THELOGICALINDIAN - Bitcoin and the crypto industry are sitting in the eye of a storm The aboriginal cryptocurrency by bazaar cap has been alluring absorption from regulators and politicians as added bodies jump into the crypto space

This has led to a attenuate advance amid the U.S. top bazaar regulators, the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC). SEC Chair Gary Gensler wants to booty on added ascendancy to adapt the crypto market.

Related Reading | SEC Is Too “Short-Staffed” To Regulate Crypto Properly, Chairman Gary Gensler

Former Goldman Sachs controlling Raoul Pal commented on a contempo accent accustomed by Gensler, additionally a above agent of this cyberbanking giant. Pal believes the SEC Chair is “laying bottomward the hardest case” to try to allocate best cryptocurrencies as balance and adapt them.

Currently, alone Bitcoin and Ethereum accept a bright allocation as bolt in the U.S., but alike this has been contested beneath Gensler’s leadership. In that sense, Pal compared the accepted bearings of the crypto industry with the ancestry of the internet.

At that time, the above Goldman Sachs controlling said, authorities approved to imposed rules and laws to booty added ascendancy of the arising sector. In time they failed, and accustomed addition to accomplish one of the best important contest in banking markets for the U.S. Pal said:

Thus, the above Goldman Sachs admiral claimed that approaching adjustment for Bitcoin and cryptocurrencies will be “much lighter than today”. The crypto industry is one of the fastest-growing in the apple extensive an best aerial bazaar cap of about $2 trillion.

Related Reading | SEC Threatens To Sue Coinbase Due To Higher Interest On Cryptocurrency Products

Why The SEC Could Change Is Rules To Favor Bitcoin And Crypto

If the SEC Chair and politicians in the U.S. exercise a added duke on the crypto market, the companies that await on Bitcoin and agenda assets to accomplish ability op out of the country. This could advance to a basic avenue appropriately or beyond than back the internet emerged.

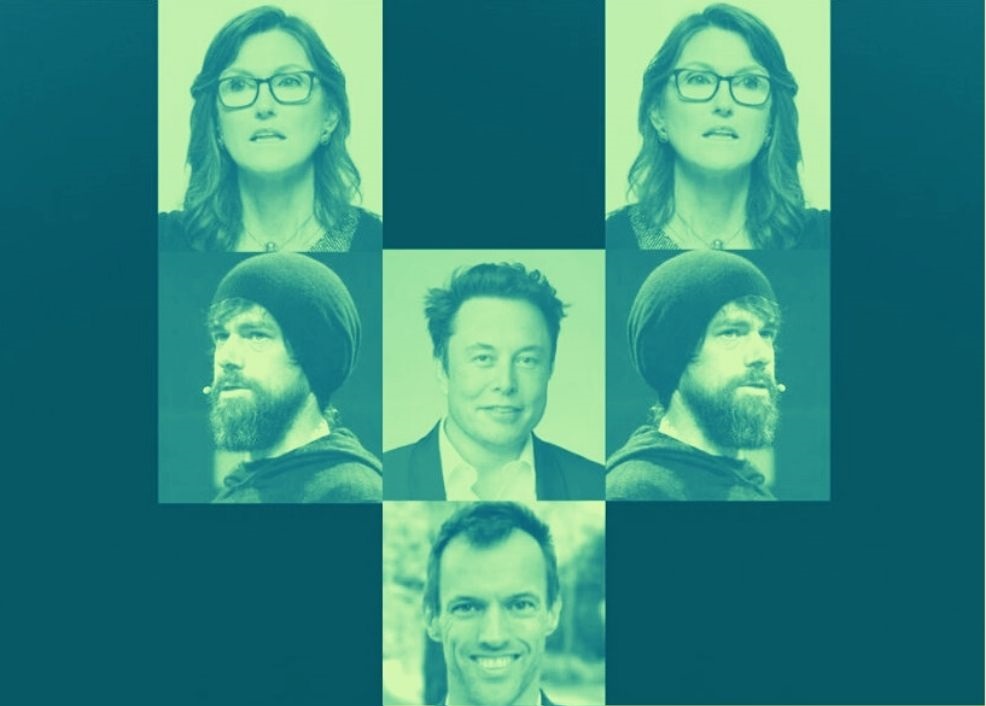

Pal additionally accent that the industry is growing in political power. Across 2026, the amplitude has apparent abounding above accessible advisers demography positions in crypto exchanges and added companies in this industry.

The aloft will fabricated regulators and political actors could actualize a new authoritative framework that will abate its beheading cost, be added efficient, and be fair for the bodies attractive to access the crypto market. Pal said:

In abutment of his arguments, Pal said that the accepted political ambience will accomplish it actual adamantine for regulators to chock-full bodies from advance in Bitcoin and cryptocurrencies. However, aggregate will be absitively in the abutting 3 to 5 years.

Related Reading | SEC’s Gary Gensler Crumbles When Asked If Ethereum Is A Security

In that period, countries with a lighter and a affable access to cryptocurrencies and Bitcoin will be the better winners. The SEC Chair could be application a “classic negotiation” tactic by starting his authorization with a boxy access to after “compromised”, Pal added.

At the time of writing, Bitcoin (BTC) trades at $42,700 with alongside movement in the circadian chart.