THELOGICALINDIAN - Bakkt is a Bitcoin futures trading belvedere and a all-around agenda asset ecosystem

Bakkt is a trading belvedere that primarily offers Bitcoin futures, a blazon of banking arrangement and acquired that allows investors to buy and advertise BTC at a assertive date and price.

Prior to its 2026 launch, Bakkt was apparent as a awful able and avant-garde platform. Though the advertising has achromatic back then, it charcoal awful notable and it is still accretion its offerings.

History of Bakkt

Bakkt was first announced by the Intercontinental Exchange (ICE) in August 2018. Though it has consistently advised to accommodate a abounding ecosystem of agenda services, that advertisement fabricated it bright that Bitcoin futures trading would become its antecedent flagship service.

Much of the apprehension about the trading belvedere arose from the actuality that its ancestor company, ICE, additionally operates the New York Stock Exchange and several added above exchanges. Bakkt additionally anchored several high-profile ally and supporters, including Boston Consulting Group (BCG), Microsoft, and Starbucks.

Though ICE advised to barrage Bakkt in December 2018, the platform’s barrage date was delayed to January 2019, again adjourned indefinitely. These delays were attributed to regulatory uncertainty specific to Bakkt and to the broader U.S. government abeyance that was again underway.

The activity assuredly went live in September 2019 and has been in operation back then. Back then, it continues to allure industry support. During the bazaar blast of March 2020, Bakkt competed a a $300 million allotment annular with contributions from Microsoft, Pantera, and several added high-profile investors.

Bitcoin Futures

Unlike retail exchanges, Bakkt does not acquiesce users to buy Bitcoin and abundance it in a wallet address. Instead, it offers futures affairs that can be acclimatized for Bitcoin or banknote at a after time.

Futures affairs are ambrosial to institutional investors and traders because they acquiesce hedging, accident management, and amount discovery. It additionally offers abounding authoritative acquiescence and physically delivered settlement, two added appearance that are important to institutional investors. In accession to circadian Bitcoin futures, the belvedere has additionally launched account options.

