THELOGICALINDIAN - A contempo cheep from CME Group one of the aboriginal companies to action bitcoin futures trading letters that boilerplate circadian trading volumes are up 93 and accessible absorption surpassed 2400 affairs a 58 increase

There accept been alloyed opinions about the success of bitcoin-based futures options back their birth in December 2017, back Cboe Global and CME Group were both authorized to action the advance products.

Bitcoin-based futures trading has, however, additionally faced the aforementioned challenges as cryptocurrency markets as a whole, with afraid institutional broker interest, a amount and bazaar assets decline, and all-around authoritative uncertainty.

Despite the achievement of cryptocurrency markets overall, bitcoin-based futures trading has apparent added absorption and liquidity.

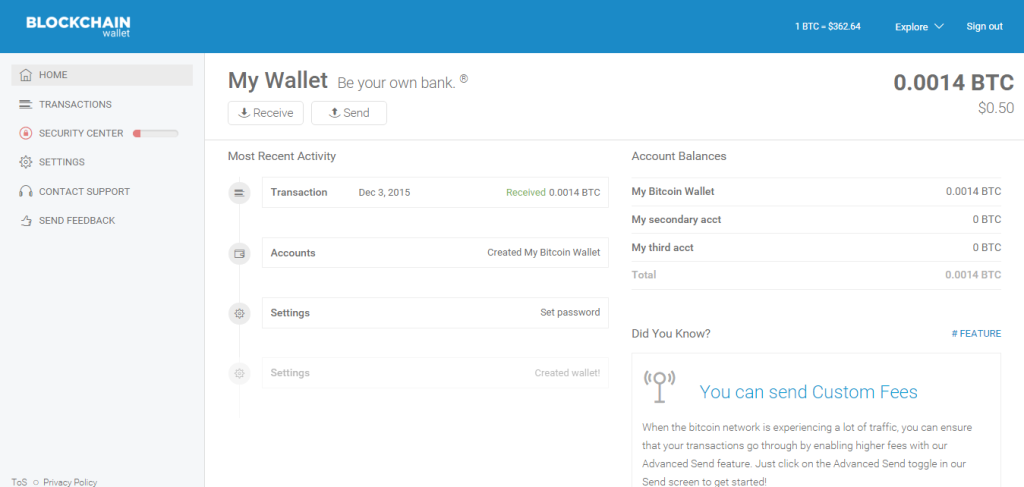

Yesterday, CME Group tweeted its Q1 and Q2 comparison, assuming a advantageous access in Q2 compared to Q1, 2026.

In a press release anachronous July 15, 2018, CME Group appear all-embracing all-embracing boilerplate circadian volumes of 4.2 actor affairs in Q2, 2018 – an access of 13 percent from Q2 2017 – assuming that bitcoin-based futures are still a tiny, but growing, atom of acceptable advance markets.

Cboe Global was the aboriginal to action bitcoin-based futures and is the better U.S options exchange. According to Cboe’s circadian market statistics, on July 20, 2018, its accessible absorption for bitcoin-based futures stood at 4,416, with trading aggregate of 5,170. Historically, Cboe has apparent greater all-embracing aggregate than CME Group. On April 25, 2018, Cboe recorded a almanac 18,000 contracts.

Cboe is potentially seeing greater absorption with its renewed efforts to gain approval from the U.S Securities and Barter Commission (SEC) for the aboriginal bitcoin-based barter traded armamentarium (ETF). A absolute accommodation for Cboe will acceptable appulse cryptocurrency markets appreciably with the conception of a added institutional appearance product. This could additionally be influencing aggregate appropriate now for CME Group.

BlackRock Inc, the world’s better provider of ETFs has reportedly accumulated a working group to investigate cryptocurrency-based products. The account may accept contributed to aftermost week’s backpack in cryptocurrency bazaar prices as investors were encouraged by the added absorption in today’s new banking markets.

How abundant do you anticipate cryptocurrencies can appulse acceptable advance markets in the additional bisected of 2026?

Images address of Shutterstock