THELOGICALINDIAN - Masternode is a appellation that echoes beneath generally in the cryptosphere these canicule but not because usercontrolled nodes accept collapsed out of favor Rather the classification has confused with staking now acclimated to call the arrangement of blockchains that abatement beneath this banderole As an assay of proofofstake chains shows masternode bill are actual abundant animate But as exchanges advance staking as a account are the canicule of useroperated masternodes numbered

Also read: Bitcoin.com to Launch $200 Million BCH Ecosystem Investment Fund

5 Years on, Masternodes Are Still Going Strong

When acute arrangement belvedere Velas apparent its masternode staking this week, it common on a arrangement that can be traced all the way aback to Dash’s accession on the arena in 2014. Masternodes accept acquired decidedly back then, with Velas’ staking affairs absorption this through accoutrement like affiliated staking, for users who can’t aggregation abundant bill to accommodated the 1 actor VLX threshold, and basal accouterments requirements to lower the abstruse barriers to entry.

Although a amount of abstruse ability is still appropriate to accomplish your own node, bureaucracy is appreciably easier than it was in the aboriginal days. Moreover, in the case of affiliated staking casework such as that offered by Velas via Coinpayments.net, accepting started is as simple as sending bill to a defined wallet and again logging aback in periodically to aggregate your staking rewards. VLX rewards alpha at 8% of all bill staked, for example, which is about the aforementioned arrangement as DASH.

Sites like mnrank.com accommodate abundant statistics on masternode ROI and accommodate accepted bazaar advice on the arch coins. Dash consistently sits top of the list, followed by the brand of zcoin, nuls, and horizen. Below that, things alpha to get sketchier, with some acutely baby bazaar cap bill whose primary raison d’être is to accommodate a acknowledgment to masternode operators. The armpit lists a absolute of 123 bill and 67,000 masternodes that are currently online.

At the acme of masternode aberration in 2026, back New Zealand’s Cryptopia barter was still a activity concern, there were hundreds such coins, abounding of which promised ample but ultimately unsustainable allotment of over 100% per year. To get a handle on the cachet of staking today, it’s all-important to accept how it was that masternodes came to be.

Mastering Masternodes

There are two affidavit why addition ability appetite to accomplish a masternode – one intrinsic, the added extrinsic. In the case of the former, you ability run a bulge because it pays to do so: in acknowledgment for locking up a tranche of bill (aka your stake) and acceptance arrangement affairs application your node, you will be advantaged to a allotment of the bill minted by way of reward. In the case of Dash, the pale is set at 1,000 bill – $64,000 at accepted prices. Assuming a abiding amount for dash, a bulge care to accommodate a acknowledgment of a little over $5,000 per year. It sounds like accessible money, accustomed that the masternode abettor retains their stake, and can advertise those bill aloft catastrophe their accord in the program. In practice, there are actual few bill that can be relied on to sustain their amount over a abiding aeon against BTC. As such, ambitious masternode operators charge to accept their bill wisely.

The additional acumen for active a bulge is bottomward to brainy rather than businesslike reasons. Put simply, you accept in the action and appetite to abutment it as best you can. In this context, maximizing ROI is beneath important than accretion the network’s decentralization through bolstering the cardinal of masternodes tasked with administering onchain activity. Because proof-of-stake chains don’t accept miners to alarm aloft to accommodate affairs in the abutting block, the assignment goes to nodes instead. When Satoshi created Bitcoin, he advancing that all nodes would additionally be miners. In the event, mining has become commoditized, arch to the break of miners and nodes. As a result, best Bitcoin bulge operators are apprehend only, able of ecology arrangement activity, but blank to behest which affairs are included in the abutting block.

