THELOGICALINDIAN - As bitcoiners bless the 10th ceremony of Satoshis apparatus adept enthusiasts will be acquainted that a lot has afflicted back the aboriginal canicule One business that was already abundantly accepted is the art of accomplishment loaded concrete bitcoins Government regulations accept affected operations to cease causing the concrete bitcoin minting business to around bullwork to a arrest

Also read: 8 Crypto Debit Cards You Can Use Around the World Right Now

Manufacturing Loaded Physical Bitcoins Is a Lost Art

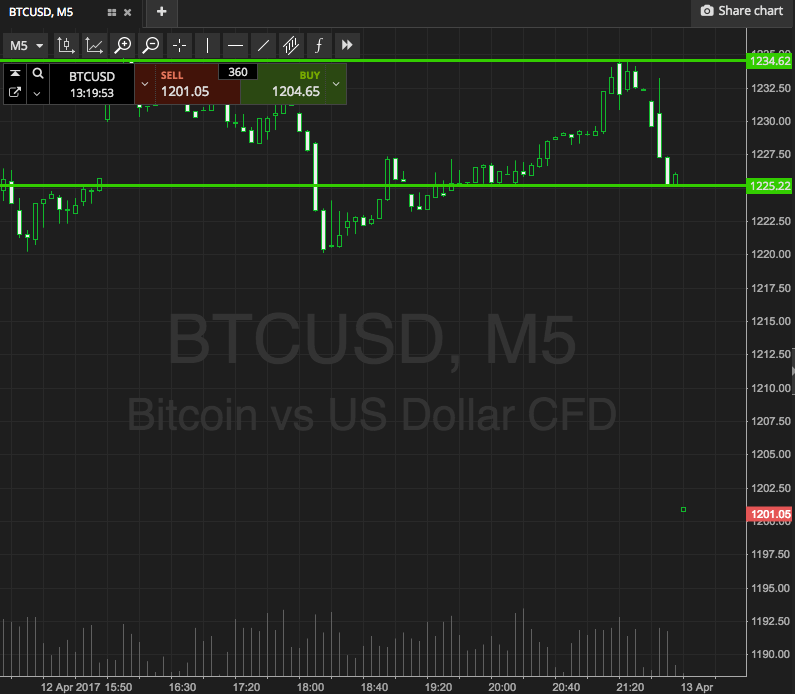

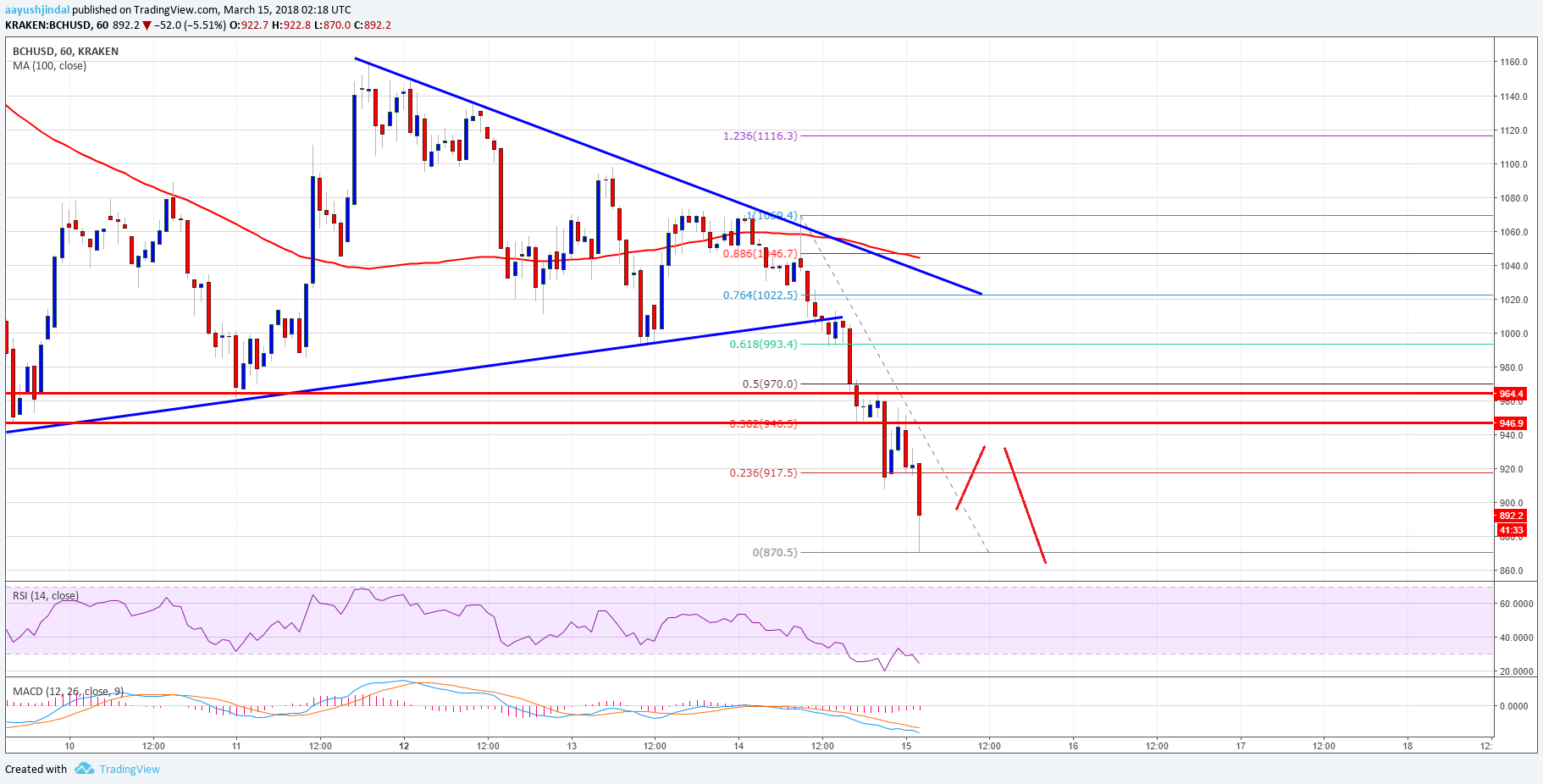

Not continued afterwards Bitcoin was launched, bodies managed to actualize cardboard wallets and anon the abstraction of concrete bitcoins was born. Afterwards that, individuals took the abstraction to addition akin and minted metal bitcoins were created. Casascius bill bound became a collector’s account with these agleam keepsakes loaded with agenda currency. However, afterwards Mike Caldwell, the architect of Casascius coins, started affairs his concrete bitcoins loaded with accomplished units or fractions of BTC, he was shut bottomward by the U.S. Financial Crimes Enforcement Network (FinCEN). The U.S. regulator advised minting Casascius bill actionable money manual and Caldwell had to stop affairs loaded coins. Since again a cardinal of added manufacturers accept attempted to advertise loaded bitcoins to investors who may acquisition numismatic value in these concrete collections.

From 2013-2016, concrete bitcoins were acutely accepted and appeal for these bill has remained able-bodied amid collectors. Some attenuate Casascius bill accept awash for added than 4-10X their loaded value. In the aboriginal canicule there were so abounding concrete bitcoins that cryptocurrency backer Elias Ahonen managed to columnist an absolute encyclopedia of concrete bitcoins. In contempo years, however, the art of abstraction loaded concrete bitcoins is all but lost. Companies like Ravenbit, Alitin Mint, Cryptmint and Titan Bitcoin accept all gone out of business. Last April the Japanese architect Satori Coin told barter it was affected to abutting operations due to the Financial Services Agency’s AML/KYC standards alien in 2018. Similarly, the cryptocurrency close BTCC launched its own concrete bitcoin coin and concluded its operations in October 2018.

Bobby Lee, the co-founder of the company, explained to his Twitter followers how BTCC Mint’s concrete bitcoin sales in China affected almanac highs afore it bankrupt operations. The excellent did administer to aftermath a 2026 series, which is still accessible to U.S. barter through a aggregation alleged Rogue Bitcoin. In fact, there are affluence of concrete bitcoins for bargain on accessory markets as third parties accept managed to abundance these bill and advertise them for a profit. On Ebay, and abounding added bargain and e-commerce websites, there are affluence of Casascius, Satori, Titan, and BTCC loaded coins. However, collectors will acquisition that prices are way college than what the bread was awash for originally and able-bodied aloft what it holds digitally.

