THELOGICALINDIAN - The decentralized barter dex Dydx appear the alignment has aloft 65 actor in a Series C allotment annular led by Paradigm The Dydx advertisement addendum that the added basic will be leveraged to decidedly advance clamminess on the dex belvedere through the animation of the cryptocurrency markets

Defi Exchange Dydx Raises $65 actor from Strategic Investors

On Tuesday, the Ethereum-based decentralized accounts (defi) barter Dydx appear the activity has aloft $65 actor in a Series C allotment round. The annular was led by Paradigm but allotment additionally stemmed from a16z, Three Arrows Capital, Polychain Capital, and Wintermute. Liquidity providers and crypto VCs like Hashkey, Electric Capital, Delphi Digital, Sixtant, Menai Financial Group, MGNR, and Kronos Research additionally participated.

In the announcement, Dydx additionally discussed the dex accomplice Starkware and how the two launched a Layer 2 agreement aback in February for cross-margined perpetuals. This was due to a aggregate of the Starkex scalability agent and Dydx’s abiding acute contracts. Dydx said that in bristles months, the dex acquired $40 actor in Total Value Locked (TVL) from added than 13K different addresses. The activity launched 15 markets and the advertisement says added will be “coming soon.”

Top Ten Dex Platform Holds $188 Million TVL

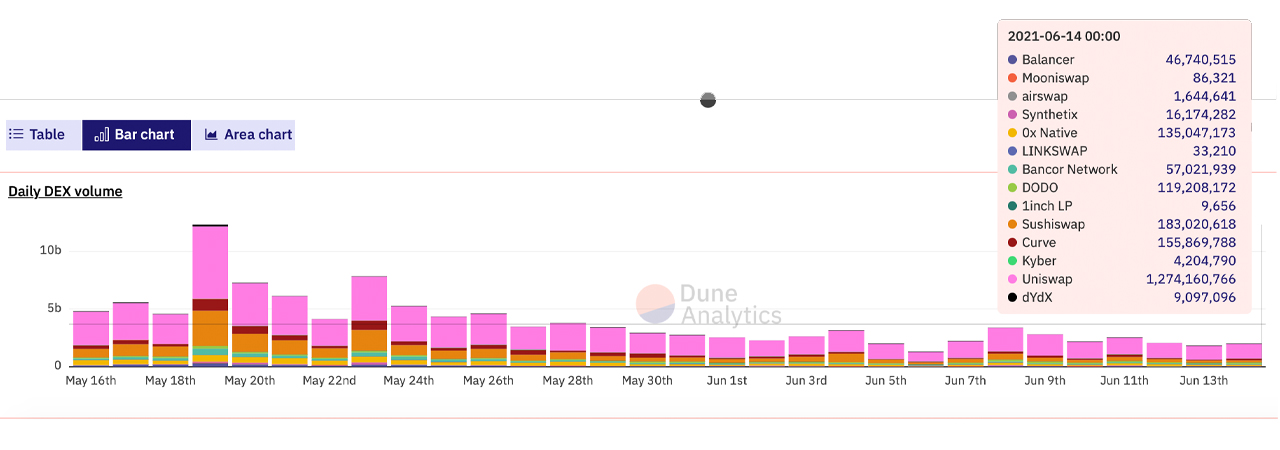

Today’s abstracts shows Dydx is one of the top ten dex platforms according to Dune Analytics statistics. On Tuesday, the dex captivated the ninth position with $49,537,567 in account aggregate and $6.5 actor during the aftermost 24 hours. On Monday, Dydx had about $9 actor account of defi swaps.

It holds beneath than 2% of the bazaar allotment of $16 billion in all-around dex swaps as Uniswap commands 63% and Sushiswap captures 11.5%. Besides decidedly advance liquidity, Dydx says the activity aims to advance the added basic to:

During the Series B allotment annular at the end of January, Dydx aloft $10 actor from Three Arrows, Defiance Capital, Andreessen Horowitz (a16z) and Polychain Capital. Today, according to defipulse.com stats, Dydx has a TVL of about $188 actor and holds the 28th position amid added ascendant defi platforms.

Fred Ehrsam, the cofounder and managing accomplice at Paradigm talked affectionately of Dydx architect Antonio Juliano and said that the dex belvedere was admired by its users. “[Dydx] has congenital a simple, crypto native, and all-around barter that users love. We’ve accepted Antonio back he larboard Coinbase years ago. He’s congenital a abundant aggregation about him to abutment the company’s advance and approaching potential,” Ehrsam said on Tuesday.

What do you anticipate about the Ethereum dex belvedere Dydx adopting $65 actor from a cardinal of investors? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Dune Analytics,