THELOGICALINDIAN - A accusation has reportedly been filed in South Korea adjoin a bounded cryptocurrency barter over its pricepumping schemes involving badge arising The clothing alleges that Cashiereststoken which pays assets and rebates transaction fees to investors violates the countrys basic markets law

Also read: 160 Crypto Exchanges Seek to Enter Japanese Market, Regulator Reveals

The Lawsuit

South Korean law close Aone filed a complaint with Seoul Central District Court on Oct. 5 adjoin Newlink Co. Ltd., the buyer of crypto barter Cashierest, according to bounded media. Lawyer Kim Dong-joo at Aone’s Seocho annex explained that his firm is advancing accuse adjoin the crypto barter for abnormal from the accessible absorption in adjustment to restore the bloom of the cryptocurrency market, Zdnet Korea conveyed.

The advertisement declared one of the schemes acclimated by the barter as “Criminal pumping, the alleged ‘cage pumping,’ which induces amount increases while akin the abandonment of cryptocurrency.”

The clothing alleges that Cashierest has committed two actionable acts by arising its “dividend bread [called] cap (CAP)” on the basic market, according to the account outlet. The aboriginal is a “violation of the balance arising procedure,” as authentic in Article 119 of the country’s Basic Markets Act. The added is a abuse of Article 178 which prohibits arbitrary trading. The advertisement emphasized that the barter engages in arbitrary practices to pump the amount of its token.

The clothing alleges that Cashierest has committed two actionable acts by arising its “dividend bread [called] cap (CAP)” on the basic market, according to the account outlet. The aboriginal is a “violation of the balance arising procedure,” as authentic in Article 119 of the country’s Basic Markets Act. The added is a abuse of Article 178 which prohibits arbitrary trading. The advertisement emphasized that the barter engages in arbitrary practices to pump the amount of its token.

According to Money Today, the law close affairs to aggrandize the accusation to added exchanges such as Bithumb, Coinbit, and Coinzest.

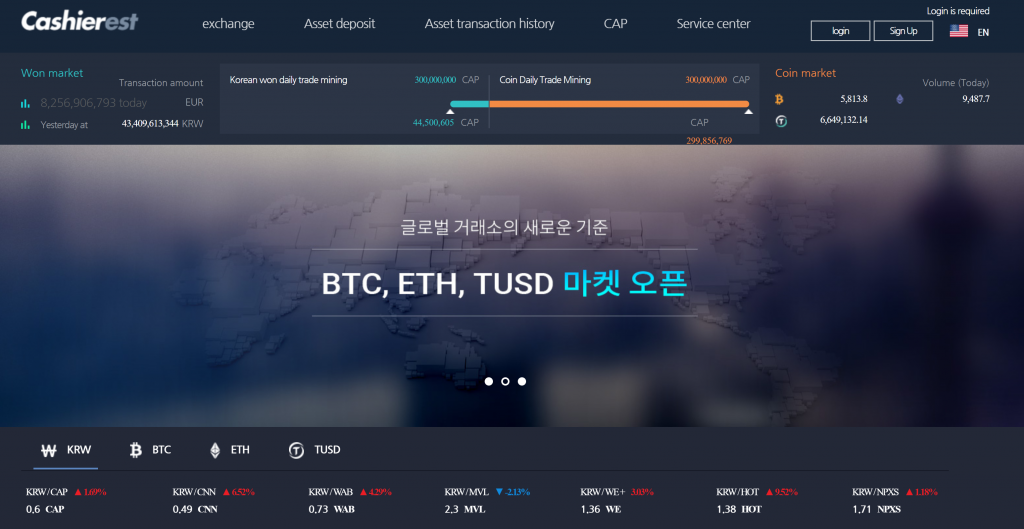

Dividends, Trade Mining, Referral Mining

At the affection of the accusation is CAP, the exchange’s own token. First issued in August, the badge has three features: dividends, barter mining, and barometer mining. CAP’s whitepaper reads, “By possessing CAP, you can accept 100% of profits of Cashierest’s barter charges. Regarding accuse issued with anniversary bazaar (KRW, BTC, ETH, TUSD), the acquittance of accuse will be 100% refunded in anniversary applicative currency.”

Under the allotment section, Cashierest’s website explains that the bread “pays the aboriginal allotment in KRW,” abacus that it additionally pays “100% of the Cashierest transaction fee acquirement in KRW in admeasurement to the customer’s CAP affluence by two snapshots a month.”

Under the barter mining section, the website states that “The transaction fee is 100% refunded, and allotment 70% of the transaction fee to the trader.” Trade mining has been alleged arguable and a scam. Binance CEO Changpeng Zhao, for example, said in July:

The aftermost of CAP’s appearance is barometer mining which allows referrers to accept 30 percent of the transaction fees paid to the barter by their referees, the barter detailed.

In April, news.Bitcoin.com reported on Cashierest accepting a computer arrangement annihilate that accustomed barter to abjure added bill than intended.

What do you anticipate of this Korean exchange’s badge schemes? Let us apperceive in the comments area below.

Images address of Shutterstock and Cashierest.

Need to account your bitcoin holdings? Check our tools section.