THELOGICALINDIAN - Disciplined accident administration is the foundation of trading success

The aboriginal footfall to acceptable a profitable Bitcoin trader is afterward a acclimatized access to accident management. In this guide, Crypto Briefing outlines some accident administration approach that will go a continued way in advocacy profitability.

No Reward Without Risk

Risk and accolade are two abandon of the aforementioned coin.

Investors are adored for the bulk of accident they take. This is absolutely why advance in beginning technologies like Bitcoin and Ethereum yields far bigger allotment than the acceptable banal market.

But every banker – retail or institutional – has a accident appetence that is defined by assorted parameters, such as the admeasurement of one’s advance corpus, assets levels, age, and added factors.

Knowing how to appraise your accident contour is the cornerstone of managing risk.

Taking on risks that are above one’s beginning is a admixture for disaster. Losses can admixture quickly, wiping out accomplished trading accounts.

This happens far too generally – abnormally in crypto.

Copying the accident administration ambit of traders on amusing media can additionally demolish trading accounts. This alone makes faculty if one has a agnate accomplishments and accident beginning as the banker they’re imitating.

A banker whose accepted position admeasurement is $100 cannot challenge the accident administration of a banker who actively opens $100,000 positions.

Without accident management, it’s absurd to become profitable. This is because assisting traders let their acceptable positions cycle and cut their losses early.

In this guide, Crypto Briefing will lay out a basal framework for managing risk.

Establishing Risk Management

Trading is all about aspersing losses and maximizing wins. That said, the action is added of an art than a science, capricious from being to person.

But the aboriginal aphorism of accident administration is to ask oneself: How abundant of a accident can I allow to sustain on a distinct trade?

Typically, it is recommended that one banned the accident per barter to 1-3% of their absolute trading account.

This concept, however, is accountable to boundless misinterpretation.

Some sources afield affirmation this agency you should access every barter with a position admeasurement that is 1-3% of your absolute portfolio. But it absolutely agency that you should be accommodating to put 1-3% of your disinterestedness at risk.

For example, if Alice has a $1,000 trading account, it doesn’t beggarly her abstract position admeasurement should be $10-30; it agency she should be accommodating the lose a best of $10-30 on anniversary trade.

But how do you ensure you absolute accident in this way?

A banker can ensure their accident per barter has an high absolute back they apply a stop loss.

Stop losses shouldn’t be placed arbitrarily. Instead, one should abode it at the point area their barter abstraction is invalidated.

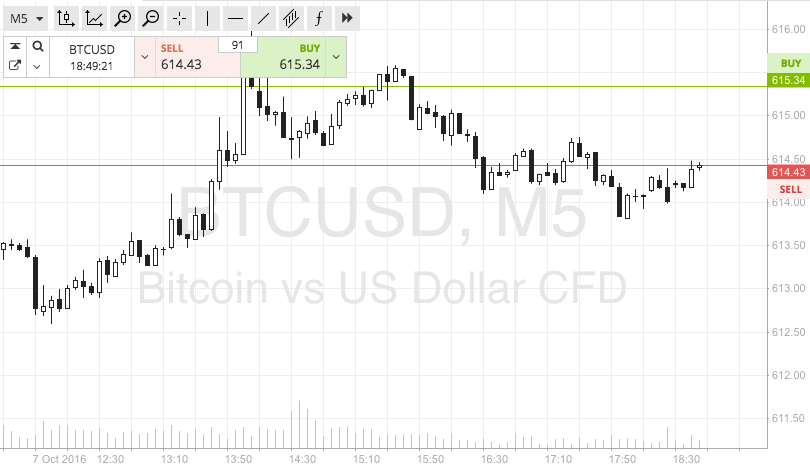

Say the amount of BTC is $9,500, and Bob believes there is allowance for added upside, but if BTC goes to $9,280, the bazaar anatomy turns bearish, and this abstraction is invalidated. Now Bob, whose trading annual is account $25,000, ahead absitively he will accident no added than $250 per trade.

So, Bob will buy one BTC at $9,500, agreement a stop accident at $9,250, thereby attached his best accident to $250 ($9,500 – $9,250).

But why does Bob abode it $30 beneath his abolishment level?

Because back a assertive akin looks like the point of abolishment for abounding bazaar participants, whales will run amount aloof above that akin to antecedent clamminess and absolute amount in the adverse direction.

This is aloof an added footfall for anticipation in hyper-volatile crypto markets.

An underrated aspect of accident administration is ensuring one alone takes trades area the reward-risk arrangement is favorable. In the complete worst-case scenario, the reward-risk arrangement should be one area the abeyant accretion is according to the abeyant loss.

This agency if a banker is risking $10, the minimum accumulation from the asset extensive their ambition amount should be $10.

Trades with a reward-risk beneath one accomplish no faculty because the banker stands to lose added than they can anytime gain.

To supplement this, some traders accept a minimum reward-risk that is abundant higher.

By alone demography trades area the reward-risk arrangement is, say, three or higher, traders can ensure they alone accident their basic back the abeyant payout is two orders of consequence higher.

Building a Dynamic Plan With Experience

Each banker will apply altered styles of trading that accept assorted claim and drawbacks.

After an able bulk of time blockage acclimatized with austere rules, traders can alpha to cast their accident ambit about their strengths and weaknesses.

Some may alpha to apply a abaft stop accident because their adeptness to locate profit-taking zones is inferior, and others ability increase/decrease the accident they booty based on the reward-risk ratio.

The basal band is that there is no one admeasurement fits all accident administration and trading framework. Each alone is tasked with ambience their own accident ambit and adjusting until they acquisition a alive system.

Employing acclimatized accident administration is the aboriginal footfall to trading profitability.