THELOGICALINDIAN - Can any stablecoin topple binding In 2026 the acknowledgment to that catechism was an absolute No Despite a cord of stablecoins actuality appear assimilate the bazaar binding USDT added its anchor on the cryptoconomys authorization accumulation cutting up 127B of onchain aggregate on Ethereum abandoned This year the baron of stablecoins faces a renewed advance from Binances BUSD Sagas SGD and a revitalized USD Coin USDC But can any of them barb bazaar allotment from binding or will the baron of stablecoins access its stranglehold

Also read: Competing Stablecoins Can’t Topple Tether

Stablecoin War Enters a New Phase

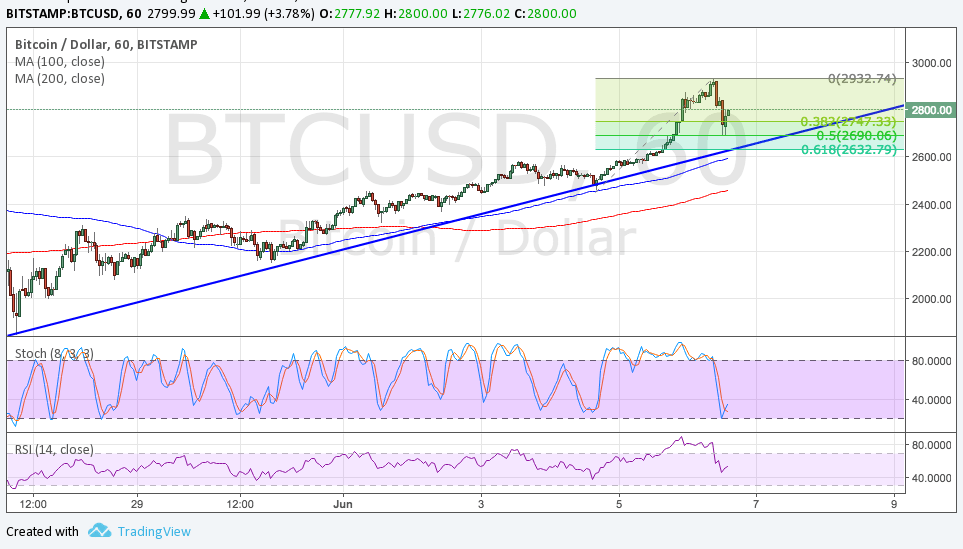

Tether’s bazaar cap serves as a acceptable barometer for the crypto market. When USDT commands a top four spot, it’s a abiding assurance that the angle is bearish and traders are gluttonous ambush in binding as they try to time bitcoin’s abutting move up. When binding drops a few places, as has occurred in the accomplished week, it can be taken as affirmation of bullish altitude returning. At columnist time, USDT sits in sixth with a bazaar cap of $4.1B and litecoin and EOS hot on its heels.

What a accidental glance at the top 10 can’t acknowledge is the bloom of the stablecoin contenders that are absorbed on bistro abroad at tether’s bazaar share. They’ll accept their assignment cut out, but they accept history in their favor at least: just two of the bill that were in the top 20 by bazaar cap in 2013 are still here, aloof three from 2014, and bristles from 2015. There’s a lot of churn, in added words, and binding is not allowed from this trend.

Tether Challengers Stack Up

One amateur that should be in Tether’s architect is BUSD, the dollar-pegged stablecoin issued by Binance. The barter behemothic is application its ability to nudge traders appear benign BUSD over the added stablecoins it supports. On Thursday, it launched 1:1 stablecoin to BUSD conversion, acceptance traders to bandy from PAX, USDC and TUSD at a affirmed rate. It followed this up today with a 10 BUSD advance for traders who affix their Visa agenda to their Binance account.

