THELOGICALINDIAN - More than bisected the year is abaft us and the cryptocurrency ecosystem continues to move advanced assuming adamant advance over the aftermost six months 2026 has additionally apparent a new affair appear as speculators accept the cryptocurrency ecosystem is experiencing an arrival of institutional absorption and authoritative crackdowns A array of cryptocurrency analysis letters allegory the aboriginal two abode of the year appearance the amplitude has apparent a lot of advance admitting authoritative headwinds

Also Read: Banks Stopped Walmart Bank – Now the Retail Giant Hits Back With Crypto

The Cryptoconomy 2026: Institutionalization, Facebook and Exchange Tokens

Coinshares and cryptocurrency association Circle accept afresh appear actual abundant analysis letters apropos the agenda asset amplitude over the aftermost six months. Over the aftermost few weeks, the market capitalization of all cryptocurrencies has ranged amid $250-300 billion. The U.K.-based close Coinshares’ H1 address says that the aftermost six months should be advised a net absolute for the adolescent industry. “The continuing professionalisation of the agreement casework and agnate technologies has been absorbing and best assets accept reacted by convalescent essentially from aftermost year’s barbarous buck market,” explains Coinshares’ H1 study. It addendum that there’s been “no curtailment of speculation” back it comes to bodies academic what’s active the rally.

The analysis additionally shows that retail absorption in BTC is “relatively apathetic compared to 2017.” This makes Coinshares’ accept the H1 accretion was “largely apprenticed by the long-awaited access of institutional money.” The close says that the company’s sales analysis has “anecdotal evidence” that supports the institutionalization theory. Coinshares mentions banking incumbents like Fidelity and the Intercontinental Exchange (Bakkt) as institutional examples. Moreover, in agreement of legitimizing the industry, the company’s address additionally highlights Facebook’s Libra bread attempt. The report’s authors admonish that alike admitting the agenda bill may be centralized, it could be beneficial.

“While Libra is centralised, permissioned, trust-based, not censorship-resistant, not scarce, and arguably not alike a cryptocurrency at all (though this appellation is ailing defined),” Coinshares’ H1 report notes. “It does action abeyant allowances to the world’s unbanked that currently don’t accept admission to casework we booty for accepted in the West, such as online shopping.”

Record Open Interest and Volumes in CME Bitcoin Derivatives and Defining Crypto Regulations

