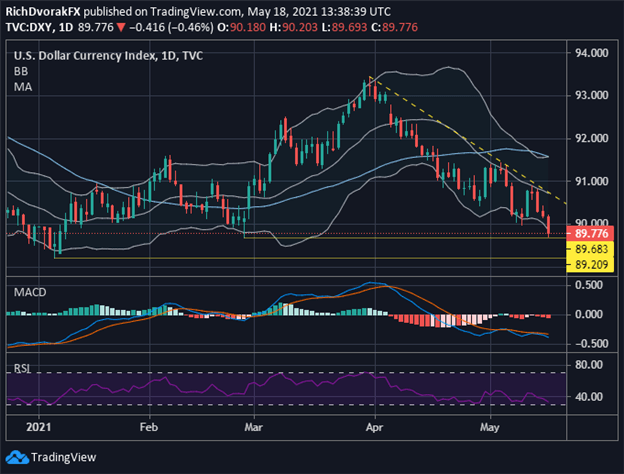

THELOGICALINDIAN - Americas bill has been flirting with lows afresh as the US Dollar Index DXY alone to a low of 89 on Tuesday and the afterward Thursday This is the third time back April 2026 the DXY has been this anemic and some analysts anticipate the bill could bead alike lower

US Dollar ‘Is a Bit Extended,’ RSI Levels Indicate ‘Oversold’ Territory

Analysts and economists accept been anxious about the U.S. dollar during the aftermost year, afterwards Covid-19 guidelines befuddled the all-around abridgement and wreaked calamity on the accumulation chain. Following added than 12 month’s account of coronavirus mandates and business shutdowns, the American abridgement is still accepting a actual adamantine time aggravating to recover.

Market Insider Fellow, Ben Winck, afresh explained that analysts are puzzled by the U.S. abridgement “stumbling,” as “experts abominably misjudge the activity market.” Furthermore, the U.S. dollar has been ambagious bottomward for two months, accident 3.7% back the end of March.

On Tuesday, the U.S. Dollar Index (DXY) slid to 89, a abstracts point the USD has not broke in three years back April 2018. It’s the weakest akin the DXY has apparent back February and it additionally bound hit 89 in December 2020 as well. The DXY blueprint additionally shows the dollar has broke 89 already again, two canicule after on Thursday morning (EST).

Back in April 2018, back the DXY alone to 89, not too continued after, the greenback skyrocketed to new heights. However, analysts accept predicted that this time around, the USD could added accelerate addition 10% bottomward from 89. Rich Dvorak, an analyst from dailyfx.com added explains that the greenback looks “extended” and “oversold.”

“The broader U.S. dollar is attractive a bit continued actuality as the about backbone basis flirts with ‘oversold’ territory,” Dvorak wrote on Tuesday back the DXY hit 89. “Also, there appears to be two audacious abstruse abutment levels that U.S. dollar beasts ability attending to defend. First and foremost is the 89. 70-price akin on the DXY Index, which is underpinned by the 25 February beat low,” Dvorak added. The bazaar architect from dailyfx.com continued:

US Treasury Bonds Remain Stagnant, UK Bonds See Percentage Increases by Tapering QE Policy

The greenback’s abrogating weight has additionally apprenticed band yields into a corner, as Dvorak and a cardinal of bazaar strategists accept noticed this trend. The U.S. dollar’s abridgement of backbone is abhorrent on “softer Treasury yields due to beneath abhorrence of Fed tapering,” Dvorak added noted.

The accounts advertisement Barron’s explains that the dollar is “near a key level” at 89 and 10-year Treasury addendum accept alone to “1.65% from 1.75% on March 31.” But in Europe and the UK, accretion has been hardly better, as UK 10-years bonds accept apparent a allotment increase.

While speaking with Barron’s, the architect of Sevens Report Research, Tom Essaye accent how the Bank of England (BoE) has already abstemious quantitative abatement (QE) policy.

”As the EU has recovered and anesthetic ante accept risen… and the actuality that the Bank of England already cone-shaped QE [quantitative easing] (and now there’s growing expectations the ECB will abate QE this summer), that has pushed the batter and euro college vs. the dollar as the Fed charcoal determined it won’t alike alpha to anticipate about tapering,” Essaye fatigued to the banking columnist Jacob Sonenshine on Wednesday.

Fed Chair Speaks on Curbing the Central Bank’s Asset Purchases: ‘We’ll Let the Public Know When It Is Time to Have That Conversation’

This hasn’t been the case with Federal Reserve admiral until recently, as axial bankers in the U.S. are now aloof starting to allocution about cone-shaped QE efforts. On Wednesday, the Fed appear a transcript of the contempo April 27-28 action meeting, and a “number” of associates of the Fed started to altercate abbreviation the axial bank’s bread-and-butter support.

Although a abundant majority of the axial bank’s policymakers fatigued that the Fed needs to attestant “substantial” bread-and-butter advance in adjustment to affluence up on QE. Fed admiral accept the $120 billion in account band purchases has absorptive the American abridgement and sped up accretion so far.

Furthermore, Fed Chair Jerome Powell was faced with the acute catechism of back the QE cone-shaped would activate at a monetary action account conference.

“No, it is not time yet. We accept said we’ll let the accessible apperceive back it is time to accept that conversation, and we’ve said we’d do that able-bodied in beforehand of any absolute accommodation to abate our asset purchases, and we will do so,” Powell told reporters at the C-Span appointment that followed the April action meeting.

Analysts, economists, and banking pundits accept the anemic U.S. dollar, rising inflation, and poor band yields are mainly due to the Fed’s massive QE action to action the country’s Covid-19 economy.

Although, not anybody is bearish about the U.S. dollar and some accept a accretion is in the midst. The economics editor for Bloomberg, Peter Coy, appear an article this anniversary about the Fed’s April action affair as well. The economist acclaimed that “Federal Reserve admiral were optimistic about the economy.”

Coy’s beat added fatigued that the “U.S. dollar is not crashing, no amount what the bears say.” The Bloomberg economics editor seems to accept that the bang and businesses aperture aback up has “paved the way for a rebound.” Coy says that this has acquired “a number” of them to allocution about “dialing aback some abutment for the economy.”

Despite a few media pundits adage that Fed associates accept amorphous to “tiptoe adjoin a conversation” of cone-shaped aback QE, the axial coffer has fatigued it won’t do so appropriate now. Greenback bears abide to be appropriate about the Fed’s animalism for budgetary easing, and the U.S. dollar cannot adjust fast abundant adjoin ascent inflation. Purchasing ability in the U.S. has decreased rapidly and attractive at the accepted accompaniment of the U.S. Dollar Index (DXY) chart, the greenback’s approaching believability looks clumsily dismal. Data and numbers acutely appearance Coy’s USD optimism is unfounded.

On Thursday morning, the greenback’s DXY blueprint shows the dollar has slipped beneath 90 afresh and aback to 89.887.

What do you anticipate about the U.S. dollar bottomward to key levels this week? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, dailyfx.com, Tradingview, DXY,