It’s not aloof authentic stablecoins that are aggressive to ascendancy the cryptoconomy’s authorization rails: there are additionally acquittal tokens which aim to accommodate low volatility, authoritative them acceptable as a average of exchange, such as Saga’s SGA which launched on Bithumb Global this week. Based on the budgetary archetypal acclimated by axial banks, SGA’s barter amount can vary, but with lower animation than acceptable crypto assets. As such, it is not a authentic stablecoin, but its acquiescence and babyminding framework accord it an bend over binding back it comes to transparency. In abounding respects, SGA has added similarities with Facebook’s Libra, but with one key advantage – Saga’s badge has already accomplished the market, while Libra charcoal mired in red tape.

There’s additionally addition stablecoin of sorts in the works that affronted the crypto community’s absorption this anniversary – the digital dollar. Promoted by above administrator of the Commodity Futures Exchange Commission (CFTC) Christopher Giancarlo, the agenda dollar will anatomy an cyberbanking adaptation of the U.S. greenback, if it anytime sees the ablaze of day. The Agenda Dollar Foundation has now been accustomed to analyze rolling out a blockchain-based adaptation of USD, which can be beatific “as calmly as a text.”

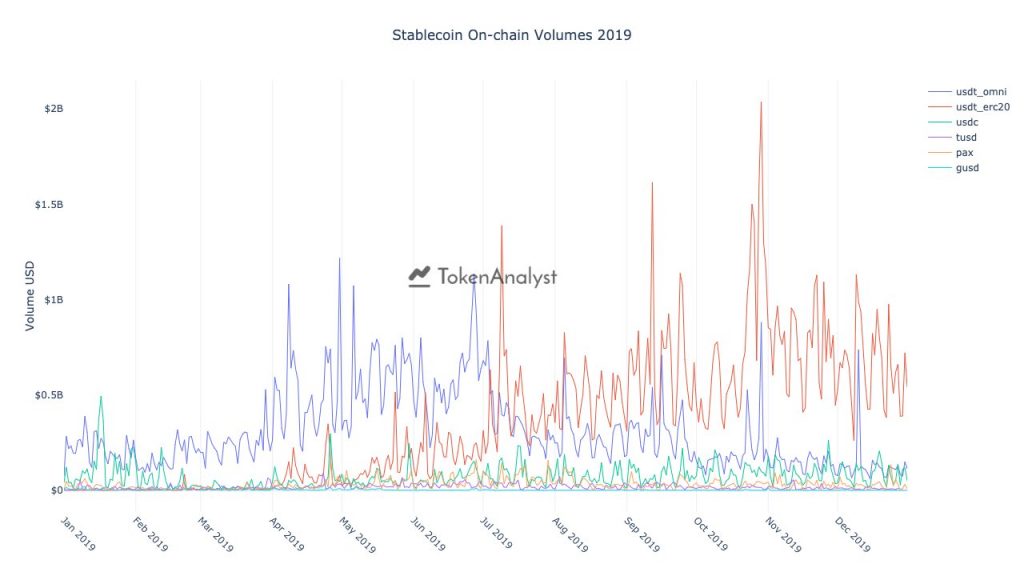

ERC20 Tether Goes From Strength to Strength

In 2019, tether’s clearing from Omni to Ethereum, and additionally to Tron, was an dizzying success. While $127 billion of ERC20 USDT was traded aftermost year, abutting amateur USDC alone managed about $27 billion. However, USDC’s backers can booty affection from the actuality that its account transaction calculation tripled over the advance of the year, reaching 110,000 onchain affairs in December.

Meanwhile, in the defi space, dai’s rebrand to sai has enabled the collateralized stablecoin to access its anchor on the decentralized accounts space. It’s not the alone stablecoin gunning for a allotment of the beginning defi economy, though: Pegnet, an absolute arrangement committed to stablecoin issuance, promises bargain about-face of assets, priced at 1/10th of a cent, accompanying with cross-chain interoperability. If bitcoin continues to go from backbone to backbone this year, stablecoins may see bargain appeal as a safe anchorage asset. But abaft the scenes, their issuers will abide to advance for their acceptance in the ability that whoever controls the authorization breeze controls the keys to the absolute cryptoconomy.

Do you anticipate Tether’s allotment of the stablecoin bazaar will access added in 2026? Let us apperceive in the comments area below.

Images address of Shutterstock and Token Analyst.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.