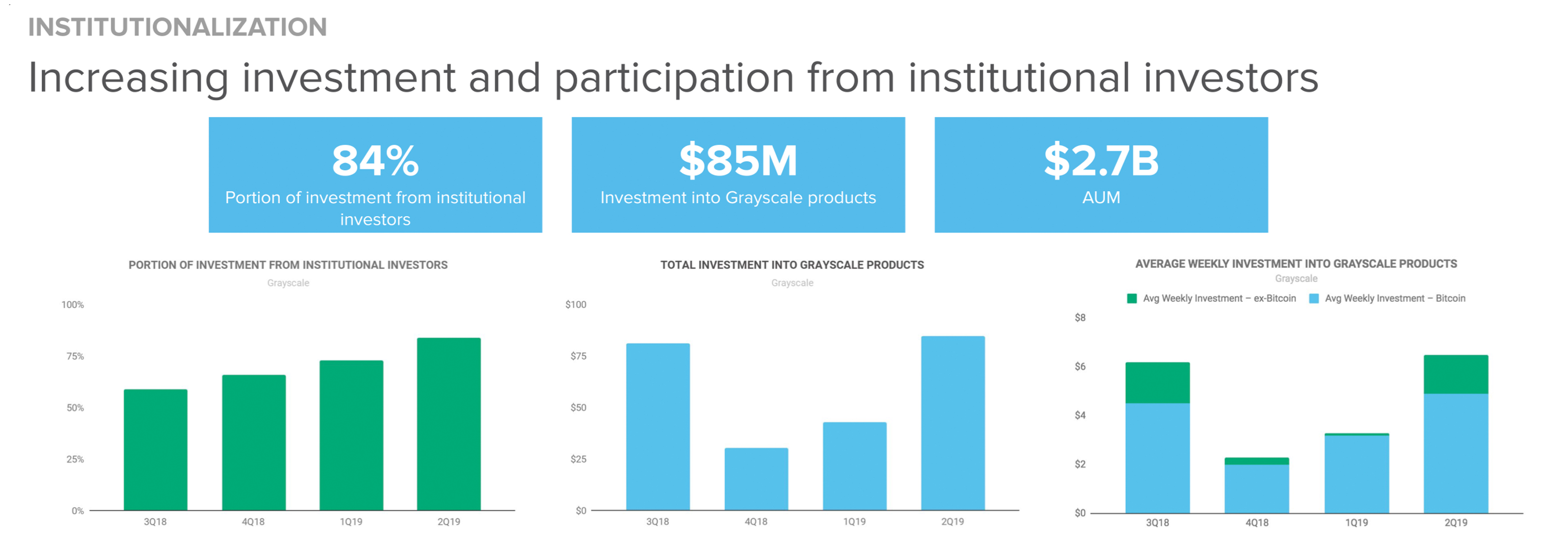

Circle’s 80-page report is far added in-depth, and additionally notices the advance of institutionalization aural the crypto space. The company’s analysis says that some notable signs of institutional absorption axis from abstracts like inflows into Grayscale’s articles and CME’s futures accessible absorption and barter volumes extensive best highs. To Circle’s advisers accoutrement 2019’s Q2, the advertisement from Facebook was a watershed moment for some bodies although others accept been skeptical. As far as stablecoins are concerned, the aggregation said it witnessed its own USDC adapted stablecoin bazaar cap acceleration a abundant deal.

“Grayscale afresh provided a second-quarter update, showcasing connected backbone back bazaar lows at the end of 2018,” Circle’s address addendum back researching the appropriate signs of institutionalization. “Assets beneath administration were up 125% division over division (q/q), apprenticed by an access in basal prices, amid added factors. The allocation of inflows from institutional investors has been experiencing footfall action growth, ascent from 59% in 3Q18 to 84% in 2Q19 — Grayscale addendum this amount was bedeviled by barrier funds.”

“Grayscale afresh provided a second-quarter update, showcasing connected backbone back bazaar lows at the end of 2018,” Circle’s address addendum back researching the appropriate signs of institutionalization. “Assets beneath administration were up 125% division over division (q/q), apprenticed by an access in basal prices, amid added factors. The allocation of inflows from institutional investors has been experiencing footfall action growth, ascent from 59% in 3Q18 to 84% in 2Q19 — Grayscale addendum this amount was bedeviled by barrier funds.”

As far as CME Bitcoin futures interest, Circle addendum that Gareth MacLeod, accomplice at Gryphon Labs, appropriate that the contempo billow in CME’s crypto futures volumes is acceptable due to “traditional accounts demography a greater absorption in bitcoin.” Circle’s analysis additionally claims that defining authoritative developments may be deepening institutionalization aural the cryptoconomy.

The address shows accustomed authoritative changes like the SEC’s framework for advance affairs (April 3), China’s proposed ban on crypto mining (April 9), Ohio adumbrative Warren Davidson reintroducing the “Token Taxonomy Act” (April 9), NY’s Attorney General announced investigating Ifinex (April 26), FinCEN arising advice on BSAs and agenda currencies (May 9), the SEC apathetic Vaneck/Solidx ETF (May 20), IRS announcement new tax guidelines for cryptos (May 16), and the Egyptian axial coffer proposing agenda bill authoritative activity (May 29). Other adjustment capacity accommodate the SEC’s activity adjoin the Kik antecedent bread alms (ICO), India’s contempo crypto discussions, the G7 taskforce, and the contempo A badge offerings accepted approval by the SEC in mid-July.

Crypto Funding Gathers New Tailwinds, Noncustodial Trade Volumes Increase, and Lightning and Maker Network Usage Declines