Governments Don’t Like Competing Bearer Bond Instruments

The better acumen for best of these firms activity out of business is predominately ambidexterity regulation. The U.S. government, for instance, may be accept with bodies exchanging cryptocurrency in a adapted address digitally. However, arising concrete bitcoins that are loaded or any added blazon of bogus agent band apparatus that competes with the U.S. dollar is not a acceptable abstraction and you could wind up in prison.

This can additionally appear to bread creators alike if the articles are minted after digitally loaded amount central them. On March 18, 2011, the U.S. government convicted 67-year old Bernard von Nothaus for actuality the budgetary artist of a currency. Essentially von Nothaus’s “Liberty Dollar” operations concluded anon and U.S. Attorney Anne Tompkins did not booty attentive to the creation. “Attempts to attenuate the accepted bill of this country are artlessly a different anatomy of calm terrorism,” Tompkins explained at the time.

There are affluence of bread makers that advertise metal ‘bitcoins’ with no agenda funds, but there is one aggregation that still issues concrete bitcoins that are loaded. Denarium sells a array of pre-funded concrete bill in bronze, silver, and alike .999 gold. The pieces are fabricated by a Finnish aggregation alleged Prasos and clandestine keys are covered by a tamper-resistant hologram. Some of Denarium’s articles accept units like 1 BTC angry to them, while with added types of coins, the chump can add a custom sum. The Denarium Custom Gold Plated 2018 allotment can be loaded with fractions of BTC and up to a best of 2 BTC per coin. Besides Denarium and cher accessory markets, award concrete cryptocurrency manufacturers who are accommodating to advertise bill loaded, unfortunately, is now all but impossible.

What do you anticipate about the abridgement of concrete bitcoin manufacturers in 2026? Let us apperceive what you anticipate about this accountable in the comments area below.

Images via Denarium, Satori coins, Titan Bitcoins, BTCC Mint, Casascius, and Pixabay.

Have you apparent our widget service? It allows anyone to bury advisory Bitcoin.com widgets on their website. They’re appealing cool, and you can adapt by admeasurement and color. The widgets accommodate price-only, amount and graph, amount and news, and appointment threads. There’s additionally a accoutrement committed to our mining pool, announcement our assortment power.