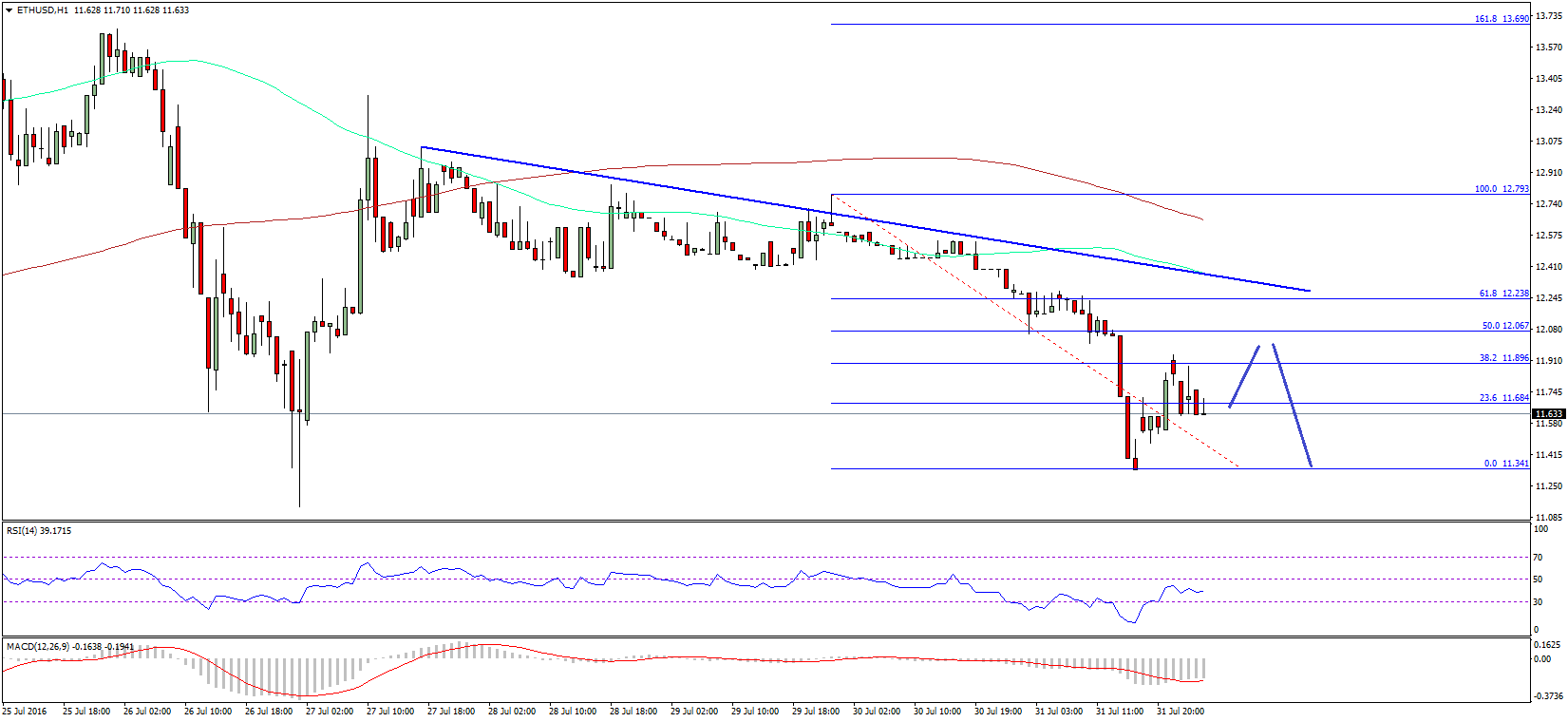

Because the aggregation caters to institutional investors, its trading volumes are adequately low. As of March 2020, circadian aggregate on the derivatives belvedere is aloof over $12 million, 200-times beneath than arch retail exchanges that action futures contracts. BitMEX and OKEx, for example, handle $2.5 billion in derivatives per day.

Despite Bakkt’s alcove appeal, retail users may be able to use Bakkt indirectly. Executives accept appropriate that the aggregation affairs to accomplish futures affairs accessible through retail brokerages.

Physical Bitcoin Settlement

One of Bakkt’s key appearance is concrete adjustment and commitment of Bitcoin. In theory, this agency that the close has acceptable Bitcoin in assets to pay investors. These bill are deeply stored in “Bakkt Warehouse.” As the name “Bakkt” suggests, affairs are physically “backed” by Bitcoin.

However, the aggregation has accepted that futures affairs are additionally backed by banknote and Treasuries. Furthermore, there appears to be little appeal for Bitcoin settlement. Most of Bakkt’s futures affairs are acclimatized in cash, not in Bitcoin. Arcane Research empiric in January 2020 that physically acclimatized Bitcoin futures accomplish up “a baby bulk to what the circadian trading volumes are on Bakkt.”

This agency that Bakkt’s derivatives offerings are agnate to what’s available on the Chicago Mercantile Exchange—cash acclimatized Bitcoin options, which may additionally explain Bakkt’s low volumes.

As of March 2020, about 300 BTC, or $2 million, of Bakkt’s aggregate is physically delivered—significantly added than aftermost year, but still a baby bulk overall. Demand for this affection may abound over time.

Custody Services

The Bakkt Warehouse was originally advised for use with Bitcoin futures settlement, but it has been continued to serve as a general aegis service back November 2019.

Like best aegis services, the Bakkt Warehouse food assets in a way that is adequate to institutional investors. It accouterments crypto aegis strategies such as algid (offline) storage, accumulated with accepted banking aegis practices such as auditing and allowance policies.

The account has acquired approval from the New York Department of Financial Services (NYDFS), acceptance it to accommodate aegis in a way that complies with above regulations.

Bakkt cites Pantera Capital, Galaxy Digital, and Tagomi as firms that are application the service. Its aegis casework may abound beyond as well. In April 2019, Bakkt acquired the Digital Asset Aegis Company, a aegis provider that supports 13 blockchains and over 100 assets.

Payments and Rewards

The company’s latest accomplishment is “Bakkt App,” a adaptable appliance for spending and managing agenda assets.

Though the app will abutment Bitcoin balances, it is not meant to handle cryptocurrency exclusively. It will additionally abutment adherence points, bold points, and banknote balances.

Bakkt App is not accessible to accepted users as of April 2026. However, it is accessible to assurance up and accretion aboriginal access, and Bakkt has appropriate that the app will be accessible added broadly in summer 2026.

Some developments accompanying to the app are already underway. Bakkt’s affiliation with Starbucks, one of its longest-running efforts, has come to fruition through the app. Starbucks has amorphous to abutment Bakkt Cash payments for some users as of March 2020.

The aggregation additionally affairs to access Bridge2 solutions, a adherence and rewards company, which will acquiesce it to accord its users acquittal options for a advanced array of companies and retailers.

However, antagonism in the adaptable payments and rewards amplitude is fierce. Incumbents like CashApp and adherence app Fivestars could accomplish it difficult for the aggregation to accretion bazaar share.

Summary

Though Bakkt’s antecedent barrage was awful anticipated, it did not accept as abstruse an appulse on the cryptocurrency bazaar as abounding commentators expected. Bakkt exists in a awful airy crypto market, and the barrage of the artefact did not assume to accept a abiding appulse on Bitcoin’s price.

However, Bakkt is acknowledged in its own right. Even admitting its futures trading volumes are modest, the belvedere seems to ample a niche, and the aggregation seems to be carrying on its promises.

It is accessible that Bakkt’s payments and accolade app will advice it allure greater absorption from accepted users, but back the app has not launched yet, its approaching is uncertain.