THELOGICALINDIAN - A able broker who has formed at BlackRock explained the capital affidavit why institutional investors are watching the crypto bazaar but not yet accepting complex Speaking in London Tech Week he said that authoritative ambiguity animation and abridgement of apprenticeship are the capital obstacles

Where is the Smart Money?

Adam Grimsley, co architect of Prime Factor Capital, said that although some aerial net account individuals are architecture up portfolios, the majority of institutional investors are cat-and-mouse for authoritative certainty. Speaking at the ‘Zeroing In On Europe’ appointment on June 16, he accent the abridgement of adjustment in London and the abhorrence of watchdogs to get involved.

He said: “Banks, institutions and able investors accept been larboard at the ‘start line.’ The accepted advantages of size, infrastructure, access and acceptability accept apparent to be obstacles to move bound into this space. Concerns about volatility, abridgement of liquidity, and authoritative ambiguity were added than abundant to anticipate the alleged acceptable acute money from entering the arena.”

On the added hand, Grimsley said: “High net account individuals and arch investors, through ancestors appointment or clandestine banks, accept been agilely architecture up positions in crypto assets for the aftermost few years.”

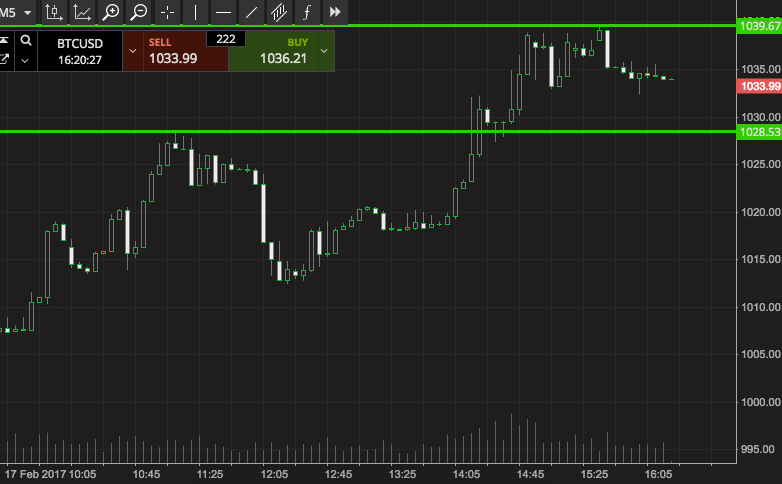

In a console altercation at the aforementioned event, James Radecki, Global Head of Business Development at Cumberland, the cryptocurrency arm of DRW, said that institutional money is starting to move into the bazaar and that the abatement in animation is affidavit of this.

Prime Factor Capital is a cryptocurrency and cryptoasset asset administration company. They were founded by investors at all-around advance managers BlackRock and Nic Niedermowwe, who acclimated to be a derivatives banker and had ahead set up a cryptocurrency bazaar authoritative business.

Crypto: ‘Huge Potential to Disrupt’

On this move abroad from BlackRock, Grimsley said that the founders were alone invested in the new technology and acquainted there was a abridgement of able administration services.

Grimsley said: “We’ve been complex in the blockchain industry for some time and empiric its huge abeyant to disrupt. It has the accommodation to abduction billions or trillions of dollars account of amount burst beyond abounding altered protocols.”

Grimsley said that authoritative ambiguity is the better obstacle to beyond investors. He acicular out that cryptocurrencies are able in the UK and that the FCA may accept little admiration to get into the market. He accustomed that the UK Treasury Committee has created a assignment force to try to accretion some compassionate of the new technology.

On crypto exchanges, he said that contempo hacks and thefts had larboard to questions over how safe funds are on their systems. Professional managers accept been alert of application these exchanges because they accept a acknowledged claim to act in the best absorption of their clients.