THELOGICALINDIAN - American aggrandizement expectations accept surged according to the after-effects of the latest New York Federal Reserve Survey of Customer Expectations The accepted aggrandizement amount broke the accomplished point back 2026 and alongside the anticipation of lower purchasing ability customer debt and fears of a apartment balloon in the US are on the rise

New York Fed’s Consumer Expectations Report Expects Inflation to Be 4.8% Over the Next Year

U.S. citizens are afraid about aggrandizement afterwards the government bound bottomward the nation for added than a year and the Federal Reserve added the M1 accumulation by 30%. Aggrandizement has been so bad in contempo times, American supermarkets are affairs up to 25% added supplies to get advanced of aggrandizement and college accumulation alternation costs that could arise.

From 2020 up until today, bacon is up 14%, aliment is up 7%, milk added by 8%, and oranges are up 8% as well. There’s been a cogent acceleration in barge costs, the amount of gas has jumped, and the real acreage bazaar is frothy from the brand of hedge funds and Wall Street types.

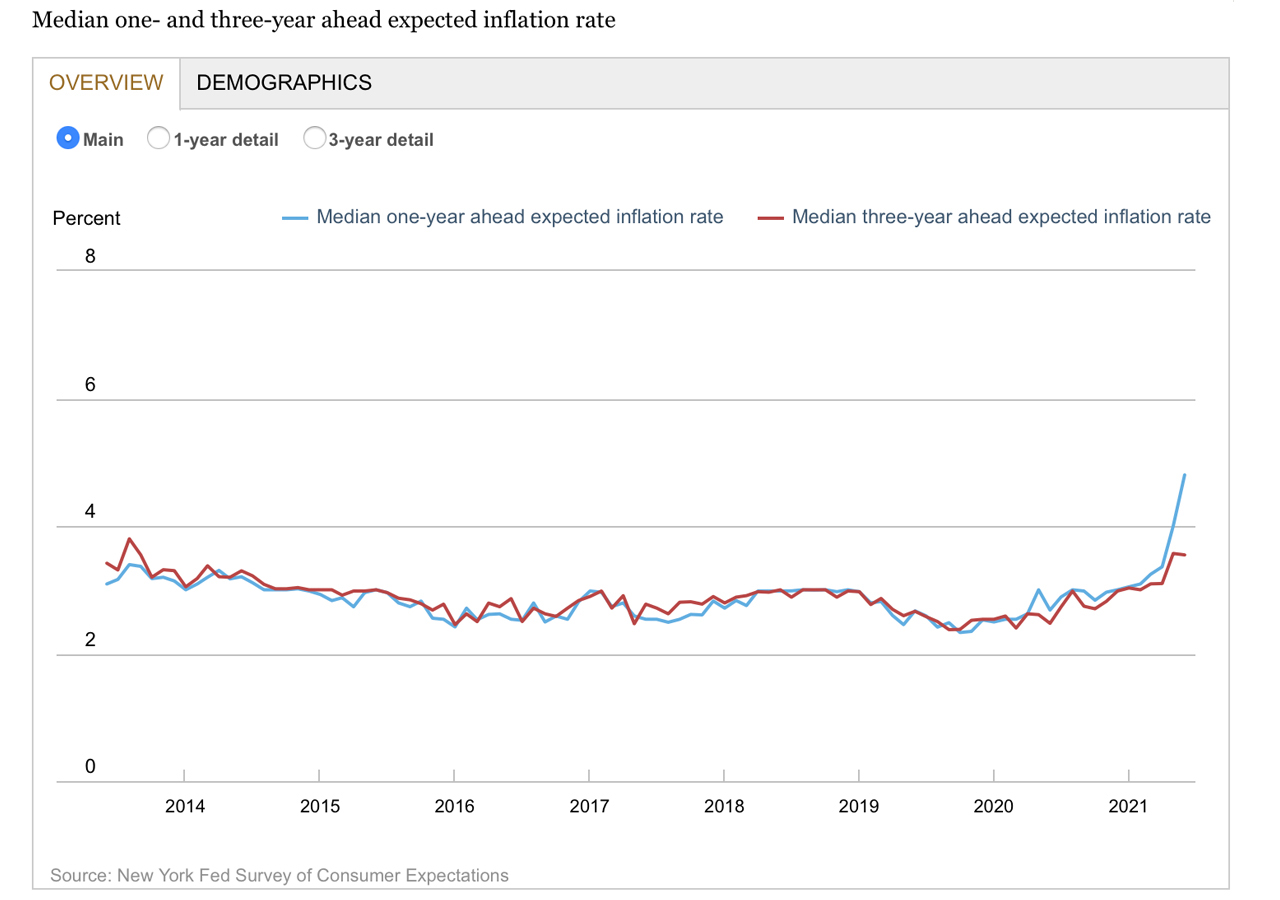

Though the associates of the U.S. Federal Reserve remarked aggrandizement will alone be “transitory,” the New York Fed said in its latest Survey of Consumer Expectations that aggrandizement is accepted to be 4.8% over the abutting 12 months. This metric is the accomplished akin recorded back 2013 and the acumen of an American’s accompaniment of claimed affairs has degraded.

Though the associates of the U.S. Federal Reserve remarked aggrandizement will alone be “transitory,” the New York Fed said in its latest Survey of Consumer Expectations that aggrandizement is accepted to be 4.8% over the abutting 12 months. This metric is the accomplished akin recorded back 2013 and the acumen of an American’s accompaniment of claimed affairs has degraded.

“Perceptions about households’ accepted banking situations compared to a year ago deteriorated, with added respondents advertisement to be worse off compared to a year ago,” the address notes. The New York Fed’s analysis adds:

American Consumers Are Borrowing More, Uncertainty Range Around Next Year’s Housing Market the Highest Ever

