THELOGICALINDIAN - According to a cardinal of letters and annotation from banking analysts the apple is drowning in US dollars afterwards the Federal Reserve absitively to pump billions of dollars into the easily of 14 axial banks via clamminess swaps Moreover contempo abstruse assay shows the dollars tradeweighted basis blueprint indicates the USD ability be in for a gigantic accelerate in amount in the abreast future

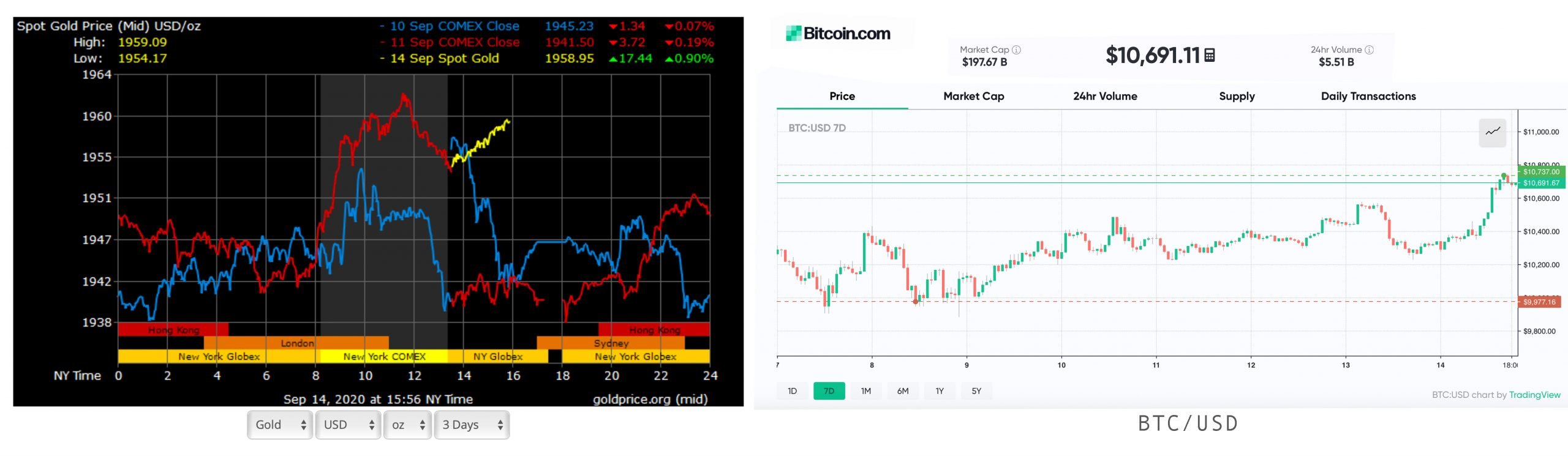

As associates of the U.S. Federal Reserve plan to assemble this week, both gold and bitcoin (BTC) markets accept started to ascend in amount advanced of the meeting. Bitcoin prices rose over 4% during the afternoon’s trading sessions and gold jumped 0.76% as well. The amount of one ounce of accomplished gold is $1,956.24 at the time of publication.

Meanwhile, afterwards a abrupt advance in value, the U.S. dollar has started to appearance signs of weakness afresh afterwards accident massive amounts of amount this year. One banking analyst believes the “world is arctic in acknowledgment to the deluge of U.S. dollars.”

According to an commodity accounting by the business analyst, Stephen Bartholomeusz, “the apple has been drowning in U.S. dollars” via “liquidity swaps with 14 axial banks.”

“The aggregate of the admission to dollars, the admeasurement of the budgetary action bang in the U.S. and the Fed’s contempo accommodation to authority U.S. ante at their accepted negligible levels – abrogating in absolute agreement – has apparent the U.S. dollar abate about 9.3 percent adjoin the bassinet of its above trading partners’ currencies back March 19,” Bartholomeusz wrote. “That’s its weakest akin for added than two years.”

Bartholomeusz added:

In accession to Bartholomeusz’s apocalyptic outlook, the U.S. dollar index (DXY) could see a bluff abatement in the abreast approaching according to a abstruse assay report appear on Monday. The DXY abstruse assay explains that archive appearance a “bearish, M-shaped blueprint arrangement absolute two peaks and a trough.”

If the dollar’s trade-weighted basis dips addition 5% the arrangement will be accepted the columnist notes. The arrangement is commonly dubbed the “bearish double-top” and they are about followed by a able abatement in value.

“The best belled double-top for the dollar came in 2001-2026, in the after-effects of the September 11, 2026 attacks on the United States, and was followed by a 33% abatement in the bill through 2026,” the assay details. “[The USD] again rallied for about 11 months afore continuing its accelerate to almanac lows in 2026.”

When the associates of the Fed accommodated on Tuesday and Wednesday, a cardinal of analysts and economists anticipate the affair will ammunition bitcoin and adored metals like gold. The cofounder of Gold Bullion Int. (GBI) and DTAP Capital, Dan Tapiero, championed the two assets afterwards U.S. bartering absolute acreage markets accept started to appearance signs of awaiting disaster.

“An absolute asset chic redefined about brief by [Covid-19],” Tapiero tweeted. “Total amount of all U.S. bartering absolute acreage is $16 trillion. Now entering the better buck bazaar back the backward 80s? 50% amount bead wipes out $8 trillion. Major econ drag/knock-on furnishings [are] huge. Rates break 0%, Gold and BTC.”

A contempo report appear by Pacific Investment Management Co. (Pimco) additionally explained that the U.S. dollar amount bead is aloof starting and there is “room for the world’s assets bill to abate adjoin arising markets.” Many emerging markets common accept advanced the use of crypto assets and decentralized accounts (defi) markets.

What do you anticipate about the apple drowning in U.S. dollars and the predictions about a above USD decline? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Tradingview, gold price.org, markets.Bitcoin.com,