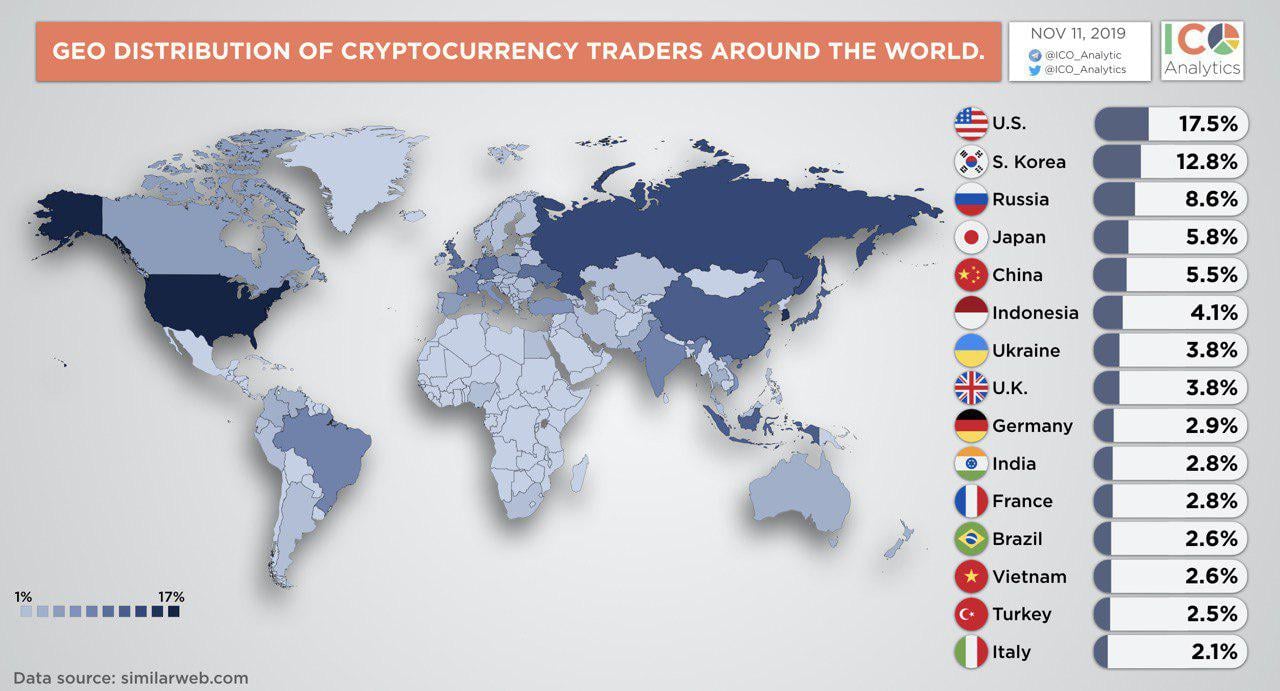

THELOGICALINDIAN - With exchanges authoritative so abundant of the industry inflows and accounting for added than 40 of the jobs any assay of the year has to alpha and end there An assay of the ascendant trends active trading platforms serves as a proxy for barometer the cryptospheres all-embracing bloom From antecedent barter offerings to staking as a account 2026 was the year that crypto exchanges broadcast and diversified

Also read: Bitcoin Emits Less Carbon Than Previously Claimed, New Study Finds

Exchanges Double Down on Partnerships and Referrals

Forging partnerships with absolute businesses and ramping up barometer programs are two means in which exchanges accept aesthetic their account this year in a bid to abduction added of the market. In the case of partnerships, it’s an befalling to tap into the user abject of crypto companies that accept a able attendance in the space, while barometer schemes are advantageous for incentivizing users to advantage their acceptability to onboard accompany and associates.

Referral schemes accept apparent a revival, with exchanges rolling out solutions that affiance added advantageous agency than previously. This week, Kraken revamped its barometer scheme, able a 20% kickback, up to a best of $1,000 per client. Elsewhere, Nominex has apparent success with a barometer arrangement that is not bound in agreement of levels, giving an allurement for aboriginal adopters to advance the chat and acquire the rewards – a binary affiliate is the abstruse appellation for it. It’s accumulated this with a built-in token, NMX, that is awarded to aboriginal adopters, to added accumulate acceptance and body loyalty.

As for the trend appear partnerships, the accomplished ages abandoned has apparent Indian barter Wazirx acquired by Binance, and Poland’s OAAM Consulting anatomy a cardinal affiliation with IDAX. As a aftereffect of the arrangement, any European teams and blockchain projects that intend to be listed on IDAX or barrage an IEO on the belvedere will assignment with OAAM. Arrangements such as these are affirmation of how exchanges are accretion their ability into territories area they abridgement a presence. Through accumulation their absolute cast and user abject with localized ability from specialist companies, exchanges accept been able to abound their all-around user base.

