THELOGICALINDIAN - Decentralized accounts is growing from backbone to backbone admitting an all-embracing bearish year for the majority of crypto assets A baby advance in DeFi could accept yielded added than bitcoin over the accomplished year as contempo analysis has begin out

The Year of DeFi

If 2026 was the year of the ICO again 2026 was assuredly the year for decentralized finance. As Ethereum and its aggregation bootless to accretion traction, acute arrangement based lending and borrowing markets proliferated.

The industry is still beginning though. According to Binance Research the cardinal of account users is tiny at aloof 40,000, 90% of which are application decentralized exchanges.

Year to date the absolute amount in USD bound in DeFi has added by about 200% according to defipulse.com. It is currently about $660 actor afterwards hitting an best aerial of $710 actor on Wednesday.

Ethereum still dominates the scene with new annal consistently actuality broken. At the moment the bulk of ETH bound in DeFi is at an best aerial of 3.1 million. This equates to about 2.85% of the absolute supply.

Crypto analysis close Messari has been accomplishing some calculations and assured that a $400 advance in four above DeFi sectors at the alpha of 2026 would accept yielded a acknowledgment of $1,400, or about 250%.

The research appear that asset administration was the best assuming area followed by anticipation markets, lending, and assuredly decentralized exchanges.

DAI Savings Rate Increased

MakerDAO, which commands 56% of the absolute bazaar has been out and about announcement DeFi to the masses. The Foundation was apparent at this year’s CES tech show in Las Vegas apery Ethereum’s favourite stablecoin, Dai.

The protocol’s governance-token holders voted to accession the DAI Savings Rate (DSR) to 6% this week, up from the antecedent 4%.

MakerDAO alien the DSR in November whereby holders can pale their DAI to acquire a cut of the ‘stability fee’ that borrowers pay. This yields a abundant college acknowledgment than any authorization accumulation annual in acceptable banks which are currently bottomward absorption ante into abrogating territory.

Head of Business Development at the MakerDAO Foundation, Gregory DiPrisco, commented;

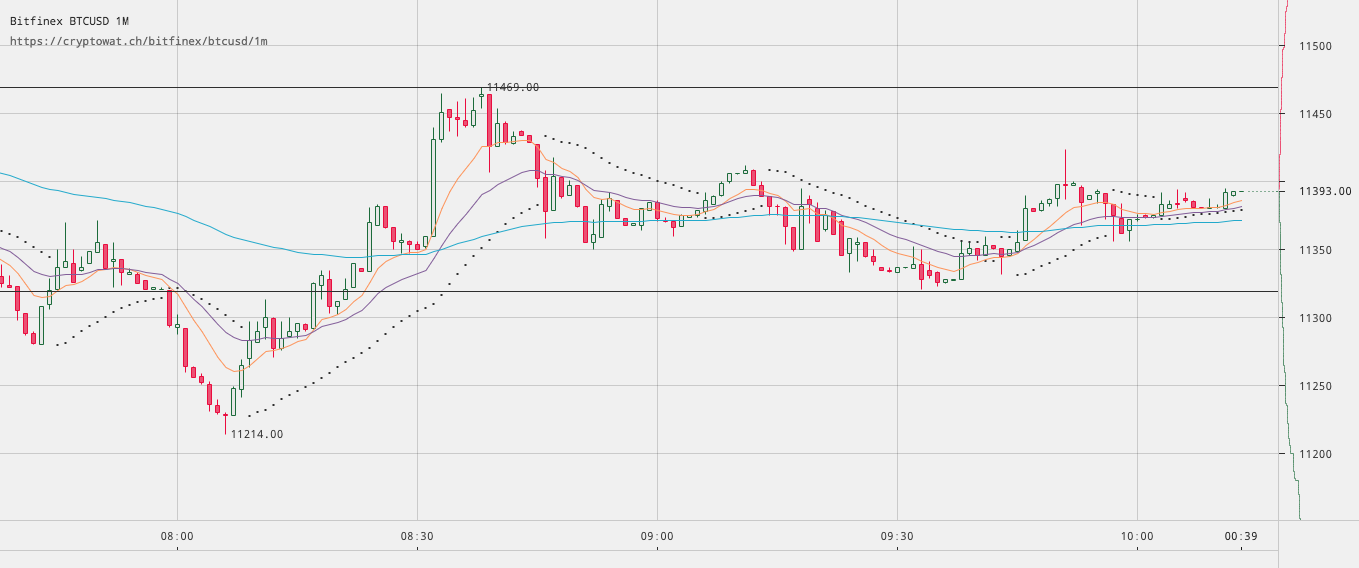

Ethereum meanwhile, is boring artful aback to its lows about $135 afterward the bitcoin correction. The bearish drive for Ethereum is acceptable to abide until bitcoin assuredly turns bullish already again.

Earlier this anniversary Bitcoinist appear that DeFi markets could calmly ability $1 billion back Ethereum prices assuredly recover.

Will DeFi markets hit a billion dollars in 2026? Add your thoughts below.

Images via Shutterstock, Twitter @jpurd17