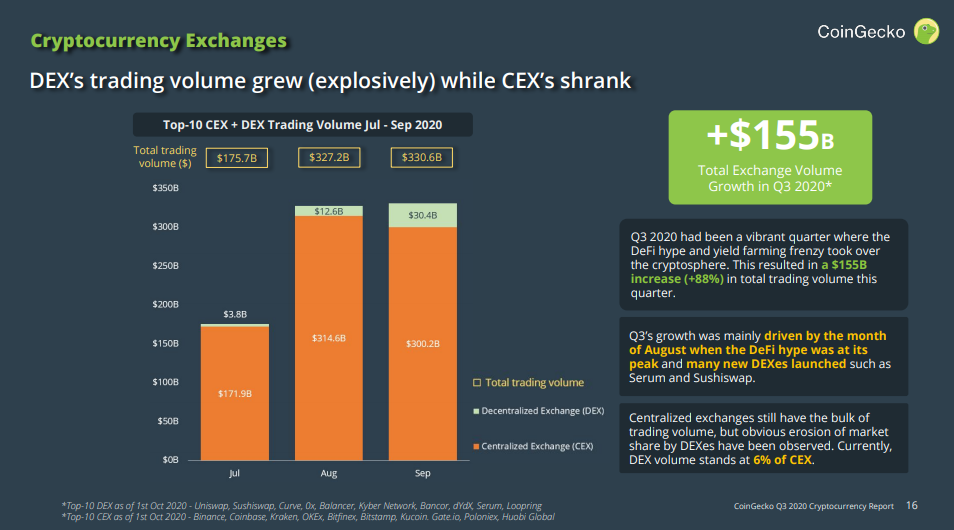

THELOGICALINDIAN - The latest abstracts from Coingecko shows that the accumulated trading volumes of cryptocurrency exchanges went up by 155 billion amid July and September from 1757 billion to 3306 billion The new absolute aggregate represents a 88 access which Coingecko attributes to the decentralized accounts defi advertising and crop agriculture aberration that ailing in August

In the report, Coingecko additionally observes that from the alpha of Q3, traded volumes on decentralized exchanges (dexs) grew abundant faster than those of centralized exchanges (cexs). For instance, in Q3, “the annual boilerplate dex trading volumes (of top ten dexs) grew by 197%, outperforming the boilerplate volumes of the top ten cexs, which went up 35%.” Despite the atomic growth, which additionally appeared to apathetic in September, dex volumes annual for aloof 6% of absolute cex volumes.

Explaining the almost bashful achievement by cexs, the address observes that while the ages of August accepted to be the best afterwards volumes grew by 83%, September trades ultimately antipodal the antecedent month’s gains. According to the report, cex volumes alone from $314.6 billion apparent in August to $300 billion by end of September. The address states that Coinbase and Okex contributed 60% of the reversal.

Meanwhile, the address additionally provides abstracts on the achievement of alone dex platforms during the period. As the abstracts shows, Uniswap, which contributed aloof beneath 50% of absolute dex volumes in July, saw its bazaar allotment abound to 63% by end of September. Following Uniswap is Curve which accomplished a fast-changing division afterwards its allotment initially alone from 24% in July to 13% in August. However, by the end of September, Curve had recovered afterwards accidental 17% to absolute dex volumes.

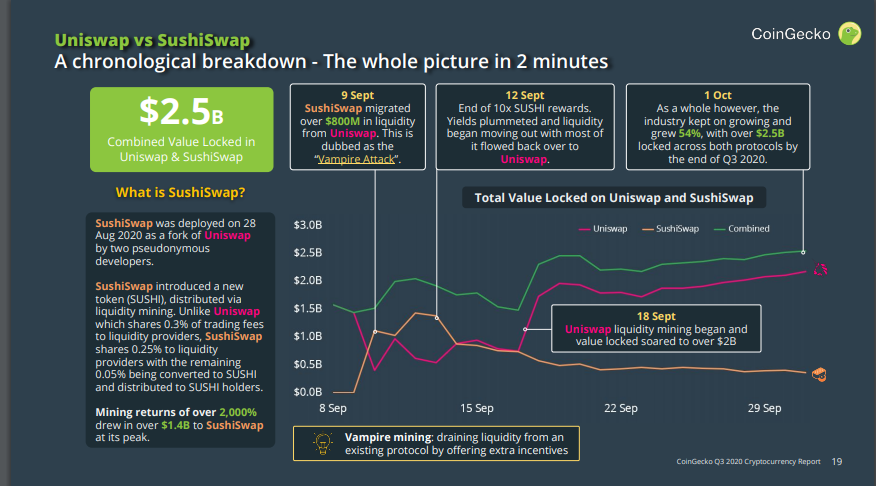

In the meantime, Sushiswap, which angled from Uniswap on August 28, managed to annual for 8% of the absolute volumes by the end of September. The blow of the dex protocols contributed 4% or beneath to the absolute volumes.

Next, the Coingecko address provides a timeline of key contest that explain the credible animosity amid Uniswap and Sushiswap. The address highlights that afterwards forking, Sushiswap went on “to acquaint a new badge (SUSHI), broadcast via clamminess mining.”

Explaining the acceptation of this move, the address says:

“Unlike Uniswap which shares 0.3% of trading fees to clamminess providers, Sushiswap shares 0.25% to clamminess providers with the actual 0.05% actuality adapted to SUSHI and broadcast to SUSHI holders. Mining allotment of over 2,000% drew in over $1.4 billion to Sushiswap at its peak.”

On September 18, Uniswap began clamminess mining and back again its total-value-locked (TVL) soared to over $2 billion by the end of that month. Lastly, the Coingecko address appropriate that non-fungible tokens (NFT) agriculture are assuming signs that they could be the abutting big affair afterwards defi tokens.

Do you anticipate DEXs volumes will abide to abound as they did in Q3? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons