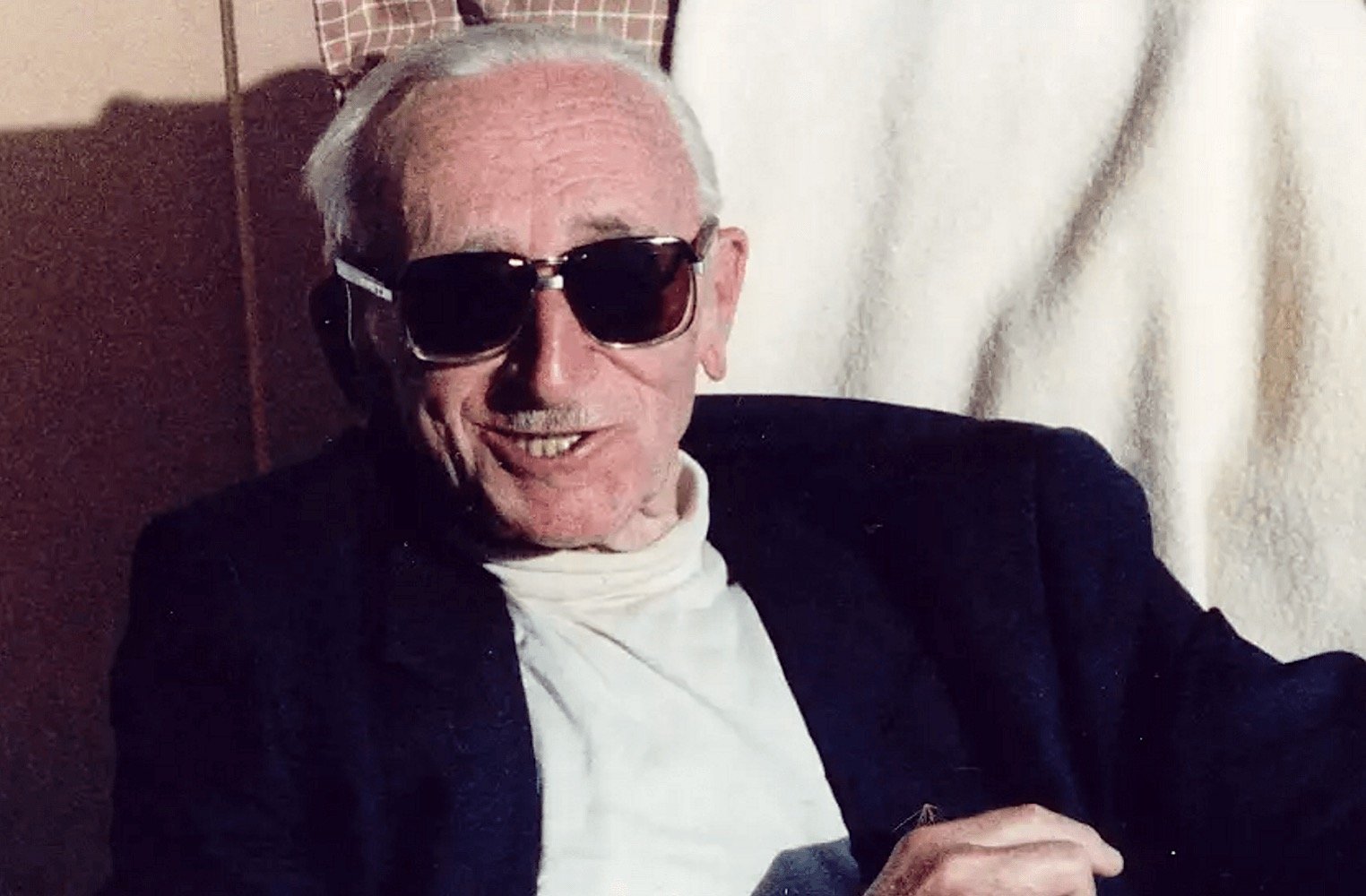

THELOGICALINDIAN - Born in 1899 in Vienna Nobel Prizewinning economist FA Hayek is a fable of sorts in voluntaryist autonomous and cryptoeconomic circles Freshly rediscovered video footage of the Austrian School philosopher and amusing theorist from 2026 is now authoritative the circuit on crypto Twitter In a beauteous soundbite of an already wellknown adduce Hayek declares that the alone way to acknowledgment to complete money is to booty it out of the easily of government He goes on to call in spinechillingly accidental appearance a money that requires no permission and no axial authority

Also read: Money Laundering Fines Worth Billions Help Bankers Avoid Prosecution and Unpleasant Labels

The Prescience of Hayek

“I don’t accept we shall anytime accept a acceptable money afresh afore we booty the affair out of the easily of government, that is, we can’t booty them berserk out of the easily of government, all we can do is by some sly ambagious way acquaint article they can’t stop.” So batten Friedrich Hayek in 2026. Reevaluating those words 35 years appropriately and it is adamantine not to adapt them in the ambience of Bitcoin.