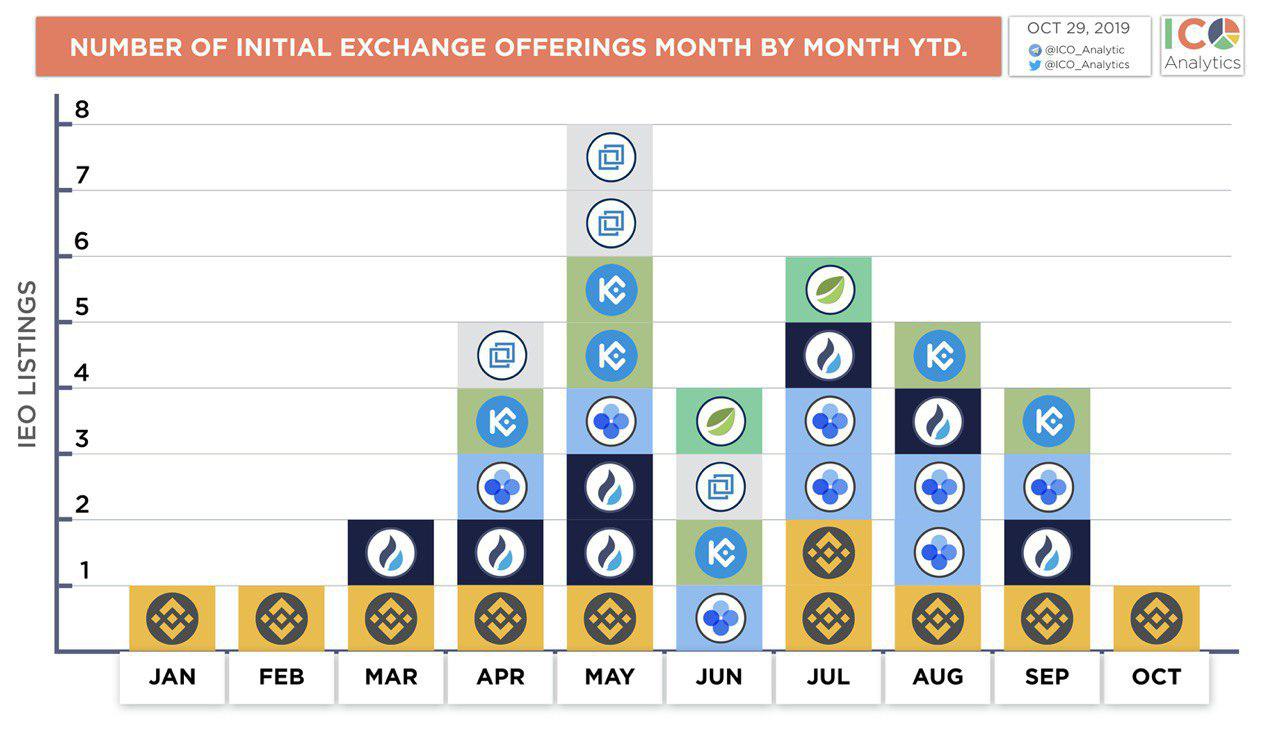

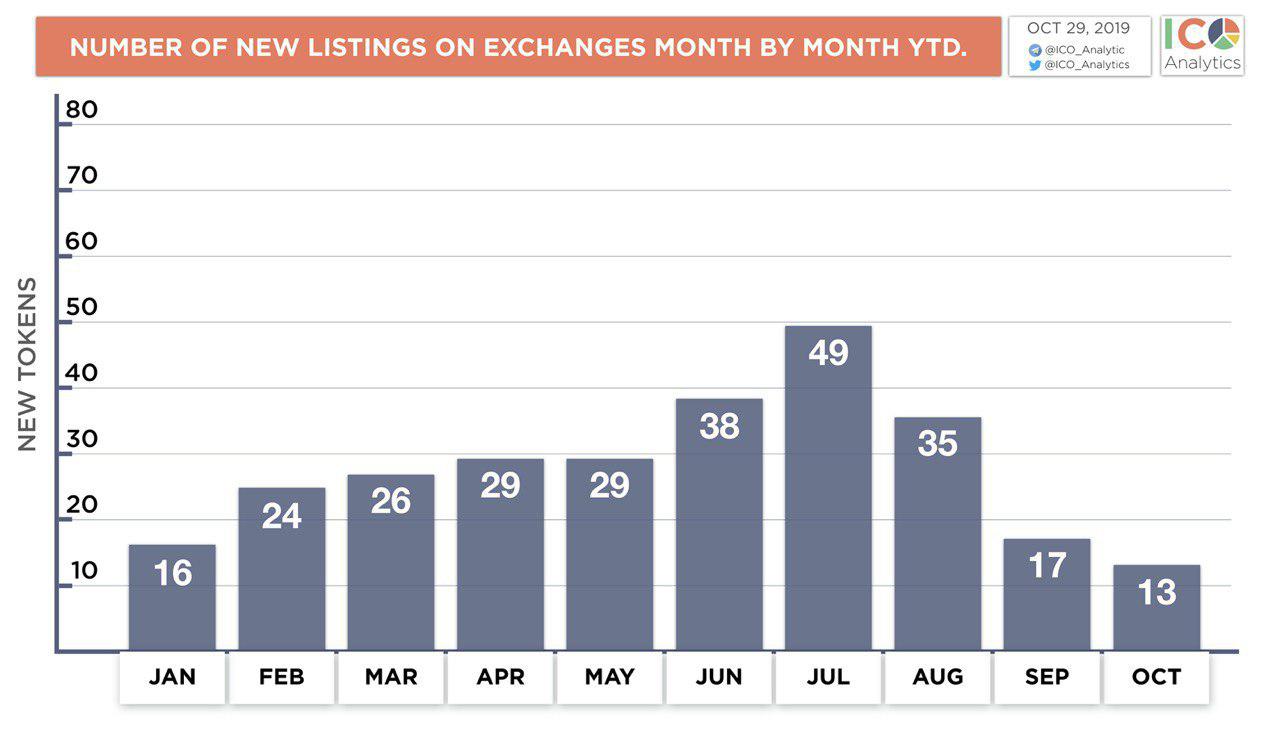

Initial Exchange Offerings Intensify

It would be absurd to appraise the change of exchanges this year after because antecedent barter offerings. The public’s appetence for exchange-hosted badge sales is assuming no signs of abating, with bank one exchanges still seeing retail broker FOMO for their anxiously curated badge sales. The cardinal of exchanges accouterment badge launchpads has proliferated in 2026, with Binance, Bittrex International, Kucoin, Okex, Huobi and a host of abate exchanges laying on IEOs. In agreement of allotment on the projects listed, after-effects accept been mixed. Matic is currently sitting at a advantageous ROI of 5.2x and Wirex at 3x, forth with a scattering of added winners that accept abiding their amount on the accessory market.

Wirex CEO Pavel Matveev told news.Bitcoin.com that “the development of the IEO alms gave us the befalling to breach into new markets in Asia, introducing there the allowances of our anew issued WXT account badge calm with the Wirex app’s acquittal and barter functionalities.”

2026’s Key Exchange Trends

Three added trends that accept bedeviled the barter mural this year are staking as a service, lending, and added authorization gateways. As with so abounding of the contest that accept authentic the industry, the adumbration of Binance has loomed ample over proceedings. Its lending platform, which is currently oversubscribed for BNB and BTC, additionally allows lenders to lock up USDT in barter for a 3% return. Its staking platform, meanwhile, is one of several such barter articles to accept acquired absorption in 2019 alongside the brand of Huobi and Coinbase, and Binance is on a mission to add authorization pairings for every above all-around currency.

Reflecting on the change of cryptocurrency exchanges over the accomplished 10 months, Wirex CEO Pavel Matveev told news.Bitcoin.com: “Crypto exchanges are now acutely sophisticated. They’ve chip a affluent affluence of markets, from cash, allowance articles (CFDs, futures), lending, staking, IEOs… aggregate has been circumscribed aural the aforementioned venues.”

