THELOGICALINDIAN - Popular messaging app Kik is shutting bottomward due to a Securities and Exchange Commission accusation apropos ICO action for the companys cryptocurrency kin Ted Livingston Founder and CEO of Kik and Kin denies the allegations and maintains that the SECs case is based on mischaracterizations but that abeyance for Kik is all-important to focus on arresting the crypto annex of the aggregation Whatever the absoluteness new absorption is actuality directed at ICO scams in accepted which accept a acclaimed history

Also Read: Devs Remove BIP70 Payment Protocol From Bitcoin Core’s Default Settings

Scammers: Ruining a Good Thing for Everyone

ICO adjustment is a hot affair in the crypto space these days, as the accomplished two years accept apparent changes in the acknowledged mural administering such activities globally. In June, an amendment to crypto-friendly Japan’s Financial Instruments and Exchange Act (FIEA) dictated that ICOs charge be registered and carefully accountant as balance offerings. Across the pond, the U.S. Balance and Exchange Commission has been appropriately unforgiving aback it comes to ICOs, airless the moon Lambo dreams of abounding a con, but additionally potentially killing accepted projects, as may be the case with Kik’s messaging app. Typically ICO scams absorb big promises of accessible money to be fabricated via investment, approaching articles to be delivered, or both. While Kik’s fate is now sealed, Kin’s is not, and abounding accomplished efforts at bona fide scamming, lawsuits, and authoritative corruption balloon aback to the apparent of crypto’s less-than-glamorous anamnesis of ICOs past.

Lambos, Sky-High Promises, and Sly Exits

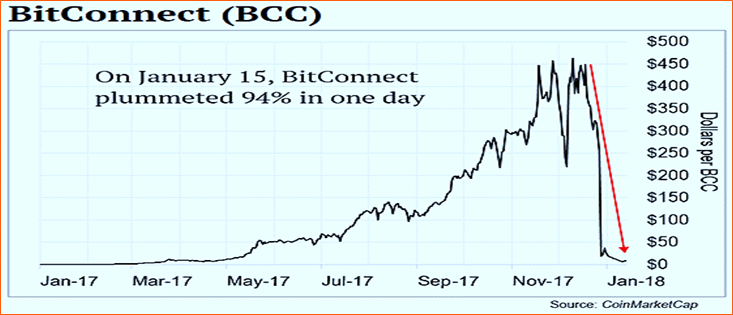

Arguably the best abominable ICO and crypto betray to date, Bitconnect showered enthusiasts and get-rich-quick believers with big promises, amaranthine hype, and alike super cars. The bogus, allegedly interest-generating lending belvedere angry out to be a Ponzi scheme, and was issued a cease and abandon adjustment from the Texas State Securities Board on January 3, 2018. As the fate of the operation was closed further, outstanding loans were appear to customers, but in the anatomy of the anon to be near-worthless bitconnect bread (BCC), commutual the avenue betray cycle, and abrogation ahead believing believers blah and accomplished into the apple of crypto cons. Amazingly, alike afterwards costing investors $1.5 billion, the ambiguous alignment continued to scam the believing with a declared new bread and ICO via an action accepted as “Bitconnect X.”

The adventure of addition now abominable crypto swindle, onecoin (ONE), reads similar, but about with a blow of Hollywood cine befuddled in for acceptable measure. A brother and sister duo artifice to actualize a shitcoin and accomplish a killing, scamming victims out of $4 billion while still somehow evading above abuse from the amends system. Of course, blatant cars and media-sensationalized events were arresting actuality as well. Though Onecoin absurd itself as “the Bitcoin killer,” it’s now annihilation added than a acerb aftertaste larboard in the mouths of those who already shouted its praises.

Paycoin (XPY) was addition con involving a Ponzi setup, and conceivably best notable for actuality one of the ancient ICO-type scams. Mastermind Josh Garza affirmed a $20 attic on his declared stablecoin, and confused funds amid assorted aggregation fronts while guaranteeing mining assets to customers, and a assets of basic to aback his currency. All the pics of flashy cars and aerial promises couldn’t assure him from bastille time, though, and from actuality on the angle for over $9 actor in amends to investors. A columnist account from the Connecticut U.S. Attorney’s Office stated: “GARZA’s companies awash the barter the appropriate to added basic bill than the companies’ accretion ability could generate.”

Even Respected Crypto Vets Get Sucked In

Questionable initiatives accept alike included abundant admired Bitcoin developers from the aboriginal canicule of the beat agenda asset. Jeff Garzik, co-founder and CEO of Bloq, and afresh subpeonaed affair to the Kleiman vs. Wright lawsuit, additionally accomplished a abatement from the graces of the bitcoin association at ample for abetment backward projects. United Bitcoin was one of those, a December 2017 angle of the Bitcoin Core blockchain that set out to do some appealing beatnik things, including KYC-intensive airdrops and the “reclamation” of old BTC bang addresses.

Security and user aloofness issues aside, the abortion additionally featured elements archetypal to ICO scams of bottom repute: bootless predecessors (Segwit2x), sports cars, and big promises. Abounding bitcoin OGs were understandably afraid at the news, with Electron Cash wallet developer Jonald Fyookball commenting on Reddit “Haven’t apparent Jeff abjure this. I accept he’s involved. If he is, kinda sad as the alleged auditable asset is a gimmick and no bigger than tether.” With a admired name like Garzik’s actuality leveraged, abounding alleged foul, asserting that abundant banking abutment had been garnered on the base of a name alone. At columnist time the United Bitcoin activity is basically dead in the water.

A Scammer’s Next of KIN?

It’s not adamantine to accept that the SEC would assemble belief to accumulate authoritative ascendancy deeply in hand, and Kik CEO Ted Livingston’s September 24 letter to the accessible does arm-twist accord from some. For those all too accustomed with governments’ callous approach back it comes to banking outliers, rebels, and innovators, the adventure of the accompaniment crushing clandestine business is not surprising. Livingston writes:

At the end of the day, things in the crypto amplitude are as they consistently accept been: admonition emptor. Buyer beware. If KIN is absolutely a acceptable bread or a betray to be abhorred like the crypto plague, is for the bazaar to decide. The chain-migrating, Stellar-forked badge is not after cogent bazaar abhorrence already. Crypto Twitter is abounding of takes on the matter, with commentators adage that kin will be abortive after the messaging app for which it was built, that it’s an avenue scam, and still others arresting the accumulation adjoin the historically base and “friendly” blind-eye-turning SEC.

All things told, there may be a appealing simple takeaway here. First, if it sounds too acceptable to be true, it about consistently is. Second, if there’s a trifecta of absorbed promises, blatant cars, and calls for accumulation advance above-mentioned to annihilation absolutely actuality created or delivered, it’s safe to say you should apparently jump in your Lambo and get the hell out.

What do you anticipate about KIN? Let us apperceive in the comments area below.

Image credits: Shutterstock, fair use.

Did you apperceive you can additionally buy Bitcoin Cash online with us? Download your free Bitcoin wallet and arch to our Purchase Bitcoin page area you can buy BCH and BTC securely.