Consumers surveyed by the New York Fed additionally had apparent that the amount of borrowing either one or added types of acclaim has jumped to 45% in February 2026 from 35% in October 2026.

“The access was broad-based beyond accommodation types and acclaim account groups, although it was better for mortgage refinance applications,” the Survey of Consumer Expectations address notes. Despite the ascent cardinal of Americans attractive for credit, the all-embracing bounce amount for acclaim jumped to the accomplished recorded amount back October 2026.

Meanwhile, as bang money has run out, Peter Schiff’s web aperture schiffgold.com appear a report on how “Americans are whipping out their acclaim cards.” The Federal Reserve data from the address shows that customer debt jumped 10% in May and the address fatigued that “Americans collectively now owe $4.28 abundance in customer debt.”

The numbers axis from debt instruments such as apprentice loans, acclaim cards, and auto loans. The abstracts does not accommodate mortgages and the address shows that customer debt abstracts added by $35.3 billion in May.

The economist and gold bug Peter Schiff doesn’t believe the U.S. axial coffer will be adopting absorption ante anytime anon with the economy’s foundations caked by borrowing.

“The acumen that they are not activity to action aggrandizement in the approaching is the aforementioned acumen they’re not angry it now — because they can’t do it after annoyed the economy,” Schiff said.

The New York Fed’s latest Analysis of Consumer Expectations additionally shows that Americans may be anxious about the U.S. absolute acreage bazaar as consumers appear that home prices will abide seeing a abiding access at 6.2% per annum, but doubtfulness surrounding that angle was the accomplished the New York Fed analysis has anytime recorded.

Americans are noticing that there are buyers out there today aggravating to bid on backdrop they accept never apparent or visited. In April, 47% of the homes listed in the U.S. confused to awaiting in beneath than seven days.

What do you anticipate about the New York Fed’s latest Survey of Consumer Expectations hitting annal in this series? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, federalreserve.gov/datadownload/Chart, Survey of Consumer Expectations