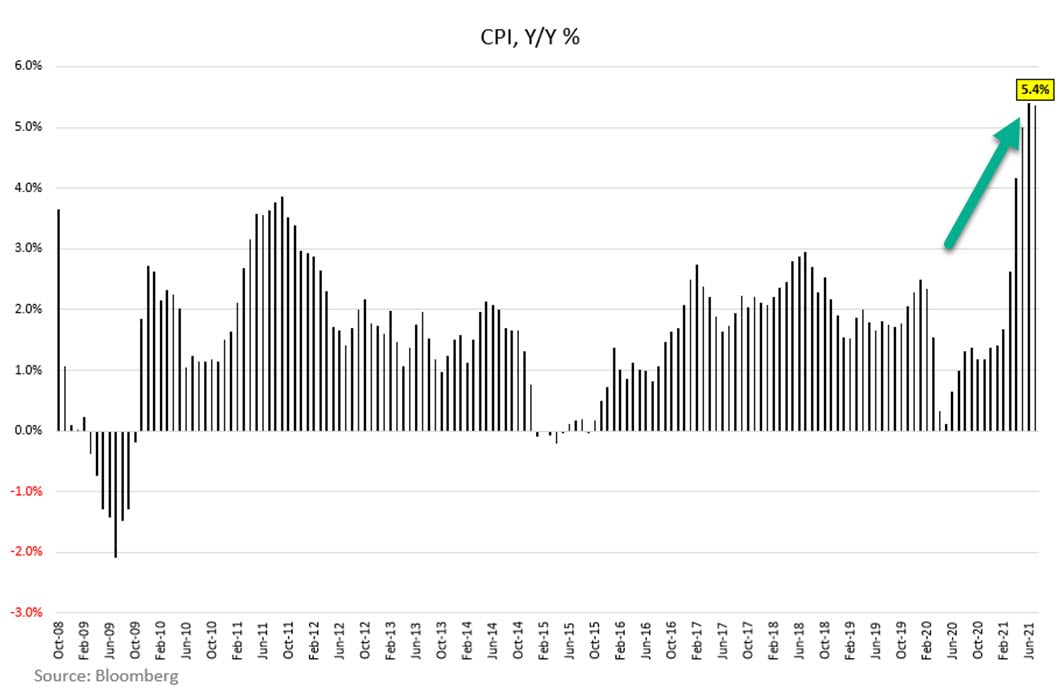

THELOGICALINDIAN - The United States is adverse astringent aggrandizement admitting the Federal Reserve and boilerplate media acceleration bottomward on adage the accident of purchasing ability is aloof concise This anniversary customer and ambassador metrics from July accept been appear by the US Bureau of Labor Statistics and aggrandizement is growing stronger

July CPI Stats Show a Jump to 5.4%, Producer Prices Skyrocket by 7.8%

President Joe Biden has been compared to Jimmy Carter as Americans are witnessing the activation of stagflation. The appellation “stagflation” was actual accordant during the Carter administering because America saw apathetic bread-and-butter advance and all-inclusive unemployment numbers. Bread-and-butter advance and unemployment numbers in 2026, attending a bit added abominable because of the after-effects 2026’s Covid-19 lockdowns and government mandates caused.

