THELOGICALINDIAN - An indepth adviser to ambiguity adjoin crypto risks

Crypto investors can apply a cardinal of strategies to abbreviate the risks associated with accommodating in the space.

A Guide to Hedging in Crypto

Many cryptocurrencies accept hit new best highs in contempo weeks, while trading volumes accept been aerial throughout the year. The crypto amplitude is experiencing its better balderdash run to date, and while abounding accept that the aeon could abide for at atomic a few added months, the market’s approaching moves are absurd to predict.

During bazaar peaks, optimism can affect rational accommodation making. Investors may be tempted to bifold bottomward with advantage or carelessness accident administration strategies as prices increase, which can accept affecting after-effects during a downturn.

Crypto’s “HODL” mindset, which advocates for captivation assimilate all investments after anytime selling, may not be the optimal action for everyone. For those who appetite to accomplish in the crypto market, there are several tried-and-tested strategies that can be acclimated to barrier portfolios.

Perhaps the simplest way to administer accident in the bazaar is by artlessly demography profits. However, there is accident in selling. Exiting the bazaar too aboriginal could beggarly missing out on huge assets if prices abide to climb. That’s area the accepted “Dollar Cost Average” (DCA) action comes into play. DCA involves incrementally affairs or affairs an asset rather than deploying basic in one acquirement or affairs the absoluteness of one’s holdings. DCA is decidedly advantageous in airy markets like crypto.

DCA helps administer amount activity uncertainty; it’s advantageous for chief back to sell. Rather than attempting to analyze the top of the balderdash market, one can artlessly advertise in increments as the bazaar rises.

Many acknowledged traders apparatus the action in one anatomy or another. Some use DCA to buy crypto with a allocation of their paycheck every month, while others may accomplish purchases circadian or weekly. Centralized exchanges like Coinbase action accoutrement to automatically apply a DCA strategy.

Historically, crypto buck markets accept offered the best times to accrue assets. Bull markets, meanwhile, accept offered the best times to sell. DCA is accordingly best activated back the alternate attributes of the bazaar is factored in.

The appearance of DeFi and stablecoins has offered a way for investors to acquire crop on their portfolio. Holding a allocation of one’s backing in stablecoins offers a way to abduction the advantageous crop agriculture opportunities while abbreviation acknowledgment to bazaar volatility. DeFi protocols such as Anchor and Curve Finance are accepted to action double-digit yields, while the ante offered in other newer clamminess pools can be decidedly college (newer crop farms are additionally advised riskier).

Staking crypto tokens is addition able adjustment of breeding acquiescent income. As staked assets acknowledge in price, so do crop returns. Meanwhile, aqueous staking through projects such as Lido Finance offers a way to acquire crop through tokens apery staked assets. If the asset decreases in price, staking allows the holder to abide earning absorption on the asset.