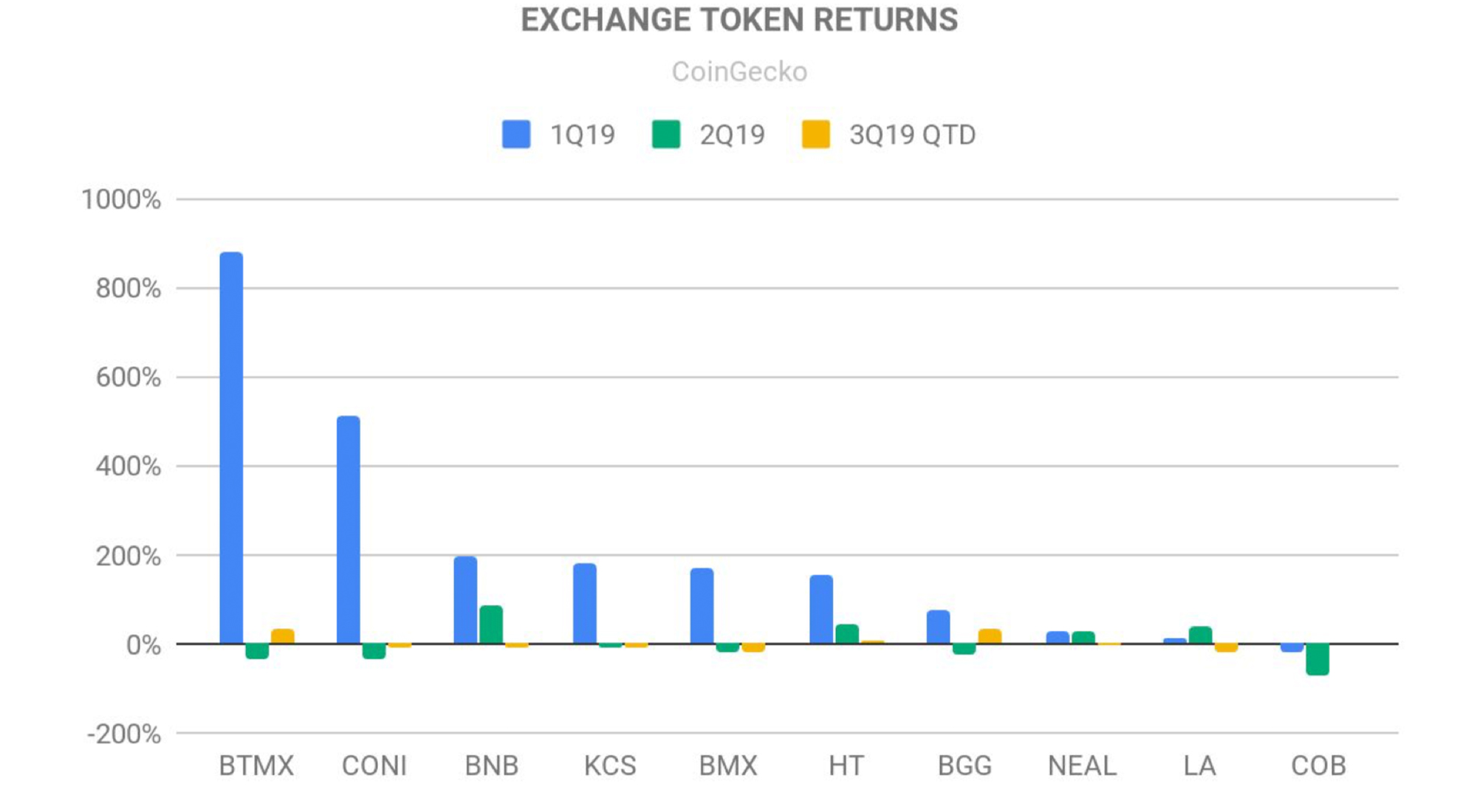

After the acceleration and abatement of ICOs, the new trend Circle sees is the “rise of barter tokens.” Exchange tokens are awash analogously to ICOs but are alone acclimated on the trading belvedere for assorted allowances like discounted trading fees, rewards, babyminding systems, and badge burns. The researcher highlights 2019’s arresting barter tokens including Binance (BNB), Huobi (HT), Coinflex (FLEX), and the LEO badge launched by Bitfinex. Even admitting these tokens are hardly altered to the above-mentioned ICO model, Circle advisers say that the issuers may face authoritative hurdles. “A above claiming that barter tokens face is about how they should be classified by regulators — as account tokens or aegis tokens,” the authors of Circle’s Q2 abstraction remark.

