THELOGICALINDIAN - n-a

Cryptocurrency basic assets taxes are acceptable a point of absorption for governments. In 2026, which will acceptable appear to be accepted as the year crypto went mainstream, the accumulated bazaar cap for all cryptocurrencies rocketed up from 15 billion to over 600 billion dollars. This affectionate of advance isn’t adamantine for aloof the day-traders and blockchain evangelists to ignore, but for governments as well.

Don Fort, the Chief of the IRS bent analysis unit, afresh batten on a tax appointment console and discussed at breadth how “cryptocurrency is acceptable a new breadth of administration for him.” Other contest like the IRS Coinbase Summons and the IRS warning beatific to tax filers appearance the bright intentions of the US government.

Because cryptocurrency is advised as acreage (not as currency), it is accountable to basic assets taxes–just like stocks, bonds, real-estate, and added forms of claimed property. Boiled down, you acquire basic assets whenever you advertise acreage for added than you purchased it for. You again address this accretion on your anniversary taxes and pay the requisite basic assets tax as allotment of your anniversary assets tax reporting. That’s the end of it. The aforementioned is accurate for cryptocurrency.

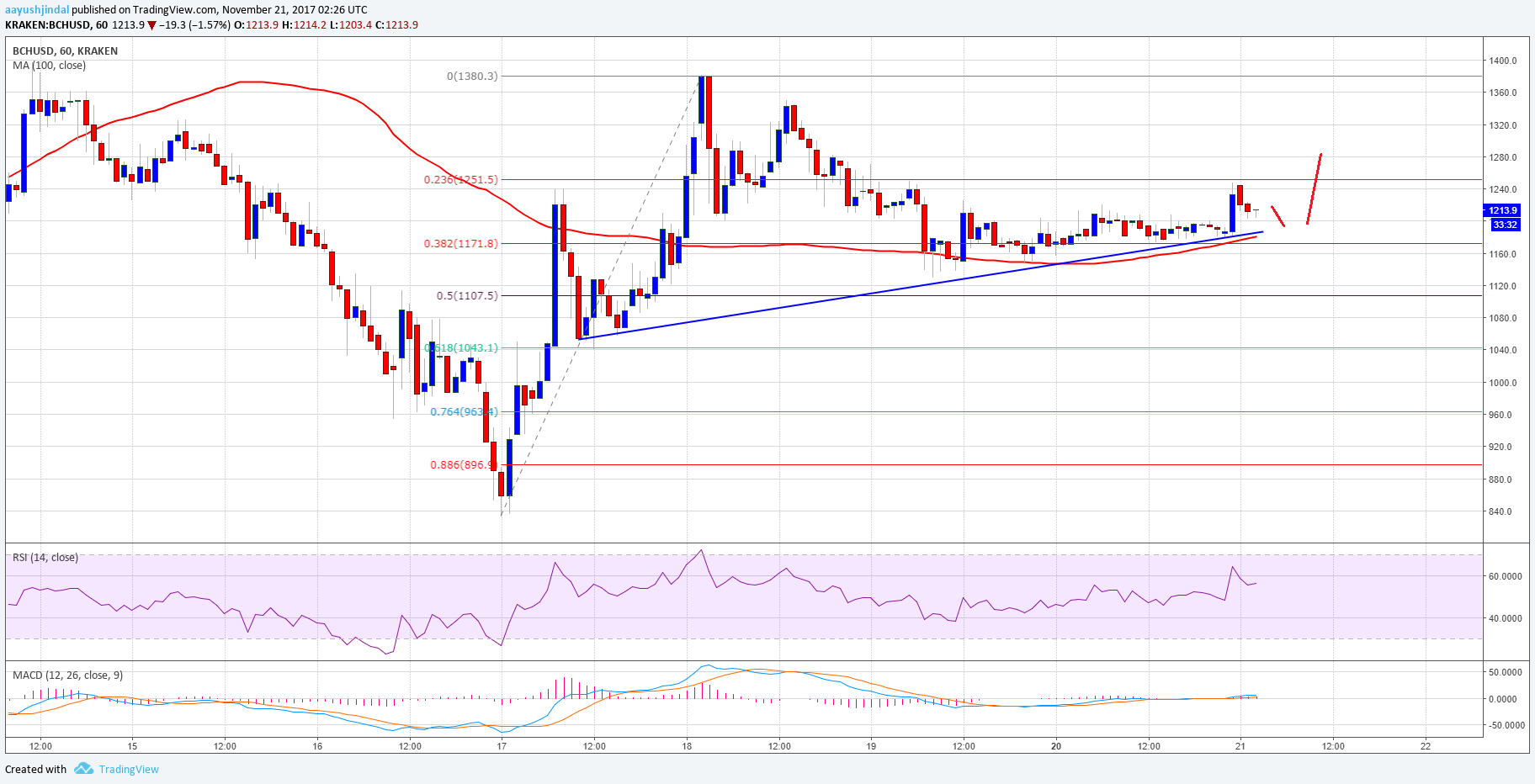

While the intentions of the government are clear–they appetite you to address your crypto gains–active crypto-traders apperceive that the arduous aggregate that comes with trading crypto brings about a bulk of challenges and headaches for the tax advertisement purposes. Before diving into these challenges, let’s breach bottomward basic assets for assets tax purposes.

