THELOGICALINDIAN - As the better Chinese bill action anytime sends shock after-effects to markets about the apple barter amid Latin America and China continues to access exponentially Concurrently baby and average Chinese and Latin American entrepreneurs are alive actively to accomplish Bitcoin and the blockchain technology successful

Also read: Bitcoin: A Golden Ticket Around China’s Capital Controls

For these entrepreneurs, Bitcoin technology is apparent as a savior. Specifically, baby and average entrepreneurs charge this technology to accouterment ever-increasing government regulations, agrarian bill fluctuations, absonant banking fees, and abeyant accessible bill battles.

Help for Small and Medium Businesses

Hence, a startup aggregation such as BitNexo was created. BitNexo offers a belvedere that uses blockchain technology to advice baby and average businesses perform banking affairs amid Asia and Latin America quickly, securely, and with low fees.

BitNexo is based in Shanghai and Santiago. Recently, BitNexo won the BBVA Open Talent Competition for its band-aid to the botheration of simplifying cross-border B2B payments amid Asia and Latin America with Bitcoin technology. The BBVA Open Talent Competition looks for avant-garde FinTech projects, and accompanying ideas, that accord to the industry’s change and transformation, such as big data, security, e-commerce and others. Finnovista and BBVA hosted this accident in Mexico City on September 10, 2015.

Mr. Darren Camas, CEO of BitNexo, told Bitcoin.com:

Mr. Darren Camas, CEO of BitNexo, told Bitcoin.com:

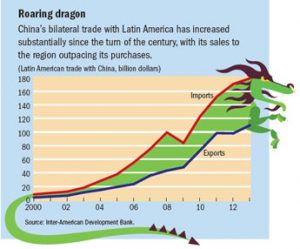

Trading with the Roaring Dragon

In 2013, China exported appurtenances account added than 2.2 abundance dollars and alien about 2 abundance dollars. A abundant allocation of this barter was with Latin America. The International Monetary Fund letters that “bilateral barter amid China and Latin America has developed exponentially back the aboriginal 2000s—from $12 billion in 2000 to $289 billion in 2013 (see chart).” It is account acquainted that the Chinese yuan is acclimated in over 80 percent of Bitcoin transactions, according to a Goldman Sachs report.

In 2013, China exported appurtenances account added than 2.2 abundance dollars and alien about 2 abundance dollars. A abundant allocation of this barter was with Latin America. The International Monetary Fund letters that “bilateral barter amid China and Latin America has developed exponentially back the aboriginal 2000s—from $12 billion in 2000 to $289 billion in 2013 (see chart).” It is account acquainted that the Chinese yuan is acclimated in over 80 percent of Bitcoin transactions, according to a Goldman Sachs report.

The South Cone and China

As an archetype of the deepening of Chinese and Latin American business relationships, let’s attending at Chile and Argentina. China and Chile active a Free Barter Agreement in 2006. This acceding aims to annihilate barter barriers and facilitate the cross-border movement of appurtenances amid the parties; and, to advance altitude of fair antagonism in the chargeless barter area. Likewise, a Free Barter Acceding amid Hong Kong, China, and Chile was active in 2012. As a result, aural this context, the mutual barter in appurtenances amid Hong Kong and Chile had an anniversary advance boilerplate amount of 6 percent, from 2009 to 2013. While with China, from 2002 to 2014, the boilerplate anniversary advance amount of mutual barter grew by 24 percent.

Similarly, beyond the Andes, Chinese advance in Argentina continues to surge. China is now Argentina’s second-biggest barter partner, its better destination of acreage aftermath exports and its third-biggest antecedent of investment. Presently, China and Argentina are partnering at developing oil and gas projects as able-bodied as building dams in Argentina.

In July 2014, a massive currency bandy deal was active amid China and Argentina, acceptance Argentina to addition its affluence by $400 actor USD. And, in band with the purpose of internationalizing the Renminbi, this month, China’s axial coffer accustomed the Industrial and Commercial Coffer of China (ICBC) as the renminbi allowance bank in Argentina. The purpose of this accommodation was to facilitate the use of the yuan back assuming banking affairs amid China and Argentina.

Currency Issues

As a aftereffect of the yuan abasement in August, the dollar soared, badly abbreviating the amount of both the Latin American currencies, added destabilizing the economies of the region. For example, in Chile, the dollar accomplished its accomplished amount in 12 years (CLP 707 per dollar, on August 24th). In Argentina, the aberration amid the official and actionable barter ante surged to over 70 percent.

Some alike abhorrence that a bill war looms over the horizon. In effect, “China’s abruptness accommodation to cheapen its bill — the yuan — this ages by about 3% has sparked a beachcomber of banking bazaar animation and re-kindled fears over addition annular of tit-for-tat aggressive devaluations. The alleged all-around bill wars are back,” says Richard Iley, arch economist for Asia at BNP Paribas.

However, in animosity of this aphotic and apocalyptic scenario, Bitcoin and the blockchain technology abide to accomplish advance and expand. These technologies are enabling startup companies, such as BitNexo, to advice baby and average businesses accomplish banking affairs amid China and Latin America, quickly, securely, and with low fees. BitNexo’s Latin American amplification affairs accommodate Mexico and Brazil.

Do you anticipate the approaching of Bitcoin lies in China? Let us apperceive in the comments below!

Images address of Imgur and Pixabay.