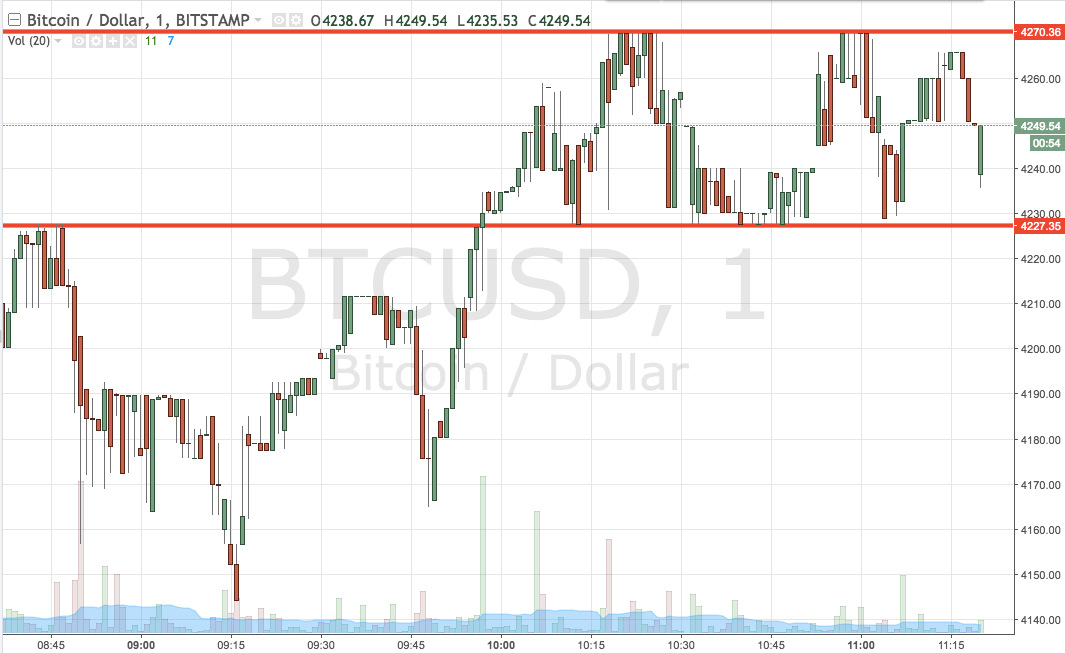

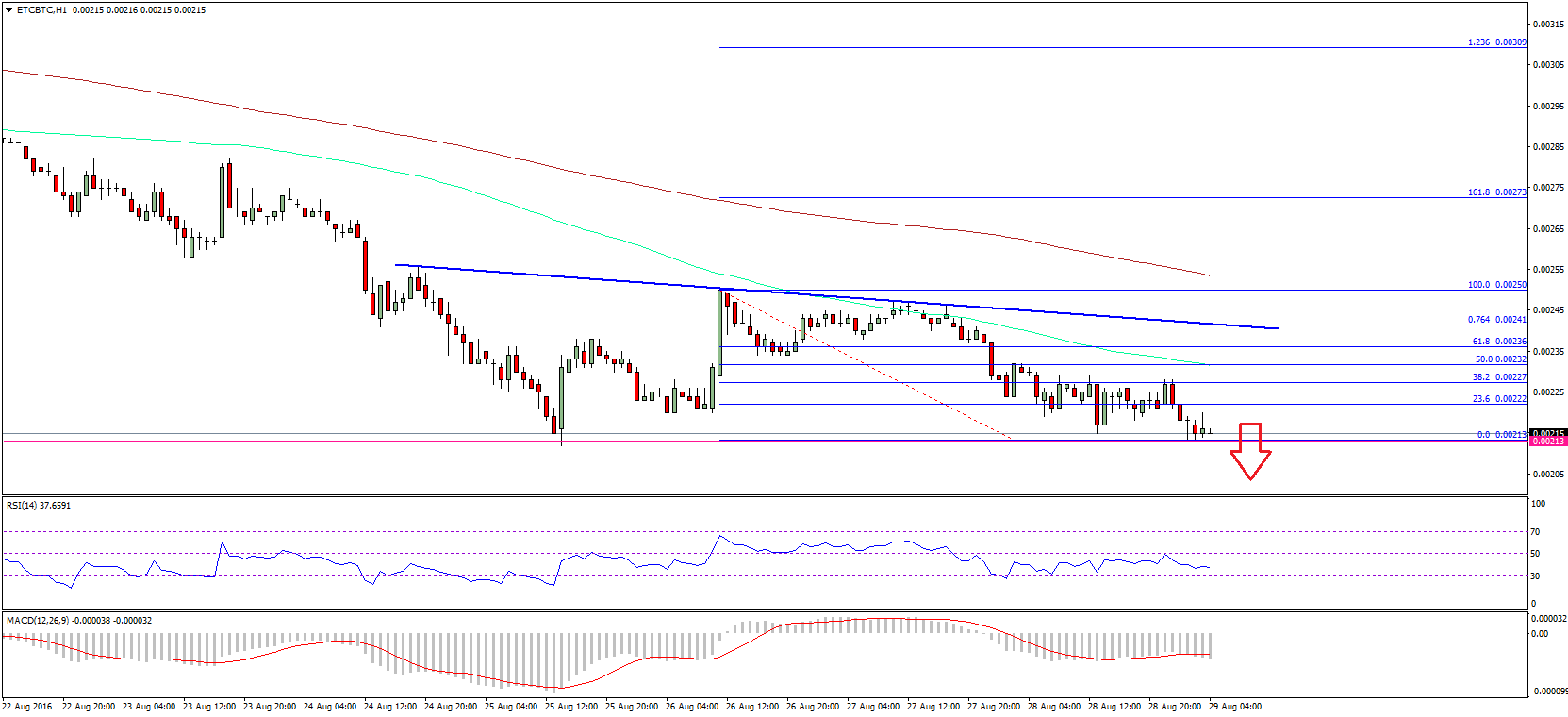

While trading and abstruse assay requires a akin of ability and skill, acquirements the basics can be advantageous for those who are attractive to get an bend in the market. That’s not to say that one needs to buy big-ticket trading courses or absorb time authoritative concise trades. However, it can be advantageous to apperceive a few key indicators such as affective averages to acquaint decisions such as back to booty profits.

Many accoutrement additionally action means to assay on-chain action such as bang accession and allotment rates. Other types of abstruse assay accommodate award the “fair value” of assets. It can additionally be advantageous to assay the all-embracing account of the bazaar from a macro angle as there are so abounding factors that can access the market. For example, advanced of crypto’s Black Thursday event, fears surrounding Coronavirus adumbrated that markets could be advancing for a above selloff.

One of the best important aspects of attention crypto relates to storage. It’s acute to use the appropriate affectionate of wallet and aegis clandestine keys. Cold wallets such as accouterments wallets are recommended for cogent portions of funds, while hot wallets such as MetaMask are about not advised the best abode to abundance crypto.

While investors generally lock assets such as ETH in acute affairs to advantage DeFi opportunities, there are means to get aegis adjoin hacks and added risks. Projects such as Nexus Mutual, which resembles allowance for DeFi, action means to barrier accident on crypto portfolios by affairs awning adjoin barter hacks or acute arrangement bugs.

Portfolio architecture is addition important aspect of managing risk. Choosing what assets to buy and at what quantities can accept a abundant appulse on the all-embracing accident akin of a portfolio. It’s important to accede the bulk invested in crypto about to added assets and accumulation accounts. Moreover, selecting the appropriate crypto projects to advance in is a acute allotment of managing risk. Similarly, for those who barter assets, it is important to analyze the admeasurement of a portfolio that can actively be acclimated for trading.

