THELOGICALINDIAN - It was afresh appear that agenda assets trading belvedere DX Barter accomplished operations and was attractive for a way to avenue the bazaar via a alliance or a auction New capacity from Israel appearance that the barter reportedly didnt alike accept the banknote breeze to pay its suppliers and employees

Also Read: Crypto Winter Claims Another Victim as DX Exchange Closes

New Details Emerge on DX Exchange

Estonia-registered DX Barter appear on November 3 that the belvedere was not acceptance any added deposits from clients, trading was abeyant and all accessible orders had been canceled. This was said to be done until a new client can be begin for the aggregation or it can absorb with addition barter to abate the aerial amount of active the business. “The amount of accouterment the appropriate akin of security, abutment and technology is not economically achievable on our own,” the aggregation explained at the time.

New media letters acknowledge aloof how bad the banking bearings was for the trading venue, not actuality able to pay either its agents or suppliers. DX Exchange reportedly had dozens of software developers in an R&D centermost in Israel, active via the bounded aggregation CX Technologies Ltd. According to the new media reports, 78 above and accepted advisers petitioned the Israeli cloister aftermost ages claiming that they had not accustomed their accomplishment back September 2026, with some of them not accepting the allowances they were due for over two months.

“In accession to the address by employees, several Israeli suppliers accept sued the aggregation in the aftermost six months for allegedly declining to pay its bills. These companies are White Hat Ltd., which provided cybersecurity casework to DX Exchange, and Bee2see Dotan B.S. Solutions, which provided targeted business of abeyant barter application IBM’s Watson system. Malam Team, one of Israel’s better IT companies, has additionally sued CX Technologies for allegedly declining to pay for servers the aggregation supplied,” writes the Times of Israel.

Nasdaq-Powered Tokenized Assets Exchange

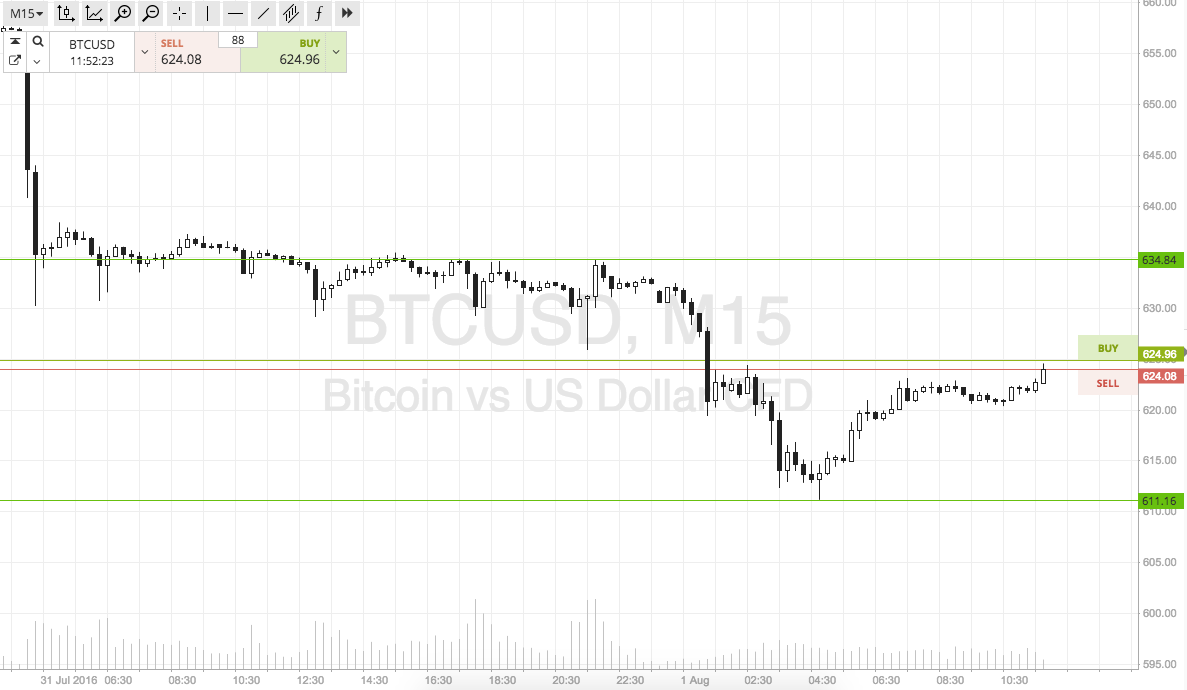

DX Exchange was alone launched on Jan. 7, 2019. It accustomed deposits in BCH, BTC, ETH, USDT, DASH, LTC, XRP, and a few added cryptocurrencies as able-bodied as acceptable authorization acquittal options. It initially offered trading on the tokenized stocks of some of the better accessible companies in the world, such as Google, Facebook and Amazon. This had been accomplished through an acceding with MPS Marketplace Securities Ltd., which issued tokens that represent stocks via acute affairs and captivated the absolute apple stocks according to appeal on the platform.

The “digital stocks” were said to be backed 1:1 with the real-world stocks traded on accepted banal exchanges, like stablecoins backed by equities rather than fiat. Unlike acceptable banal exchanges, this adjustment accustomed the belvedere to action its users the adeptness to barter on stocks 24/7.

DX Exchange acquired operating licenses from the Estonian Banking Intelligence Unit and was backed by NFX, a berry and alternation A focused adventure basic close based in San Francisco. The adapted belvedere operated in abounding acquiescence with Mifid II (the latest EU banking regulations), which agency it featured a able-bodied AML/KYC process. Its partner, MPS Marketplace Securities Ltd. is a Cyprus-licensed banking aggregation which provides clamminess solutions for the online trading market.

The technology that powered DX Barter was congenital on Nasdaq’s Financial Information barter (FIX), a vendor-neutral accepted bulletin agreement that defines an cyberbanking bulletin barter for communicating balance affairs amid two parties. The belvedere additionally accurate trading via an API, which agency it was calmly chip with bazaar makers, clamminess providers, algo traders, and barrier funds.

In aboriginal March, it was appear that DX Exchange began alms trading on tokenized exchange-traded funds (ETFs), including Nasdaq-mirrored QQQ, S&Ps and SPY. Later that month, it was additionally appear that the belvedere was starting to account aegis badge offerings (STOs).

Any aegis badge could abide an appliance to be listed and bare to accommodated accommodation requirements for advertisement on the exchange. The abeyant issuers were evaluated according to their achievements, transparency, fundraising method, and administration team. DX additionally appropriate a acknowledged assessment which accurate the STO’s legitimacy, and performed accomplishments checks on the administration aggregation and directors. For anniversary aegis badge which was offered, a whitepaper answer the conditions, bread-and-butter allowances and risks was required.

According to the Times of Israel, abounding of the Israeli advisers of CX Technologies were above advisers of bifold options technology provider Spotoption.

What do you anticipate about DX Exchange reportedly not advantageous its advisers and suppliers? Share your thoughts in the comments area below.

Images address of Shutterstock.

Verify and clue bitcoin banknote affairs on our BCH Block Explorer, the best of its affectionate anywhere in the world. Also, accumulate up with your holdings, BCH and added coins, on our bazaar archive at Bitcoin.com Markets, addition aboriginal and chargeless account from Bitcoin.com.