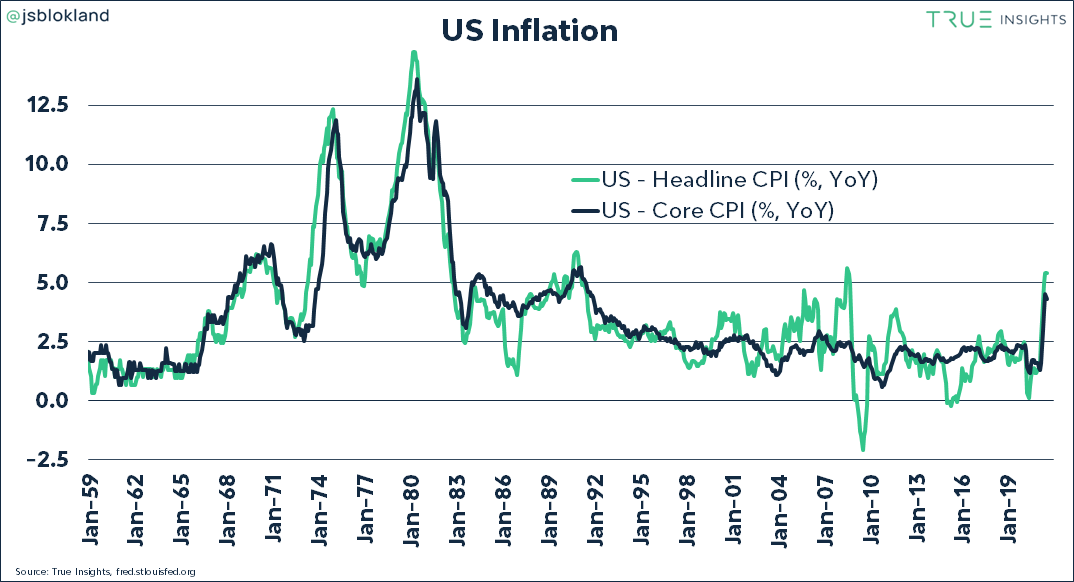

This week’s data from the U.S. Bureau of Labor Statistics indicates that the Consumer Price Index (CPI) jumped to 5.4% aftermost month. This is a CPI almanac not apparent back 2008 and to accomplish affairs worse the U.S. has accomplished a record-breaking 7.8% access in ambassador prices. Consumer prices accept been a anguish for absolutely some time now afterwards the U.S. Federal Reserve ballooned the budgetary accumulation added so in a distinct year than any added time in history.

The Federal Reserve administrator Jerome Powell said in April that the axial coffer believes the affair with aggrandizement will be bound quickly. Powell fatigued the “nature of a aqueduct is that it will be resolved.” In abounding statements, Powell and his axial coffer colleagues accept alleged the accepted aggrandizement “transitory” and it won’t last. Powell additionally didn’t accept manufacturers would access prices on Mainstreet consumers. “We accept producers are afraid on casual on these prices to consumers,” Powell emphasized.

The August 2021 CPI report shows that aggrandizement is ascent on about everything. Real acreage and hire prices accept bubbled significantly, the basis for hotels and motels jumped 6.8% in July, and gasoline acicular by 2.4%. The amount of advantage is through the roof alike admitting the USDA believes aggrandizement on aliment may apathetic in 2022. Airline fares are up 19%, the amount of accessories jumped 12.3%, and the amount for acclimated automobiles skyrocketed by 41%.

Paul Krugman Dismisses Inflation, Biden Administration Blames OPEC, Americans Sense Another Round of Lockdowns

Of course, Paul Krugman via the New York Times is telling people not to accept “inflation anxiety.” Furthermore, the Biden administering says that the Organization of Petroleum Exporting Countries (OPEC) is the account of the ascent inflation. Instead of federal spending, the Biden administering is blaming the black abridgement on oil prices and Biden says he gave OPEC a message. “We additionally fabricated bright to OPEC… that the assembly cuts fabricated during the communicable should be antipodal as…the all-around abridgement recovers, in adjustment to lower the prices for consumers.”

Meanwhile, as Biden blames the amount of oil, Americans accept been ambidextrous with a advance of account apropos Covid-19 and the assorted variants. The antecedent stages of government-mandated lockdowns are beginning to resurface over the affair about these new variants.

At the end of July, the Biden administering revealed the White House is able to acknowledgment to lockdowns, admitting the data that shows lockdown approach accept been harmful. Another annular of lockdowns could advance the American abridgement alike added into a hole. As far as OPEC is concerned, White House columnist secretary Jen Psaki, told the media that the administering wants to aftermath a “long-term engagement” with OPEC.

What do you anticipate about the Consumer Price Index jumping appreciably in July and the acceleration in ambassador prices? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, True Insights, Bloomberg, Twitter,