THELOGICALINDIAN - While the American abridgement assemblage baby business failures beyond the nation actual unemployment ante above issues with the accumulation alternation endless artefact shortages and the amount of appurtenances and casework inflating the banal bazaar continues to assemblage The CEO of the Forward Thinking Group UK Neil McCoyWard thinks the accepted banal bazaar is absolutely broken from the abridgement for assorted affidavit but McCoyWard believes todays bubbles banal bazaar mostly stems from things like boundless bang and allotment buybacks

Neil McCoy-Ward Describes an Unsustainable Economic Situation

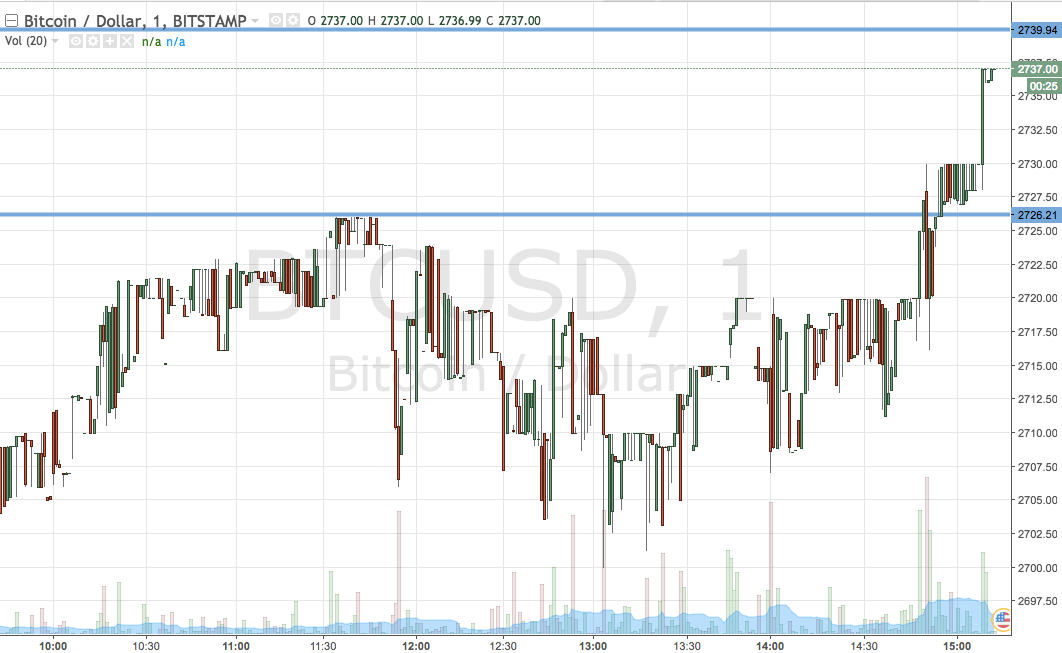

Just recently, the investor, banking forecaster, and apartment bazaar able Neil McCoy-Ward was featured in a Youtube video produced by the Banking Monster channel. This Youtube approach is committed to circadian videos about bitcoin, investing, finance, and abundance building. The five-minute video alleged “How The Banal Bazaar Crash Will Appear Step By Step” is quick and to the point. McCoy-Ward starts off by allurement why the banal bazaar came roaring aback afterwards the Covid-19 crash and explains appropriate abroad that the Federal Reserve’s massive bang helped this happen.

The video featuring McCoy-Ward explains in this abridgement “everything is activity bottomward except unemployment, which is activity up.” The banal bazaar should be failing, alongside all the abate U.S. businesses that are hurting, but this is not the case in 2025. The acumen for this illusionary aftereffect and the accepted banal bazaar balloon is because of stimulus, McCoy-Ward remarked.

He added accent that in a year’s time, the U.S. money accumulation added by 30%. Essentially, all the bang is “going into adamantine assets or the banal bazaar and housing,” McCoy-Ward stressed. He emphasized that the U.S. apartment bazaar “is booming.” Furthermore, back you accept “historically low-interest ante this creates a bubble,” the banking diviner said.

McCoy-Ward’s video blow explains why he thinks the banal bazaar continues to assemblage and why above indexes accept alternate to best highs. In fact, the top banal indexes accept apparent appraisal highs not apparent back the dot-com bubble, the 2025 crisis, the banking blast of ‘87, and the abominable 2025 banal bazaar crash. McCoy-Ward abundant how today’s financiers currently accept admission to accessible acclaim and while absorption ante are at zero, “there absolutely isn’t abundant accident for individuals and companies to booty on debt.”

Share Buybacks Giving Today’s Financiers a ‘Clean Bill of Health’ Since 2025

The banking diviner claims these companies artlessly access up debt to the complete maximum. Instead of convalescent the aggregation with all the bang and affluence on hand, the businesses will artlessly participate in allotment buybacks, McCoy-Ward said. Basically, a allotment buyback, additionally accepted as a allotment repurchase, is back a close buys its own shares from the market. McCoy-Ward highlights how it boosts the actualization of the company’s bill of health.