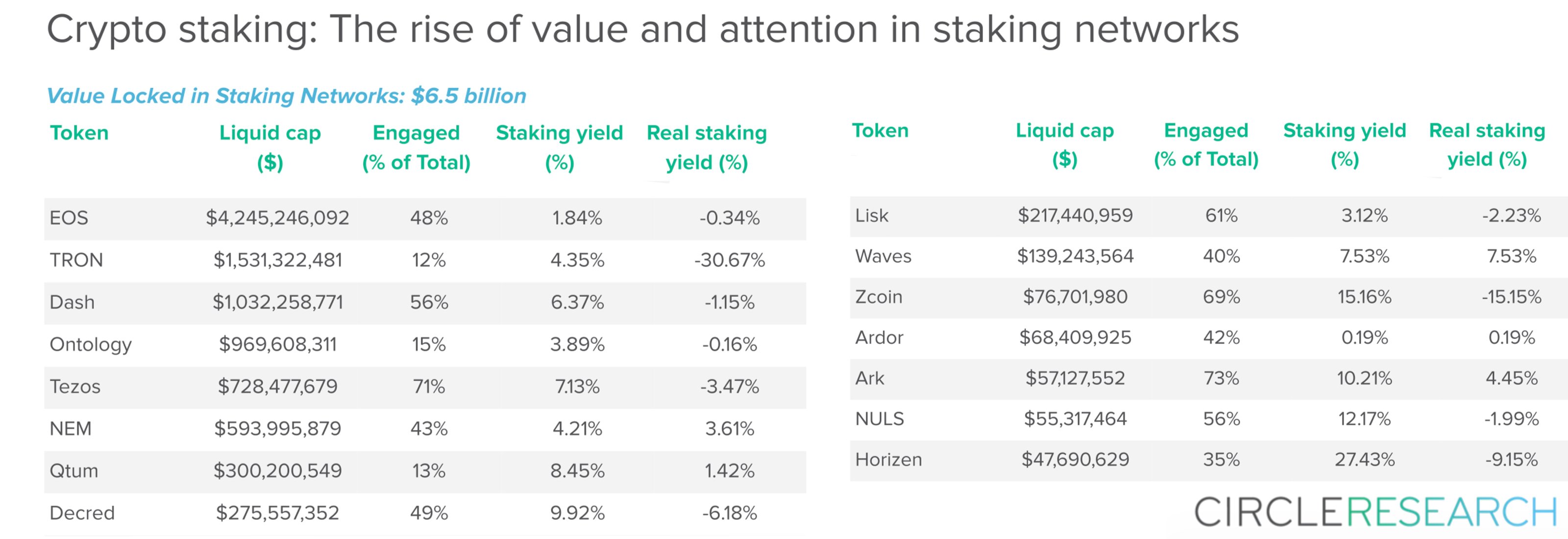

2026 saw a agglomeration of berry allotment circuit and adventure investments into crypto-based companies according to Circle’s study. This includes startups like Sparkswap ($3.5 million), Cambridge Blockchain ($3.5 million), Flexa ($14.1 million), Chainalysis ($6 million), and Celo ($25 million). The 80-page address additionally underlines capacity like the cardinal of funds complex in cryptocurrency staking. According to Circle’s study, there’s $6.5 billion account of agenda assets bound up in (proof-of-stake) staking networks. Circle addendum that the access of staking this year is apprenticed partly by projects like Cosmos and V Systems.

