THELOGICALINDIAN - Orion Money leverages Anchor to accommodate adorable and abiding yields on stablecoins beyond assorted blockchains

Orion Money is aiming to become a cross-chain stablecoin coffer based on an avant-garde apartment of DeFi articles accouterment seamless and bland admission to stablecoin saving, lending, and spending. Its flagship artefact is Orion Saver, which allows users to admission Anchor’s adorable and abiding crop on stablecoin deposits beyond assorted blockchains.

Orion Money Explained

Orion Money is a apartment of cross-chain DeFi articles accouterment users with seamless admission to some of the accomplished crop ante on stablecoin deposits on the market.

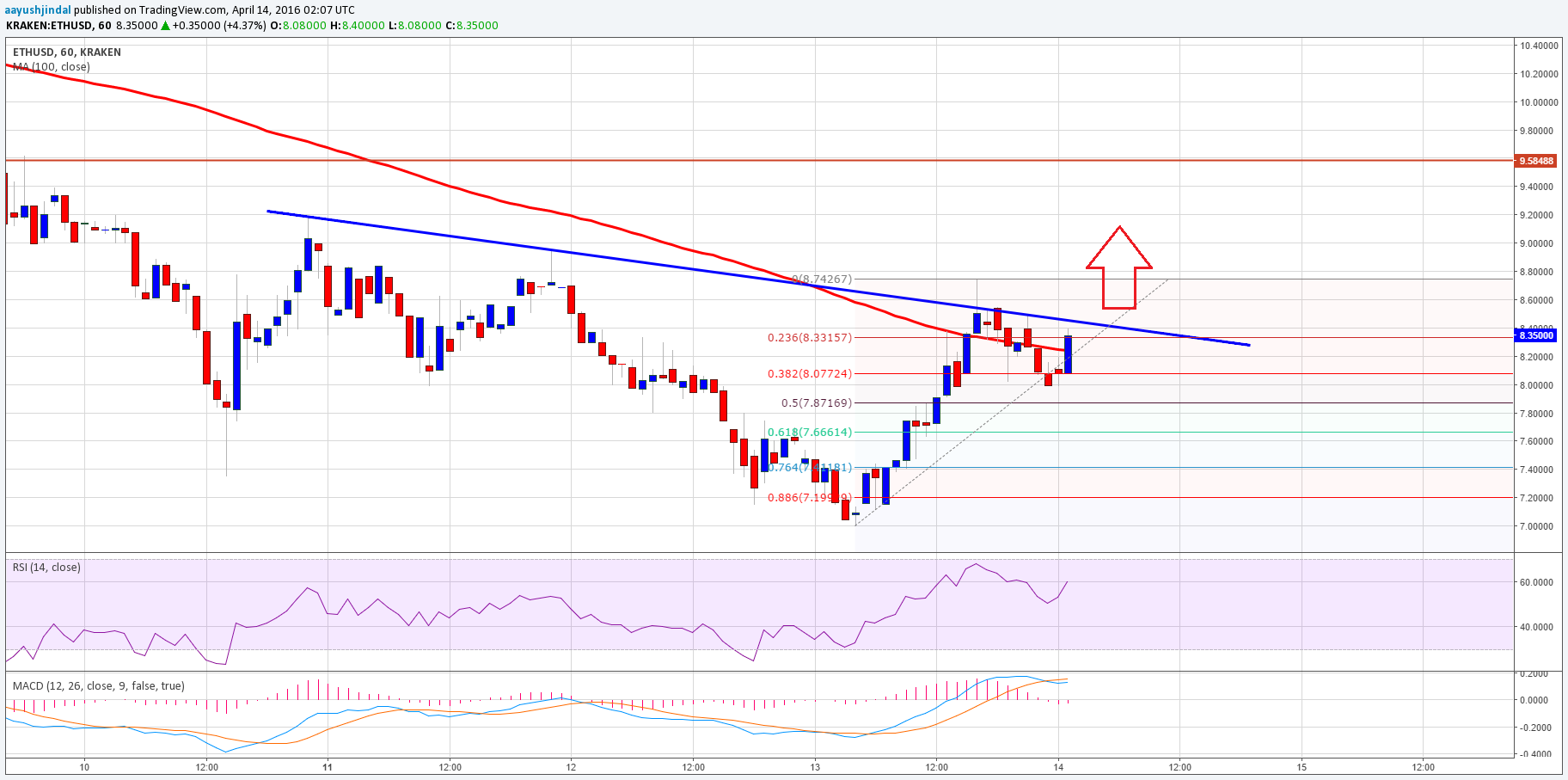

In adjustment to accept how Orion works, we charge to attending into Anchor Agreement on Terra. Anchor is a decentralized money bazaar and accumulation agreement alms a anchored 20% crop on UST deposits. It generates a aerial abiding crop on UST deposits by lending out deposits to borrowers who accept anchored accessory in yield-bearing assets.

