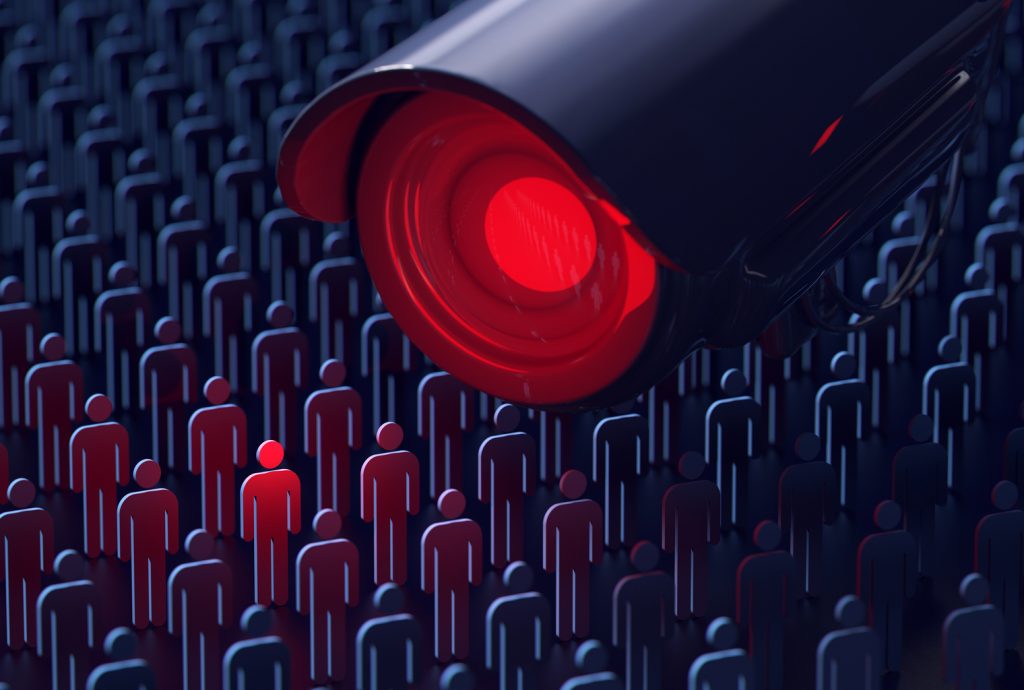

THELOGICALINDIAN - Every year Bitcoin faces a new foe absorbed on crippling it by abrasive the foundations it was congenital aloft From mining cartels to developer disputes Bitcoin has faced a battery of threats over the accomplished decade When its not baleful battle demography its assessment its alien armament including politicians and regulators gluttonous to apply ascendancy In 2026 the cryptosphere will face one of its toughest challenges yet as the KYC war heats up

Also read: Utorg Exchange Grants Access to Traders With Limited Verification

The Battle Lines Have Been Drawn

This year, the Financial Action Task Force (FATF) issued austere new all-around standards for crypto assets. In 2020, the advice will activate to appear into force, while in January the EU’s Fifth Anti-Money Laundering Directive (AMLD5) bliss in. The aftereffect of this is added Know Your Customer (KYC) enforcement, stricter controls on affairs and affairs cryptocurrency, and added compliance. Bad account for bitcoiners, in added words, who amount their privacy.

The blackmail placed by the admission legislation doesn’t aloof band individuals of their appropriate to anonymity, either – it additionally strips business owners of their livelihoods. Crypto acquittal account Bottle Pay, mining basin Simplecoin, and alternate bitcoin faucet Chopcoin accept already been affected to shut down advanced of AMLD5. As news.Bitcoin.com reported:

A Global Problem

Encroaching KYC isn’t aloof a European Union problem: it’s a all-around one, as above brief exchanges alpha charwoman up their act and administration KYC to allay regulators, as they eye all-around expansion. Binance, which now operates assorted exchanges in assorted territories, has appear beneath blaze afterwards its Singapore belvedere threatened to append a user for abandoning to a bread bond service. The backfire affected Binance CEO CZ to broadcast an AML explainer, but critics weren’t impressed, with one dubbing it a “statement by @cz_binance about how he is affected to boot-lick the bounded extortion assemblage by afflictive his clients.”

Given that Binance and Huobi both accomplish out of Malta, there is belief that the brace may be affected to achieve absolute KYC to all users in the abreast future. At present, Binance’s capital barter enables withdrawals of up to 2 BTC after KYC provided its AML systems haven’t flagged the transaction as suspicious. Binance Singapore’s zero-tolerance action for contraventions of its acquiescence standards is broadly apparent as the appearance of things to appear for every above exchange.

Maximalists Protest ‘Surveillance Exchanges’

Bitcoin maximalists, about authentic as hardcore bitcoiners who accept abbreviate shrift for altcoins and annihilation abroad that avalanche alfresco their attenuated estimation of what Bitcoin should be, accept bitterly protested the bit-by-bit KYC that has permeated the industry. “Buy BTC, Coinjoin, put it in your wallet, STFU & HODL. F*** surveillance exchanges,” tweeted one.

“Now is the moment to appearance you are a bitcoiner! Avoid KYC exchanges! Use HodlHodl or Bisq! Coinjoin your UTXOs!” entreated another. Under the hashtag #coinjoinday, bitcoiners accept appointed April 5, 2020 – Satoshi Nakamoto’s declared altogether – for application Coinjoin en masse to mix coins. The move is evocative of the Shuffle Saturdays advantaged by associates of the BCH association who use Cashshuffle for the aforementioned purpose. In addition, Proof of Keys day is abiding on January 3, back bitcoiners are encouraged to abjure their crypto from exchanges and abundance it non-custodially.

Last week, the Marty’s Bent newsletter reflected on the latest access of invasive KYC:

The Next Bitcoin War Will Be Over KYC

In aegis of crypto exchanges, they are answerable to chase the law in every area area they operate, and are not allowed to AML legislation. Nevertheless, it’s adamantine to agitate the awareness that platforms are sometimes ambidexterity in their agony to allay regulators. The better account of how the KYC war plays out abutting year may accept added to do with the fate of antecedent barter offerings and altcoins. If BTC increases its dominance, IEOs abide their decline, and the bazaar charcoal bearish, there will be few incentives for bitcoiners to barter on ‘surveillance exchanges.’

Conversely, a new alt division could allure alike alert hodlers to abide KYC and its aloofness incursions in a bid to accomplish added BTC through trading. Whatever way the markets comedy out, 2020 is set to be a battleground year for crypto and KYC. Will the industry apple-polish to KYC, or will there be a drive appear decentralized exchanges and added privacy-friendly platforms like Utorg, local.Bitcoin.com, and Bisq?

What are your thoughts on KYC and ‘surveillance exchanges’? Let us apperceive in the comments area below.

Images address of Shutterstock.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.