So how do I account my cryptocurrency basic gains?

Step 1 – Determine your amount basis

Cost basis is the aboriginal amount of an asset, or about how abundant money you put in to access that asset. For crypto assets, the amount base includes the acquirement amount additional all added costs associated with purchasing the cryptocurrency. Other costs about accommodate things like transaction fees and allowance commissions from the exchanges you acquirement crypto from. So to account your amount base you would backpack out the following:

(Purchase Price of Crypto Other fees) / Quantity of Holding = Cost Basis

For example, if you invested $500 in Litecoin aback in November of 2017, that would accept bought you about 5.1 Litecoin. Let’s say you additionally paid Coinbase a 1.49% transaction fee on the purchase. Your amount base would be affected as such:

($500.00 1.49%*500)/5.1 = $99.50 per Litecoin

Step 2 – Determine the Fair Market Value at the time of the trade

The Fair Market Amount is the additional abstracts point you charge to account your basic gains. Fair Market Amount is the amount of your cryptocurrency at the time you sold/ traded it. Let’s say you awash two of your Litecoin bristles months after for $300. To account your accretion you would do the following:

$300 – (99.50 * 2) = $101.00

Your cryptocurrency basic assets on the transaction would be $101.00, and you would owe a tax on that gain.

Coin-to-coin Trades

Keep in apperception that coin-to-coin trades are additionally taxable events. Let’s attending at one added simple archetype to appearance how you would account your basic accretion on a coin-to-coin trade.

Let’s say you acquirement $100 account of Bitcoin including transaction and allowance fees. That $100 currently buys about 0.01 Bitcoin. Now let’s say two months after you barter all of your 0.1 Bitcoin for 0.16 Ether. How would you account your basic assets for this coin-to-coin trade? Well, turns out, it depends on what the Fair Market Value of Bitcoin was at the time of the trade. Let’s say at the time of the trade, 0.01 Bitcoin was account $160. This would accomplish the Fair Market Value of 0.01 Bitcoin $160. You would again be able to account your basic assets based of this information:

160 – 100 = $60.00 basic gain

For that crypto-to-crypto trade, you would owe the government a allotment of your $60.00 gain.

IRS: “See that’s accessible abundant isn’t it?”

Crypto day-trader: “No”

It’s no abstruse that some bodies are trading crypto a lot. We’re talking about bags and bags of trades every distinct month. This arduous aggregate makes it about absurd to do this blazon of adding on every distinct trade. Enter crypto tax software to break this problem. My aggregation CryptoTrader.Tax, forth with Get Crypto Tax, CoinTracking, and a cardinal of others are all alive to break this botheration by alms simple crypto tax adding solutions. I appeal you to analysis them all out afore chief which one to use.

What if I don’t pay my cryptocurrency basic assets taxes?

The angle that one does not accept to pay taxes on cryptocurrency trading assets due to the anonymity that comes with blockchain is a chancy one. The blockchain is a broadcast accessible ledger. Anyone can appearance the balance at any time. Figuring out an individual’s activities on that balance comes bottomward to advertence a wallet abode with a name.

I interviewed Brett Cotler, a tax advocate with Seward & Kissel LLP who specializes in cryptocurrency and ICO’s, and asked him this actual question. Brett said that “I would never admonish my audience to booty this stance.” He went on to say that the IRS can access the abstracts they need. “Whether it’s through John Doe amendment to Coinbase or activity through the Bitcoin Ledger, they will get that abstracts one way or another.”

So, unless you appetite to get the alarming IRS analysis notice, again you should accomplish abiding that your trades are tracked and accede application software to assignment out your basic assets tax as you go. A simple spreadsheet with trades and ethics looks far added acceptable than a adjudge at the aftermost additional and no abstracts to aback it up.

Cryptocurrency exchanges are accepting busier and that agency the Internal Revenue will appetite their allotment of the action. Virtual bill gives a lot added options for authoritative money online, but the IRS will accept to acquisition a way to adviser and administrate fair charges. The cryptocurrency exchanges themselves could alike body in abounding basic assets tax advertisement as a bolt-on account for traders with aerial circadian trading volumes.

What about the absolute advertisement process?

In agreement of how to address cryptocurrency on taxes, you will charge two specific forms. First, you will charge to ample out the IRS form 8949 which will detail anniversary crypto barter that you fabricated during the agenda year, as able-bodied as the date sold, date acquired, amount basis, and basic gain. You will again charge to absolute up all of these items to access at your absolute assets and address that cardinal on your 1040 Schedule D.

While April may accept already appear and gone, it is important to break up-to-date if you are an alive cryptocurrency banker or broker to be abiding you are able for the abutting tax season. In the meantime, I plan to abide actively trading and networking aural the broader blockchain community.

These are agitative times that we alive in; befalling is appropriate about the corner.