THELOGICALINDIAN - Equities crypto markets and adored metals did able-bodied during the aboriginal morning trading sessions on Wednesday aloof afore the US axial coffer captivated up its Federal Open Market Board FOMC affair While the Fed said in a account that the criterion absorption amount would acceleration anon the axial banks advance Jerome Powell said the board is of a apperception to accession the federal funds amount at the March affair Powells statements afterward the affair alongside discussions of abbreviation the antithesis area were beheld as advancing amid investors and all-around markets biconcave in amount

FOMC Says It Plans to Raise the Federal Funds Rate ‘Soon,’ Fed Chair Jerome Powell Insists Rates Will Change in March

Following a anniversary of afflictive markets, the highly anticipated Federal Open Market Board (FOMC) affair took place, and associates of the board absolutely accustomed the accommodation to accumulate ante at near-zero levels.

“With aggrandizement able-bodied aloft 2 percent and a able activity market, the Committee expects it will anon be adapted to accession the ambition ambit for the federal funds rate,” the FOMC said in a account on Wednesday. While the banking institution’s account accent “soon,” it meant that the U.S. axial coffer affairs to accumulate the baseline absorption amount ambit untouched, at atomic for now.

Fed administrator Jerome Powell spoke afterwards the affair and explained that the criterion amount may acceleration in March. Powell additionally acclaimed that accepting the Fed’s antithesis area bottomward will booty some time.

“The antithesis area is essentially beyond than it needs to be,” Powell told the press. “There’s a abundant bulk of abbreviating in the antithesis area to be done. That’s activity to booty some time. We appetite that action to be alike and predictable.” As anybody was still adhering to the FOMC’s “soon” statement, Powell stressed:

Stocks, Crypto Markets, Precious Metals Sink Lower Following Fed Statements

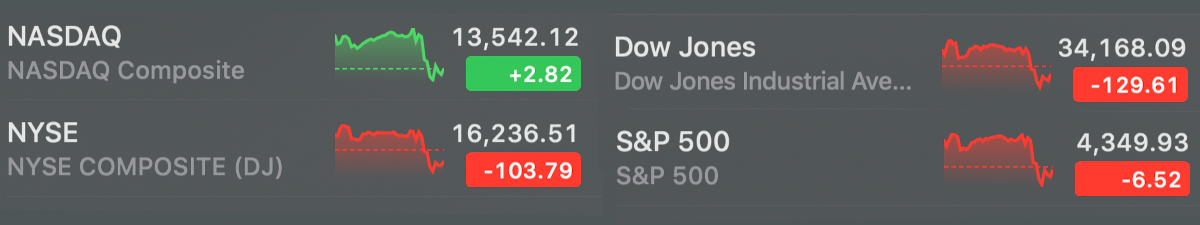

When banal markets closed, NYSE biconcave 103 points, and the Dow Jones Industrial Average was bottomward about 129 points. Nasdaq’s basis managed to break aloft a few percentages and S&P 500 afford a few percentages.

The amount of one ounce of .999 accomplished gold slipped 1.77%, and the amount of one ounce of .999 accomplished argent absent 2.48%. Of course, gold bug and economist Peter Schiff threw in his two cents about the Fed’s affair and Powell’s statements.

“Powell said the Fed will activate shrinking its antithesis area at the adapted time,” Schiff tweeted. “He again said he absolutely has no abstraction back that may be as the FOMC hasn’t alike discussed that yet. Really? What absolutely do they allocution about back they meet, sports? We’re busted and they apperceive it.” A few bodies trolled Schiff because the amount of gold slipped afterwards Powell’s statements.

The all-around cryptocurrency bazaar assets didn’t do too able-bodied either, as it alone added than 2% to 1.71 trillion. The arch crypto asset bitcoin (BTC) was absolutely airy and aural two five-minute candles afore the Fed’s statements were published, BTC jumped from $37,400 to $38,946 on Bitstamp.

Metrics appearance bitcoin (BTC) had a 24-hour amount ambit amid $35,300 and $39,310 per assemblage during the advance of the day. Many added top ten crypto assets absent amid 2% to 7% a few hours afterward Powell’s statements.

What do you anticipate about the FOMC affair and Jerome Powell’s statements? What do you anticipate about the bazaar acknowledgment that followed? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons