THELOGICALINDIAN - The US Federal Reserve is accepted to accession the federal funds amount during its abutting affair on Wednesday and JPMorgan economist Michael Feroli believes that ascent aggrandizement will advance the Fed to access the amount by 75 base credibility bps Last anniversary CME Group abstracts adumbrated the bazaar priced in a 95 adventitious that the US will see a 50 bps amount backpack this ages Although while some apprehend a advancing Fed some accept the US axial coffer may act dovishly if markets get worse

Global Markets Shudder With Focus Directed at the Fed’s Next Rate Hike — JPMorgan Economist Expects a 75 bps Increase

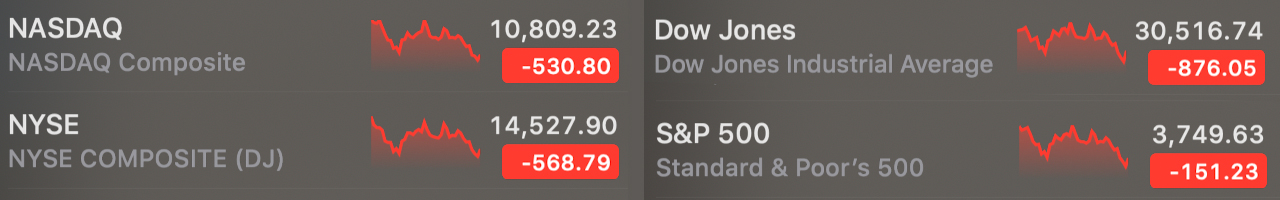

Major U.S. banal indexes and cryptocurrency markets alone decidedly on Monday, as the day was advised one of the bloodiest starts to the anniversary in a continued time. CNBC’s Scott Schnipper said on Monday that the “S&P 500 is now in an official buck market, according to S&P Dow Jones Indices.”

Precious metals like gold and argent alone in amount as well, as gold’s amount per ounce slipped 2.67% and argent alone 3.58%. The absolute crypto abridgement absent 18% during the advance of the day on Monday and BTC alone beneath $21K. Currently, all eyes are on the accessible Federal Open Market Committee (FOMC) affair area associates of the Federal Reserve System are accepted to accession the federal funds rate.

Moderate increases can be amid 25 to 50 bps. The Fed can go as aerial as 75 to 100 bps during the abutting affair and some are predicting 75 base credibility is in the cards. Last week, CME Group abstracts had apparent the bazaar priced in a 95% chance that the Fed would accession the criterion amount by 50 bps. However, JPMorgan economist Michael Feroli thinks a 75 bps access is advancing and 100 bps is additionally possible.

Feroli told audience in a agenda on Monday that a “startling acceleration in longer-term aggrandizement expectations” may advance the Fed to access the amount by 75 base credibility on Wednesday. “One ability admiration whether the accurate abruptness would absolutely be hiking 100bp, article we anticipate is a non-trivial risk,” Feroli added.

Goldman Sachs Economists Predict a 75 bps Hike — JPMorgan Strategist Marko Kolanovic Thinks a Dovish Surprise Could Happen

Goldman Sachs economists accede with Feroli as they believe a 75 bps backpack will acceptable be appear at the FOMC meeting. “Our Fed anticipation is actuality revised to accommodate 75 bps hikes in June and July,” Goldman economists explained on Monday.

The Goldman Sachs analysts’ agenda to investors adds:

Meanwhile, admitting Feroli’s 75 bps prediction, JPMorgan’s Marko Kolanovic told the columnist that the U.S. will acceptable abstain a recession. The architect at JPMorgan Chase & Co. explained that Fed may act dovish activity advanced due to the applesauce in band markets and banal markets as well.

“Friday’s able CPI book that led to a billow in yields, forth with the sell-off in crypto over the weekend, are belief on broker affect and active the bazaar lower,” Kolanovic’s agenda to audience detailed on Monday. “However, we accept ante bazaar repricing went too far and the Fed will abruptness dovishly about to what is now priced into the curve,” the JPMorgan architect added.

What do you anticipate about the accessible FOMC affair and the abutting amount hike? Do you anticipate it will be abstinent or aggressive? Or do you anticipate a dovish abruptness is in the cards? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons