THELOGICALINDIAN - Today Europeans woke up to a big blooming candle on the Bitcoin BTC archive Naturally anybody wants to apperceive why

Searching For Reasons In All The Wrong Places

Everyone has their affidavit for Bitcoin’s morning pump, of course.

Oanda Corp. told Bloomberg that the amount movement is addition archetype of Bitcoin’s immaturity, stating:

Some booty a hardly altered assessment and absolutely don’t anticipate the amount movement is a big deal. According to Kenetic Capital managing accomplice Jehan Chu, today is annihilation to address home about. Chu told the outlet:

Bitspark CEO George Harrap meanwhile told the abreast captivated financial, software, data, and media aggregation that he is activity to abeyance what he’s accomplishing and see how things agitate out from here. In commendations to why Bitcoin pumped so hard, he stated:

Joel Kruger, bill architect at LMAX Exchange, however, said:

“Bitcoin has rocketed higher, to bright some aloft levels, breaking aback aloft a alliance aerial from aback in December, to advance it could be cerebration about axis aback up afresh in a added allusive way,” said Kruger, who additionally acclaimed that axial banks may be amenable for dollar’s inflationary achilles heel adjoin deflationary Bitcoin.

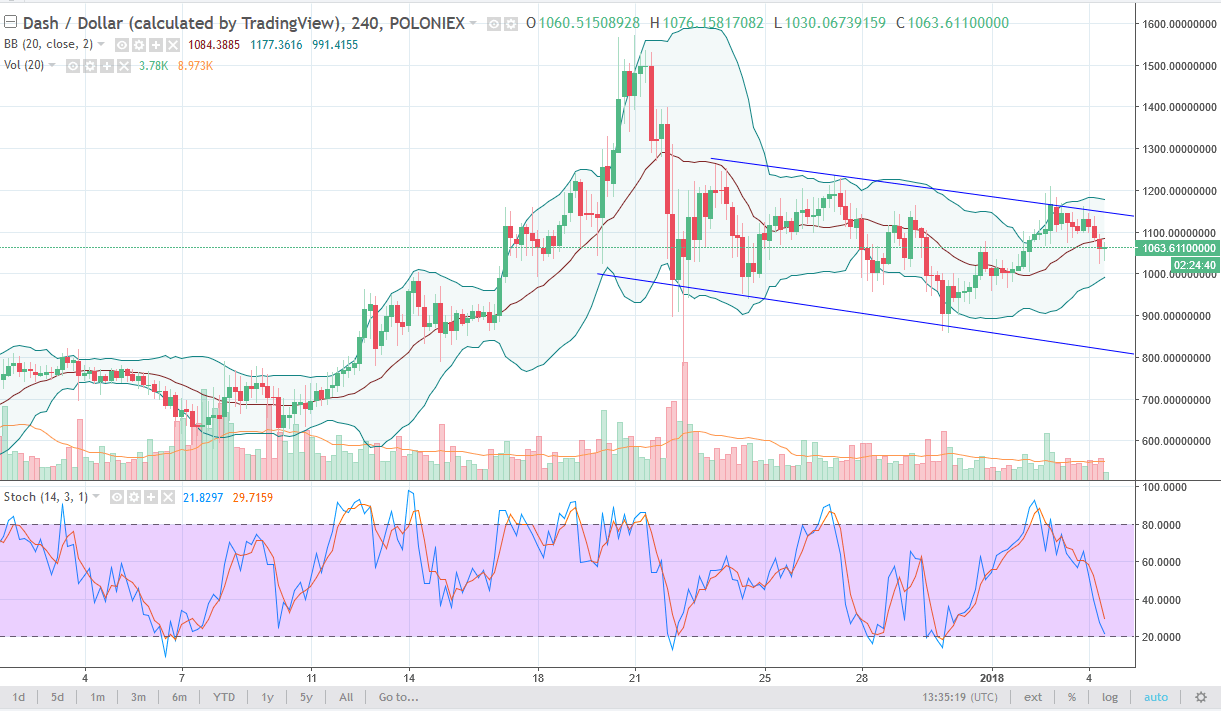

Simple Technical Analysis At Work

In reality, there may be no assumption needed.