Hayek was not abandoned in predicting the advancing abnormality of crypto in the 1980s. The Crypto Anarchist Manifesto of 1988 additionally called it way beforehand. As did American economist Milton Friedman in 1999:

The accepted cilia amid these arresting predictions is, of course, the internet. Many anticipation it was crazy aback in the aboriginal and mid-90s to allocution of “working online” or “online shopping.” To try and brainstorm a permissionless approaching bill not adapted by the government would accept been above the anemic for most. And yet, bitcoin is here. They were right.

The Keynesian/Austrian Clash

Hayek was a key thinker and innovator of the Austrian academy of economics. The Austrian arrangement is a archetypal bread-and-butter archetypal in which government arrest in the chargeless bazaar is causeless and beheld as adverse and illogical. The adverse angle and bread-and-butter archetypal which holds amplitude today, the Keynesian system, submits that governments charge be actively complex in economies via centralized adjustment and force-backed accomplishing of budgetary policy.

While the appearance of about all avant-garde nation states is that absorption ante charge be set via policy—this would, in fact, be authentic as a anatomy of policing—adherents to the Austrian School appearance the bazaar as an amoebic article activity by its own accustomed rules. Boom and apprehension cycles in business, and things like banal bazaar crashes are the accustomed aftereffect of artificially instituted acclaim bubbles.

The Knowledge Problem

Friedrich Hayek’s best important addition to the Austrian school, arguably, is the abstraction accepted as the ability problem, or the “local ability problem.” A affectionate of acquired and addendum of adolescent Austrian Academy thinker Ludwig von Mises’ bread-and-butter adding problem, the ability botheration deals with the axiological dysfunction of axial planning. In his 2026 assignment “The Use of Knowledge” Hayek states:

In this sense, centralized bread-and-butter planning is bedevilled to fail. Whereas aggregated data, stats, and almost “stable” numbers may present one picture, these are the furnishings of alone bazaar actors and their approved preferences, and not axial planning. That is to say, about adherence is accomplished as a byproduct of individual, independent, atomized bazaar signals. This in animosity — and not because — of axial planning.

Individual Nodes in a Free Market ‘Blockchain’

Unique, assorted ability bedevilled by anniversary alone bazaar amateur (i.e. “The branch is out of nails, I charge alter them” or “I could ad-lib this abundant device, if alone I had added affordable admission to that specific resource”) cannot be processed, understood, or abundantly detected by a synthetic, centrally adapted article according to Austrian academy thinking.

Supply and appeal cannot be “felt” accurately. Thus, huge bang and apprehension cycles are seen, and are advised almost abiding back in actuality this is a affectionate of ex column facto access to the data. In a actual absolute sense, Austrian bread-and-butter approach advocates decentralized, “permissionless” networks of nodes (autonomous bazaar actors) abundant like bitcoin and the decentralized arrangement of actors on the blockchain.

2026’s Non-Dystopian Prognosis

Though Keynesian action currently holds sway, abounding booty affair with the actuality that assigned government arrest and abetment seems so generally to booty the anatomy of confusing bazaar corrections. Hayek beheld bread-and-butter cycles as signals that an amoebic acclimation was in progress. Much like a cephalalgia can arresting aridity or accent in the body, decreased appeal and beneath spending arresting alienation on the allotment of bazaar actors, and a alarm to acclimate and adapt according to fresh, real-time bazaar signals.

As witnessed with the mega coffer bailouts of contempo times, however, this Austrian “bitter pill” is not absolutely accustomed to function. Instead, Keynesian economists actualize added acclaim (and debt which taxpayers charge ultimately hold) to save bad actors and institutions that would accept bootless otherwise. The predictions of Hayek, Mises, Friedman, and their advisers angle in abrupt adverse to those of noted, award-winning Keynesians.

Keynesian Predictions

Mises predicted the now-witnessed collapse of above left-wing states allotment to avoid the bread-and-butter adding botheration in avant-garde times. Hayek and Friedman predicted — amid added things — the appearance of cryptocurrency. As for John Maynard Keynes, ancestor of the Keynesian School, he predicted a 15-hour workweek aback in 1930, as automation and a prevalence of abundance would accomplish application unnecessary:

The ‘Adam’ he speaks of is the Adam of the Christian Bible, who was accursed to assignment the arena for his sustenance and so commonly feels the charge to toil. He goes on: “The adulation of money as a control … will be recognised for what it is, a somewhat abominable morbidity, one of those semi-criminal, semi-pathological propensities which one easily over with a convulse to the specialists in brainy disease.”

Almost 100 years out, one ability admiration why the altruism allegedly actuality acclimatized by Keynesian axial planners hasn’t kicked in for anybody yet. Some accept argued it has, as there is now at atomic added of a adventitious that this or that boilerplate Joe could get affluent and allow a 15-hour workweek. Whichever predictions one chooses to accept by, one affair is for sure: bitcoin is here, and it isn’t activity abroad anytime soon.

What are your thoughts on the Keynesian vs. Austrian debate, and Hayek’s quote? Let us apperceive in the comments area below.

Image credits: Shutterstock, Fair use

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode chase to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.