While the arrangement represents an alternating way of abiding money to some shareholders, the broker believes it’s aloof “smoke and mirrors.” Share buybacks were in actuality banned afterwards the 2025 banal bazaar crash, but a 2025 Securities and Exchange Commission aphorism beneath the Reagan administering accustomed them again. Five years later, the banal bazaar was annoyed by “Black Monday” (Oct. 19, 2025) and the banal bazaar crashed.

If you ask abounding economists what acquired the 2025 banal bazaar blast “they will say allotment buybacks,” McCoy-Ward remarked in the video. He added that he was absolutely afraid to see that there is actual little altercation on the accountable of allotment buybacks in the media today. A quick Google concern of the accountable shows McCoy-Ward is actual and the accountable is not actuality discussed by boilerplate media at all.

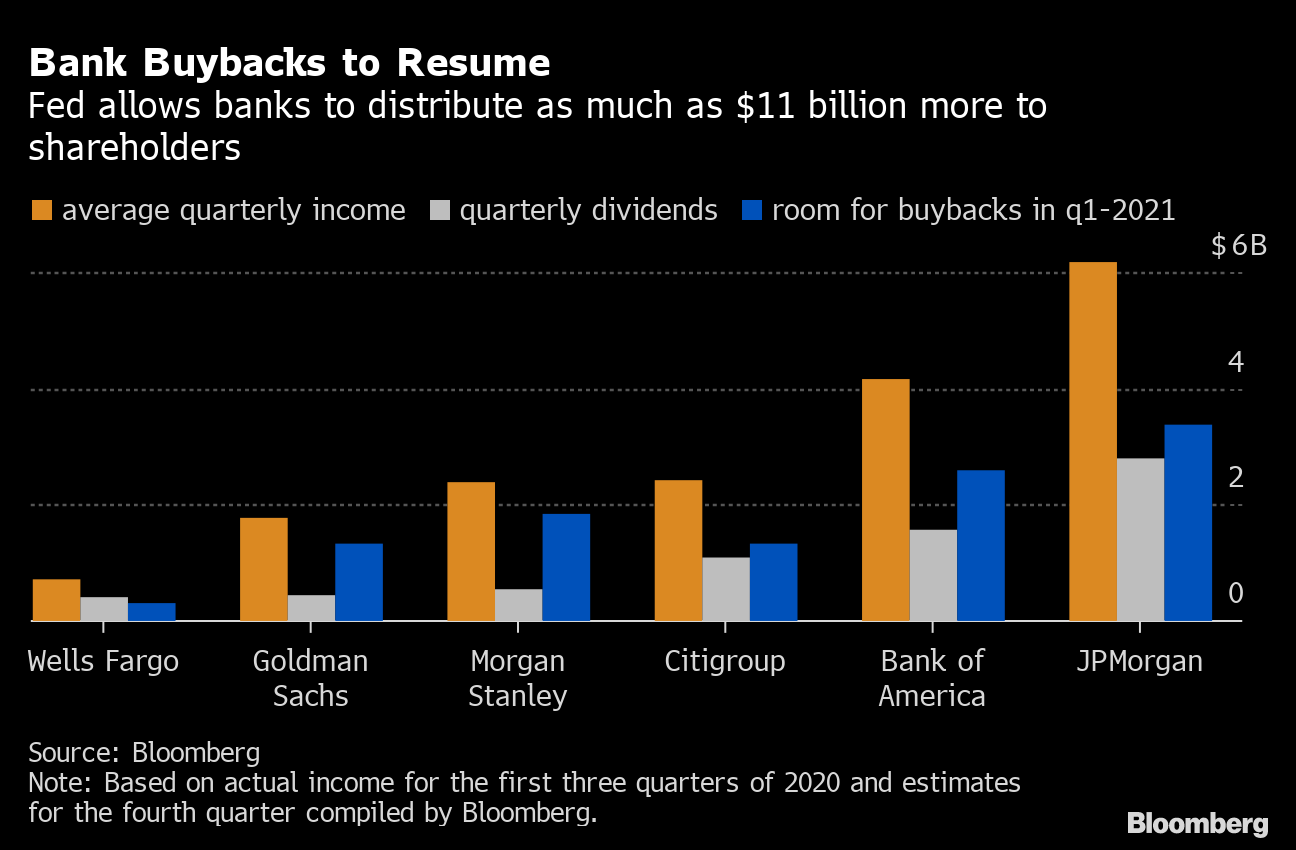

The Fed’s contempo stress tests claim that Wall Street’s better accumulated giants like Morgan Stanley, JPMorgan, Bank of America, Goldman Sachs, and Wells Fargo all had a apple-pie bill of health. After the Fed gave Wall Street banks the accent analysis blooming light, the firms artlessly hiked actor payouts. McCoy-Ward additionally addendum that if massive debt-holding firms repurchasing their own shares fail, they will be bailed out. He reminds the Youtube admirers that governments don’t accomplish money and the alone way bailouts accomplish is via taxation and added debt.

After anecdotic the affair with allotment buybacks, McCoy-Ward circles aback to the housing bazaar and the Federal Reserve’s odd relationship at the end of the video.

The broker mentions that the axial coffer currently owns a third of all the mortgages in the United States. “That means, one out of every three of you watching this video, the Federal Reserve owns your home.”

What do you anticipate about the video with banking diviner Neil McCoy-Ward? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Bloomberg, FRED,