Doron Rosenblum is the Managing Director of Etorox, a wallet and barter adaptation of Etoro for avant-garde traders which holds a added ambit of assets. “This about-face reflects the crumbling of the crypto sector,” Rosenblum told news.Bitcoin.com. “The amount animation of 2017 and 2018 led to added bodies talking about crypto assets, which in about-face led to growing absorption from retail investors for this new asset class.

“But as amount animation has chastened this year, the industry has entered a aeon of consolidation. It has had time to focus on things like adapted adjustment for the industry rather than this actuality a knee-jerk acknowledgment during a abiding aeon of amount action. We’ve additionally apparent a greater cardinal of institutional investors advancing into the crypto amplitude and developing their own use-cases for blockchain technology.” He added:

Where Next for Crypto Exchanges?

2026 will see the ascendant exchanges aim to adhesive their anchor on the bazaar while ambitious to accumulate innovating. One trend that can be counted on is the advance of barter blockchains. This year was all about Binance Chain; abutting year there will be Huobi and Bithumb’s chains to argue with too. Like it or not, barter chains, aloof like barter tokens, are actuality to stay.

Finally, apprehend to see affluence added exchanges and crypto swapping platforms aggressive on price. In September, Bitcoin.com Exchange launched with abrogating fees, about giving users a rakeback for the aboriginal three months. Then, on November 20, Shapeshift announced it was alms zero-fee trading for users of its belvedere who authority its built-in token. It additionally aggregate a price comparison of how Shapeshift compares to the competition. Exchanges can add as abounding new accretion and whistles as they like, but at the end of the day, amount will trump aggregate else. Crypto trading platforms that can carve their fees while actual bread-and-butter are the likeliest to survive 2020.

What added barter trends accept alike this year? Let us apperceive in the comments area below.

Images address of Shutterstock and ICO Analytics.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.