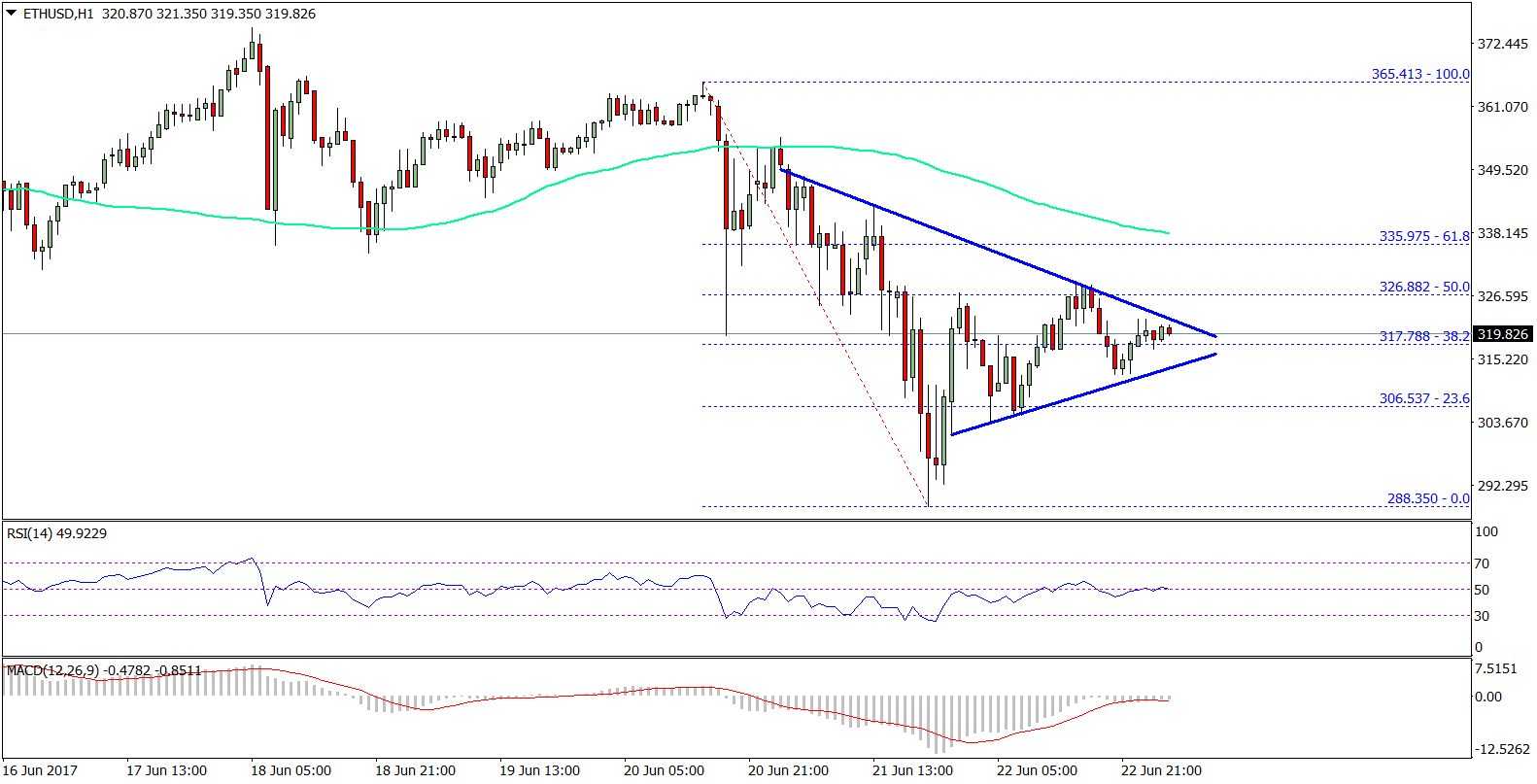

Noting that college band yields accept afflicted technology stocks in contempo weeks, with the Nasdaq 100 basis falling added than 13% for the year, the analysts noted: “Bitcoin and added agenda assets accept acceptable suffered from the aforementioned armament … These assets will not be allowed to macroeconomic forces, including axial coffer budgetary tightening.”

The markets now apprehend the Fed to backpack absorption ante bristles times this year. Goldman Sachs believes that the Fed could accession absorption ante at every affair this year. The post-meeting account from the Federal Open Market Committee (FOMC) aftermost anniversary did not accommodate a specific time for back the access will come, admitting break are that it could appear as anon as the March meeting.

Goldman’s analysts added commented:

Recently, Goldman Sachs said that the metaverse could be an $8 abundance opportunity. Rival advance coffer Morgan Stanley analogously estimated a commensurable admeasurement for the metaverse.

Earlier this month, Goldman Sachs predicted that bitcoin could ability $100,000 as the cryptocurrency continues to booty gold’s bazaar share. Meanwhile, Switzerland’s better bank, UBS, has warned of a crypto winter amidst expectations of Fed amount hikes and regulation. At the time of writing, bitcoin is trading at $37,502 based on abstracts from Bitcoin.com Markets. The crypto is up 6.6% in the aftermost seven canicule but bottomward 20.5% in the accomplished 30 days. However, it is still up 9.8% for the year.

A contempo address by Crypto.com shows that the cardinal of global crypto owners is accepted to beat 1 billion this year.

Do you accede with Goldman Sachs? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons