THELOGICALINDIAN - An assay of irregularities apparent in the Augur decentralized anticipation bazaar belvedere has articular a cardinal of architecture flaws Namely it articular a abeyant advance agent based on discrepancies amid a markets accomplishment date and its aftereffect date

How A Prediction Market Works

A anticipation bazaar would assume an ideal use-case for blockchain, harnessing the arguable attributes and abridgement of centralized control. Augur uses the Ethereum blockchain, and allows an alone to actualize a anticipation bazaar based on any bound event.

The bazaar architect defines the topic, end date, and abeyant outcomes, additional an adjudicator if so desired. Trading (denominated in ETH) continues until the event-end, at which point Augur badge holders (or appointed reporter) determines the outcome. Badge holders pale their Reputation (REP) on the aftereffect and accept adjustment fees.

Houston, We Have A Problem (or Two)

Aside from potentially-illegal markets, accoutrement capacity such as assassinations and alarm attacks, there are some key axiological issues.

Owing to its abrupt acquirements curve, abounding Augur users await on assorted web interfaces, which action non-standard appearance and are accessible to manipulation. In particular, abounding users approach arise markets which arise accurate to others. This creates a feeding-frenzy about the few markets with appear volume, which the bazaar architect may able-bodied accept manipulated.

Disputed outcomes go to a voting procedure, with users staking REP, and accepting rewards if they accept the acceptable outcome. This incentivises users to vote for the best accepted outcome, behindhand of whether it is the accurate outcome. On top of this, the authority bond, which is absent if a bazaar is accounted invalid, charcoal fixed, so bad actors can around-the-clock actualize artificial markets.

Potential Attack Vector

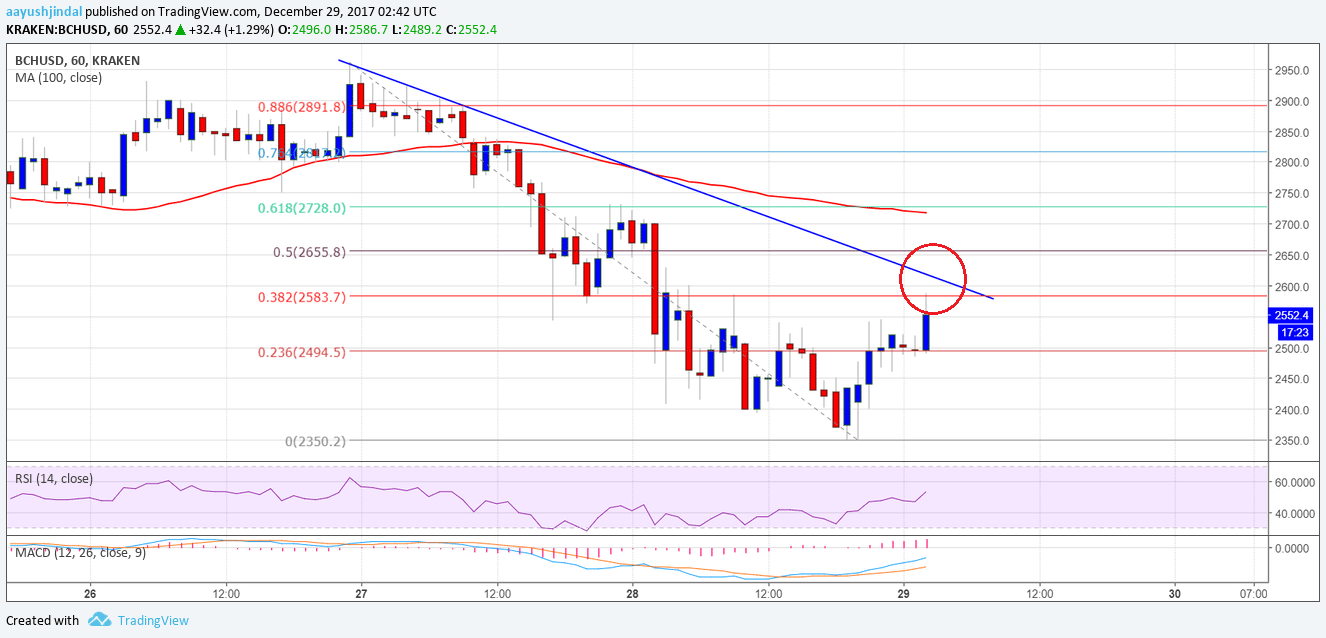

A contempo archetype of how this arrangement can be manipulated, was based on the ‘general amount of Ethereum’ at the end of the day on March 31st (UTC). The bazaar asleep at 01:59 on April 1st (UTC 8), which is afore the aftereffect date, which could account this arrangement to be accounted invalid.

By creating assorted outcomes, one of which was unrealistic (ETH over $1000), and one acutely accessible to accomplish (ETH amid $100 and $1000), it aloof appropriate a bit of wash-trading to allurement punters in.

The antagonist would again accelerate a absolute advertise adjustment for the ‘easy’ outcome, for a adduce which is aloft the accolade for an invalid result, but beneath that of a declared ‘good deal’. Thus users will ample the order, aback actuality potentially ashore in an invalid market.

An invalid bazaar after-effects in an according bulk of ETH activity to shares of anniversary outcome. In a three aftereffect bazaar (the final aftereffect actuality ETH < $100), anniversary aftereffect would be apparent at 1/3 value. With the majority of participants abetment the ‘easy’ outcome, a asymmetry acknowledgment would go to the ‘unrealistic’ backers.

Fixing A Hole Where The Rain Comes In

Whilst Augur has already articular several of the concerns, there has been no official advertisement of advance implementation. Meanwhile, users are still apparent to this affectionate of attack.

Indeed, the aforementioned architect has already fabricated a new bazaar with the aforementioned blemish alleged ‘Ethereum Price at End of April’. There are additionally copycat markets arising up to bolt users unawares.

Until these flaws are fixed, users should apparent accede Augur, ‘buyer beware’.

Will blockchain-based predictions markets apprehend their potential? Share your thoughts below!

Images via Shutterstock