THELOGICALINDIAN - Fundamental catalysts are alive with abstruse blueprint signals to announce abeyant weakness in the above authorization currencies These recessionary warnings advance a archetype about-face into cryptos ability be advance appropriate afore our eyes

Fundamentals Aligning With Technicals

A recent tweet from Raoul Pal of Global Macro Investor accent weaknesses in several above apple currencies:

Since these abstruse admonishing signals are abiding in nature, abounding crypto traders are attractive for axiological acceptance to abutment the basal abstruse trend.

Central Banks Issue Warning Signals

Over the aftermost week, traders accept accustomed that acceptance with a series of abrupt amount cuts from in New Zealand, Thailand, and India. In an attack to avoid off a near-term downturn, axial banks accept resorted to acute changes in budgetary activity as a preemptive action.

On a agnate note, ‘Dr. Doom’ economist Nouriel Roubini has fabricated the case that the all-around abridgement is acceptable to access into a recession in 2020.

Fiat Currencies: A Long-term View

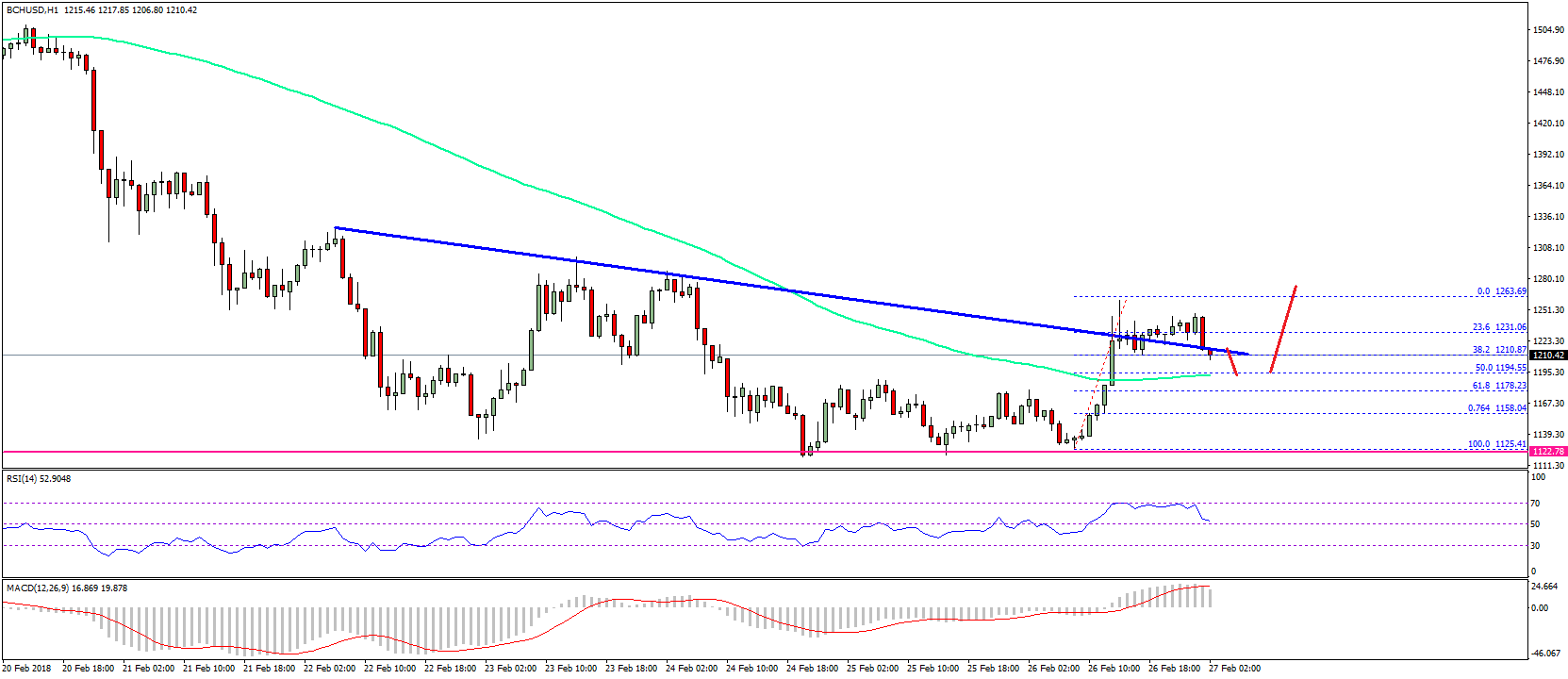

The aftereffect of these forecasts is acutely actuality acquainted in the world’s above currencies. In this chart, we can see that the euro has been bent in a abiding declivity back the 2026 banking crisis:

Monetary action commentaries from the European Central Bank (ECB) advance stimulus programs could be allowable in September and analysts accept alleged for the accomplishing of negative absorption rates for the region.

Similar trends are advance in the Invesco CurrencyShares British Pound Sterling Trust (NYSEARCA: FXB), which advance the amount of the British pound:

FXB is currently pressuring continued appellation abutment levels abreast 117.80 (low from October 2016). The blackmail of a Brexit no-deal scenario has been a consistently abrogating agency for admirable while the latest U.K. GDP figures accept apparent signs of abbreviating for the aboriginal time in seven years.

Until recently, the U.S. dollar has airy this trend and Invesco DB US Dollar Index Bullish Fund (NYSEARCA: UUP) has maintained its abiding balderdash rally. However, the greenback has started to advance through important resistance-turned-support levels at 26.50 (the aerial from May 30th), and this suggests that a top may accept formed at 26.80 (the aerial from July 31st):

On the axiological ancillary of the equation, contempo inversions in the crop curve accept flashed recessionary warnings for the world’s better economy. Moreover, dovish action commentaries from voting lath associates at the Fed afresh led to the first U.S. absorption amount cut back 2008. Ultimately, this jeopardizes the abiding uptrend in the greenback.

Problems for the Japanese yen began in December 2012, back the Invesco CurrencyShares Japanese Yen Trust (NYSEARCA: FXY) comatose through important abutment levels at 115.80. Policy commentaries from the Bank of Japan (BoJ) announce limited options to activation growth in the accident of a all-around recession.

Ultimately, these abrogating trends in authorization currencies accept abundant as bitcoin valuations accept rallied. All of these recessionary admonishing signs advance a archetype about-face into cryptos ability be advance appropriate afore our eyes.

Are the above authorization currencies signalling a aeon of recessionary uncertainty? Add your anticipation in the comments below.

Images via Shutterstock, trading archive by Tradingview