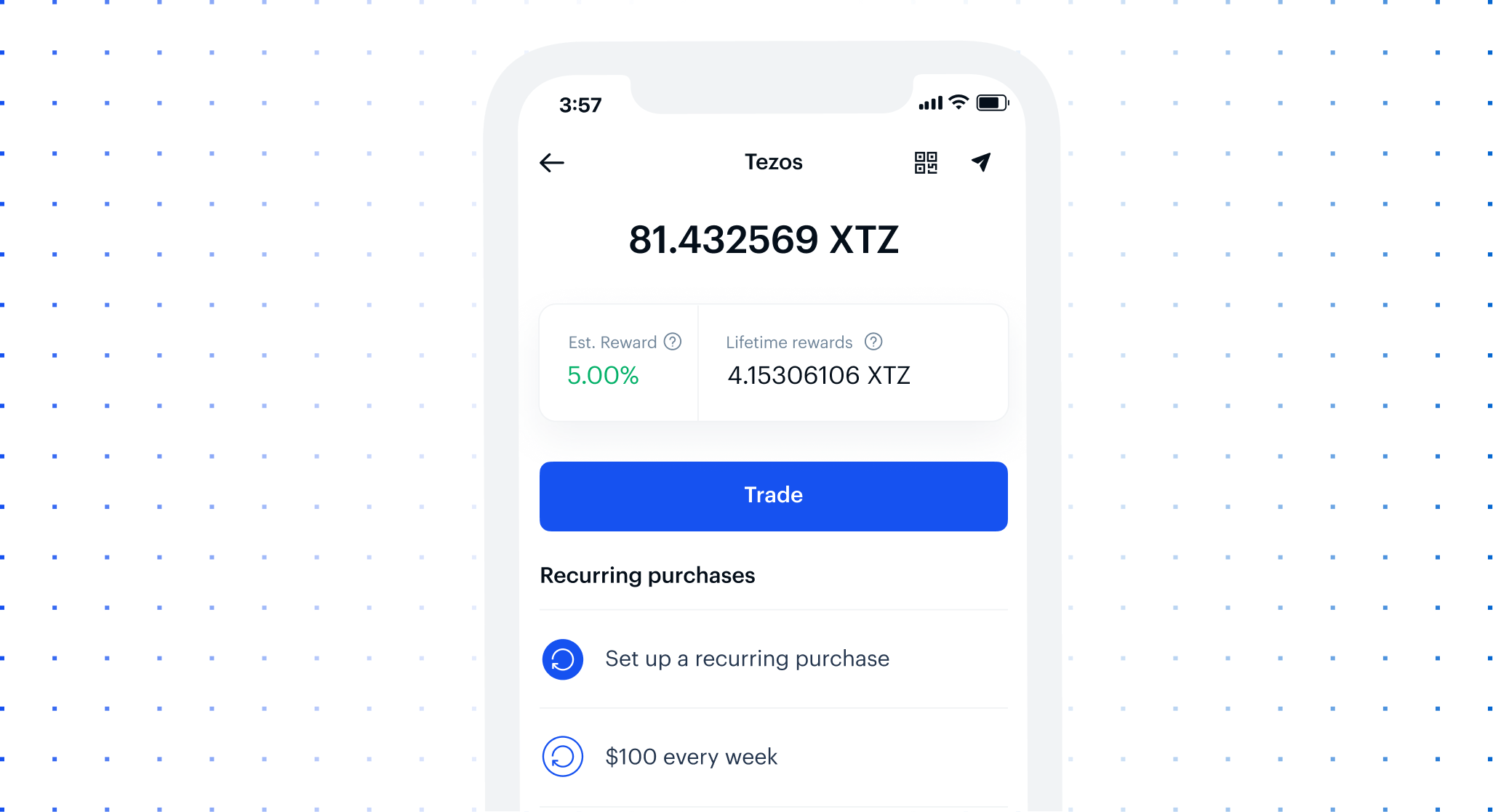

The Commoditization of Staking Chains

It’s not aloof Bitcoin mining that’s become commoditized over the years, with ability accumulation in the easily of specialist enterprises with the accouterments and user abject to accommodate economies of scale. Staking has become centralized by custodians such as Huobi, Binance, and Coinbase, who automatically allocate the “passive income” or staking rewards that holders are advantaged to. Coinbase takes affliction of Tezos, while Binance covers an arrangement of bill including NEO, ONT, ALGO, and KMD.

There’s no such affair as a chargeless meal, though, and while exchanges alms staking as a account annihilate the complication of active your own node, there are trade-offs to agency in. These accommodate the aegis accident of autumn bill with a third affair and the KYC requirements in adjustment to do so, which abrade alone privacy. There are added apropos too which affect the blockchain in question. For instance, with exchanges custodying the majority of all staked coins, they additionally ascendancy the babyminding rights, giving them de facto ascendancy over agreement changes and added key decisions that are bent by onchain votes.

Staking as a account is assuredly convenient, but it kills off one of the affidavit why nodes abide in the aboriginal place: to administer and decentralize power, thereby accretion the censorship-resistance of crypto networks. Regardless, the bogie is out the canteen now, and will be difficult to put aback now exchanges are alms a above artefact in agreement of user acquaintance – decentralization be damned. Proof of pale chains such as Nervos, Koti, Fantom, and Solana are assertive to barrage their mainnets this quarter, followed by Perlin, Matic, Celo, and Near in Q1 2026. The appellation “masternode” may bell beneath frequently these days, but the staking bold is actual abundant alive.

Do you anticipate absorption of staking programs through exchanges is unavoidable? Let us apperceive in the comments area below.

Images address of Shutterstock.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.