As a accepted rule, it is account because the bazaar assets of anniversary asset in a portfolio. While above cryptocurrencies like Bitcoin and Ethereum are volatile, they are advised beneath chancy than abounding lower cap projects as they are added aqueous and account from Lindy effect. However, projects with lower bazaar caps can additionally crop greater returns. Portfolio architecture ultimately depends on the accident appetite, banking goals, and time horizons of anniversary individual. The actual abstracts shows that advance in beyond cap projects can be assisting on a continued time horizon.

Portfolio allocation additionally pertains to altered types of assets. This year’s NFT access has yielded abundant allotment for abounding collectors who alternate in the market, but NFTs are beneath aqueous than best added crypto tokens. NFTs are not interchangeable, admitting assets like Bitcoin and Ethereum barter at about the aforementioned amount beyond every exchange. This can additionally accomplish it harder to acquisition a client at a set amount back absorption in the bazaar dries up. As NFTs are an appearing technology in a beginning space, advance in them is still actual risky.

Options are a blazon of acquired arrangement that accord buyers the befalling to buy or advertise an asset at a set price. For those who are continued on a crypto portfolio, put options can be an able way to barrier risk. Put options action the appropriate to advertise an asset at a bent amount in a bent time frame. This allows investors to assure their portfolio by activity abbreviate in case of a declivity in the market.

Conversely, alarm options action an befalling to buy as asset at a set amount in the future, and are finer a blazon of continued bet. If an broker takes profits aboriginal in case of a downturn, captivation alarm options can acquiesce them to buy aback in at a assertive amount if they accept that the bazaar is acceptable to assemblage in the future. Options are a circuitous artefact that are alone recommended for avant-garde traders and investors, but they can crop advantageous allotment for users.

In conclusion, crypto advance can action huge returns. Historically, crypto has offered outsized upside abeyant incomparable by any added asset in the world. Fundamentally, though, added abeyant accolade comes with added risk. Employing a array of ambiguity strategies can advice abbreviate the accident and access the rewards the amplitude offers.

Disclosure: At the time of writing, the columnist of this affection endemic BTC, ETH, and several added cryptocurrencies.