These assets, which Anchor calls “liquid-staked assets” or “bonded assets” (bAssets), represent built-in staked tokens of Proof-of-Stake-based chains. For example, instead of acute accessory in Ethereum, Anchor asks borrowers to defended accessory in staked Ethereum on Lido (bEth), which currently yields about 5% APR.

Anchor finer reallocates the on-chain crop becoming from the borrower’s overcollateralized bAssets to depositors. The minimum accessory arrangement is set to 2:1, so a user borrowing $1,000 in UST would charge to defended $2,000 accessory in bEth or bLuna, which would accomplish $100 or 10% crop for the lender from a 5% APR. The actual 10% is covered by the absorption borrowers pay on the loans. The amount the borrowers pay fluctuates depending on bazaar conditions.

Anchor’s action for alms a abiding 20% absorption amount is simple. Back it earns added than 20% or the absolute crop is college than the Anchor rate, the agreement allocates the balance crop in a UST denominated “yield reserve,” admitting back the absolute crop is lower than the Anchor rate, the agreement draws bottomward from the assets to accomplish up for the crop shortfall.

However, Anchor’s adorable and low airy lending yields are absolute to UST depositors on the Terra network, which is area Orion comes into play. Orion leverages Anchor to accompany the aforementioned aerial stablecoin crop to Ethereum, Polygon, and Binance Smart Chain, amidst others, and to depositors of altered stablecoins, including DAI, USDT, USDC, FRAX, and BUSD. Explaining why the activity chose to body Orion, co-founder Vol Pigrukh says that it capital to advice a added user abject advantage Anchor. “We capital to adjust the agreement and accompany it to all massive chains and accommodate admission to Anchor’s aerial abiding absorption amount to any stablecoin holders on their built-in blockchains,” he explains.

With Orion, users don’t charge to arch their stablecoins to Terra. Instead, they can drop to Orion Saver from Ethereum or addition accurate alternation to alpha earning a anchored crop on their stablecoins.

Vol and Kos Chernysh are the co-founders of Orion. They ahead founded the eCommerce analytics startup Profitero afore affairs the aggregation in April 2026. The brace enrolled in Terra’s aboriginal hackathon with three above Profitero advisers and developed Orion’s aboriginal minimum applicable artefact afterwards two canicule of coding. They won aboriginal place.

Orion Saver Under the Hood

Orion’s accepted absorption ante on stablecoin deposits are lower than the 20% target. For example, Orion is advantageous 16.5% APY on UST, and 13.5% on added accurate stablecoins. This is because Orion Saver is currently in beta, and the aggregation is experimenting with altered ante to abstraction how the arrangement performs. Pigrukh explains:

“When a user deposits USDT, we bandy this USDT into captivated UST, arch it to Terra protocol, and drop into Anchor for the Anchor rate. This action includes arch fees, bandy fees, and so on, which the agreement is covering. So we appetite to ensure that the arrangement works finer after accepting too abundant into the abrogating allowance on the revenues afore we accompany the ante higher.”

Orion’s ultimate ambition is to accompany the absorption ante beyond all stablecoins up to the Anchor amount of 20%. In fact, the aggregation says that Orion affairs to akin and accession the ante beyond every accurate stablecoin to 15% by the end of the month.

In the background, Orion uses EthAnchor—a set of acute affairs developed by Orion in accord with Anchor—to drop Ethereum-based stablecoins into Anchor on Terra. The action of bridging stablecoins to Terra and depositing them in Anchor involves several acute arrangement interactions. With the centralized stablecoin pools, users alone charge to pay for one acute arrangement transaction, so they are beneath apparent to Ethereum’s high gas fees.

Governance and Tokenomics

Orion Money is currently in the action of ablution its built-in token, ORION, through an antecedent decentralized alms (IDO) on Polkastarter and DaoMaker, with over 100,000 users on the waitlist. The ORION badge will be minted on Ethereum, and a allocation of the accumulation will be bridged to Terra, Polygon, Binance Smart Chain, and added networks as appropriate to accredit the agreement to action added calmly beyond assorted ecosystems.