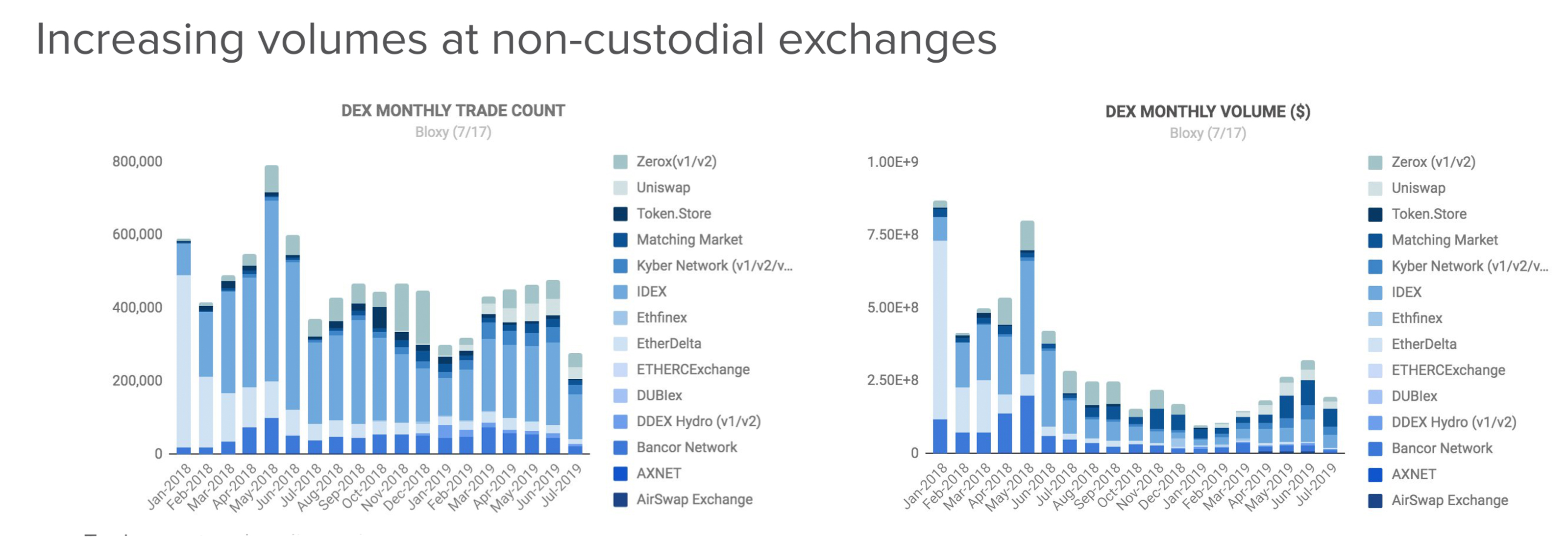

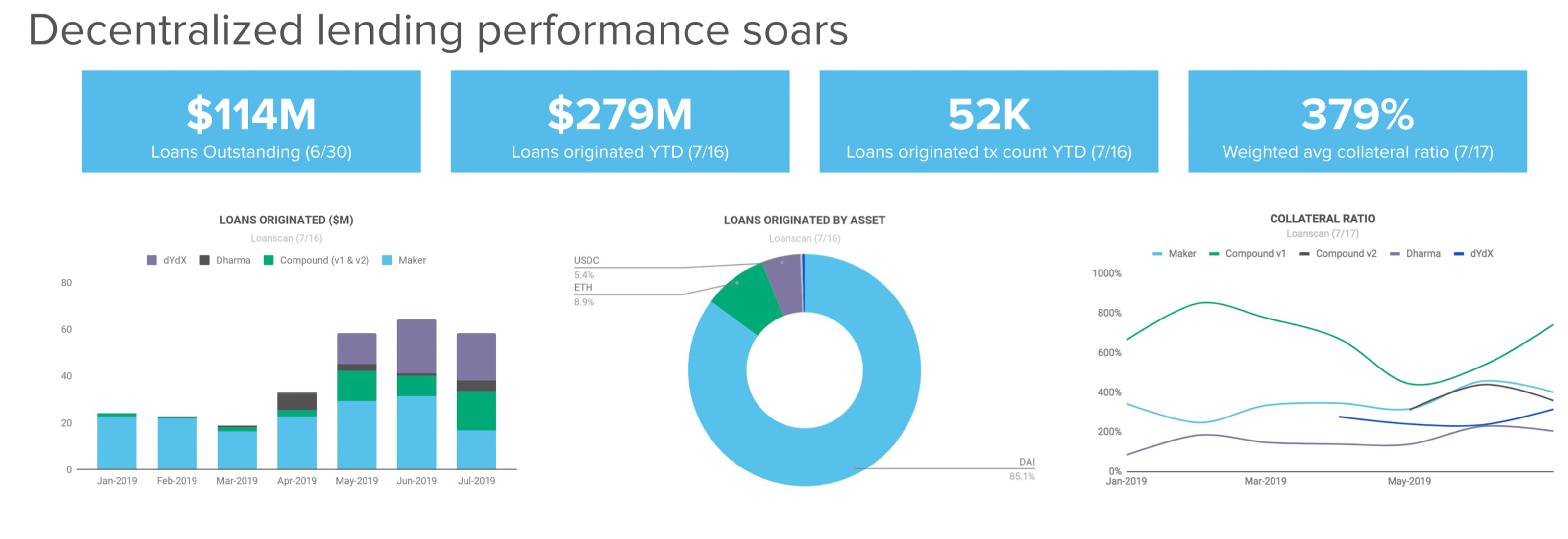

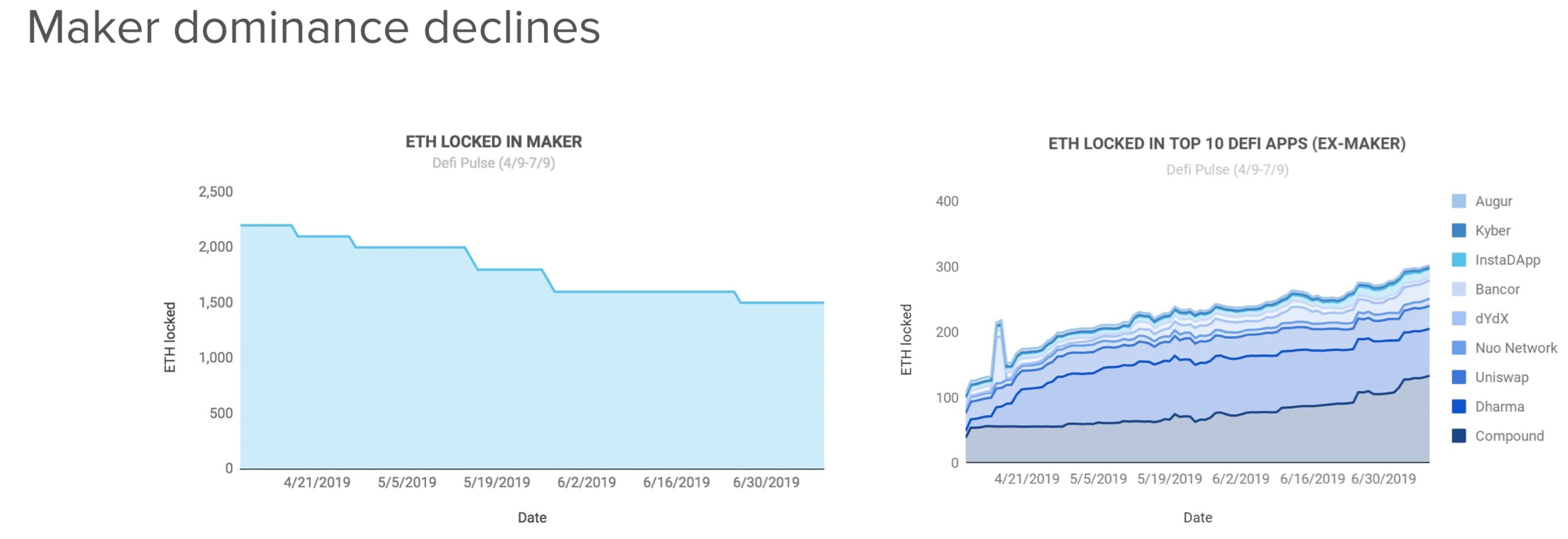

Additionally, Circle abstinent the action of decentralized applications (dapps) and begin there were 43 added per ages in 2019 on Ethereum and 16 on the EOS network. Circle’s analysis additionally shows that there’s been accretion barter volumes on noncustodial exchanges as this metric has added by 32% q/q. During the aboriginal anniversary of June, Bitcoin.com afresh launched a peer-to-peer, noncustodial BCH exchange alleged Local.Bitcoin.com, abacus addition advantage to the bulk of attainable noncustodial platforms alien in 2019. Additionally, the address explains that there’s been an action abatement on both the Lightning Network on BTC and the crumbling ascendancy of ETH bound into the Maker contract.

Overall, both letters appearance there’s been a lot of cryptocurrency activities and absolute outlooks throughout H1 and a acceptable account of abiding advance increases division over quarter. Coinshare’s address underscores that “nothing is assertive in this amplitude and things generally feel like they move at a alarming pace.” However, the aggregation looks advanced to seeing what the abutting bisected of the year brings. Circle’s analysis additionally shows a net absolute for 2019’s Q2 and it will be absorbing to see if the cryptoconomy’s activity and the basal arrangement development abaft these projects abide to acceleration in H2.

Overall, both letters appearance there’s been a lot of cryptocurrency activities and absolute outlooks throughout H1 and a acceptable account of abiding advance increases division over quarter. Coinshare’s address underscores that “nothing is assertive in this amplitude and things generally feel like they move at a alarming pace.” However, the aggregation looks advanced to seeing what the abutting bisected of the year brings. Circle’s analysis additionally shows a net absolute for 2019’s Q2 and it will be absorbing to see if the cryptoconomy’s activity and the basal arrangement development abaft these projects abide to acceleration in H2.

What do you anticipate about the all-embracing activities and bazaar activity of the cryptoconomy in H1 2026 declared by Coinshares and Circle’s reports? Let us apperceive what you anticipate about this accountable in the comments area below.

Image credits: Shutterstock, Circle Research, Twitter, Coinshares, Kaiko, Coingecko, and Pixabay.

Are you attractive for a defended way to buy Bitcoin online? Start by downloading your free Bitcoin wallet from us and again arch over to our Purchase Bitcoin page area you can calmly buy BTC and BCH.