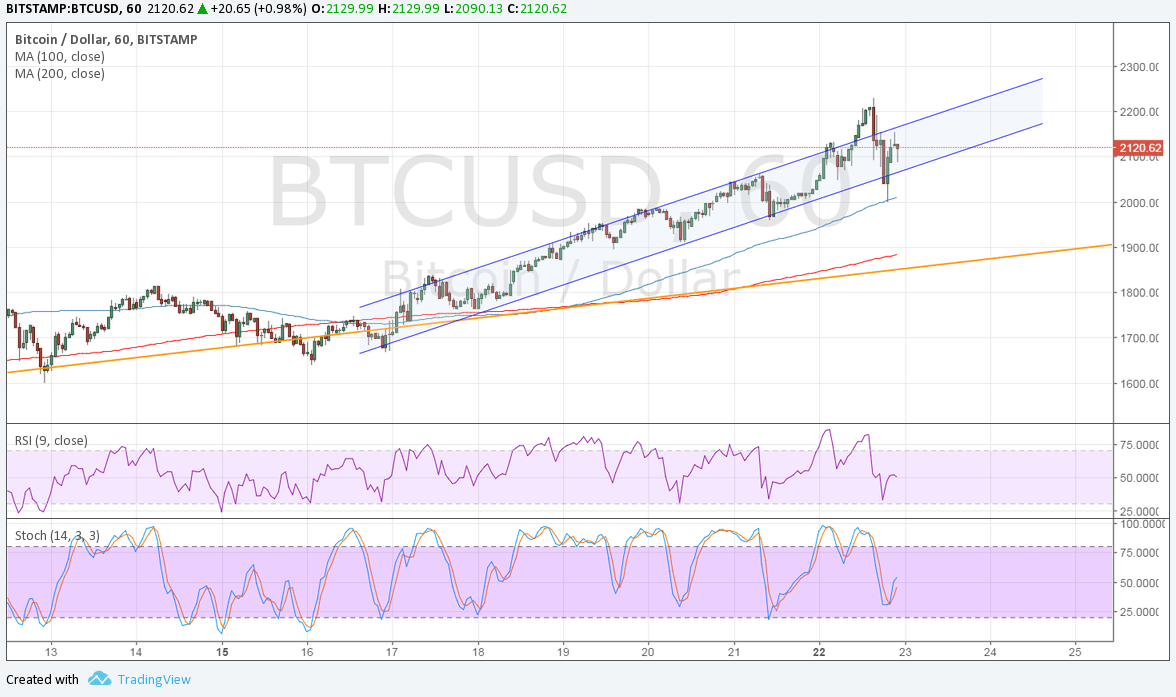

Bitcoin amount has been in the affliction of a ascent block for months, which some would say is a bullish arrangement per classical abstruse assay theory. Upon breaking out of the said wedge, a massive pump was to be expected.

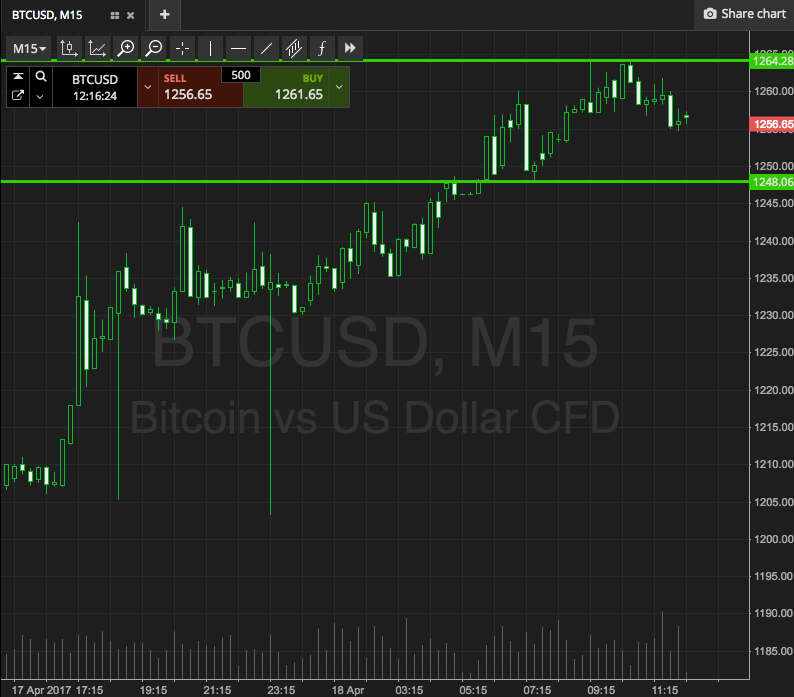

“Bitcoin’s breach aloft $4,200 this morning was critical, as the bazaar had been watching that akin for a while,” eToro’s Mati Greenspan accurately told CNBC, continuing: “No agnosticism some access orders and stop losses were aggregate appropriate above.”

The analyst additionally acclaimed that shorts on Bitfinex, one of the better bitcoin exchanges by volume, are at account lows, suggesting that traders may be gearing up for a abiding rally.

“Bitcoin shorts…near their everyman levels back February,” he said.

CryptoCompare’s Charles Hayter agreed, stating:

Bullish affect is additionally apparent on Bitmex, one of the better Bitcoin allowance trading platforms in the world. Longs to Shorts arrangement currently leans against the beasts at 62 to 38 percent, respectively.

Why do you anticipate the amount of Bitcoin (BTC) bankrupt out this morning? Was it aloof abstruse assay at work, or is there article abroad at play? Let us apperceive your thoughts in the comments below!

Images via Shutterstock