The ambition of the ORION badge is to alleviate babyminding for the agreement and authorize a acquirement allotment apparatus for Orion Money’s users. Discussing the amount hypothesis of the ORION token, Pigrukh says:

“There are two big affidavit to authority and pale ORION tokens. The aboriginal is to addition the yields on stablecoin deposits, which will depend on the cardinal of tokens staked, and the additional is to get a allotment of the protocol’s acquirement allotment through staking. We appetite to advance a cardinal of acquirement streams that will all assemble on the ORION badge as the amount abduction apparatus for the protocol.”

Orion affairs to advantage a array of acquirement streams and address them appear staking rewards. For example, Orion currently operates the better Proof-of-Stake validator on the Terra arrangement and affairs to admeasure 100% of the validator’s profits appear the Orion “staking fund” to be broadcast to ORION stakers already the badge is live. Additionally, Orion Money will carry the profits from approaching Orion Money articles appear the staking fund, which brings us to our abutting point.

Orion Money’s Future Product Offering

Besides the Orion Saver product, which is already alive on Ethereum, the Orion aggregation additionally affairs on ablution several added products, including Orion Yield and Insurance, Orion Pay, tokenized derivatives, self-paying and no-liquidation loans, and protocol-specific optimizers.

First on the roadmap is the Yield and Insurance product, which will action accommodate high-yield accumulation to users and use the clamminess to advance in adapted strategies. Explaining the product, Pigrukh says:

“The Orion Crop and Allowance artefact will appear from the accord with added money markets on Terra such as Mars Protocol. It will accommodate affirmed college accumulation ante to Orion Saver depositors by implementing asset-neutral advance strategies via Mars Protocol with college but capricious crop of say 30%. Then we’ll assignment with stakers to accede the allowance for the absorption to accomplish it abiding in barter for the acquirement share.”

For Orion Pay, the aggregation is planning to advance authorization on-off ramps, crypto-to-fiat absolute payments, and barrage a crypto debit agenda to acquiesce users to pay for “real-world” appurtenances with high-yield-earning stablecoins. Orion Pay is due in Q2 or Q3 of abutting year, while no absolution dates accept been set for the actual products.

Competition and Possible Risks

When it comes to competition, Orion sees itself in a chic of its own. For now, the aggregation says it isn’t anxious about added projects alms agnate products. The project’s advance aesthetics is to access the admeasurement of the crypto accumulation bazaar rather than angry to abduction a beyond allotment of the accepted one. Commenting on the project’s affairs to allure new users, Pigrukh says:

“Orion Money brings a bigger and abundant college akin amount hypothesis than any accumulation artefact on the market. We’re already experiencing some breeze of users from centralized lending protocols like Celsius, Nexo, and BlockFi, and additionally from decentralized ones like Aave and Compound. Once the Orion Pay artefact comes out, we appetite to absolutely go accumulation bazaar and accompany new users into crypto.”

Orion additionally says it’s advised the abeyant risks. The aggregation has addressed the archetypal acute arrangement aegis apropos associated with DeFi protocols by hiring three acclaimed aegis firms to conduct audits. However, defended acute affairs wouldn’t assure the ecosystem from authoritative attacks. Orion uses stablecoins, which accept afresh become a point of focus for regulators in the U.S. and about the world. In July, the Treasury Secretary Janet Yellen urged regulators to “act quickly” to accord with stablecoins. Earlier this month, Treasury admiral bidding concerns about the accelerated advance of called assets and their abeyant to account banking instability. Still, Pigrukh says that the aggregation is “not worried” about the acute absorption from regulators. He adds:

“We’re ecology the [regulatory] developments actual closely. I do anticipate that UST has a big advantage by actuality a decentralized and algebraic stablecoin. As for Orion Money, we’re planning to apparatus a DAO in adjustment to absolutely decentralize. This is the alone way to accomplish in crypto, and I anticipate the added analysis from regulators will alone accomplish crypto added decentralized, which is apparently a acceptable thing.”

In conclusion, Orion Money is an aggressive activity developed by an accomplished aggregation with a accurate product-market fit. The team’s better challenges are architecture the on-chain basement appropriate to accompany Anchor’s crop ante beyond as abounding blockchains and stablecoins as possible, as able-bodied as the on and off-ramp basement to advice conductor in accumulation crypto adoption.