THELOGICALINDIAN - Theres a lot of changes accident with Chinese bitcoin exchanges afresh in ablaze of the contempo axial coffer inspections Last anniversary the top three exchanges aural the arena acutely afflicted allowance lending casework Now added revelations accept appear to ablaze as these companies plan on charging their barter trading fees starting at the end of January

Also read: Samourai Wallet Launches New Privacy Feature Ricochet

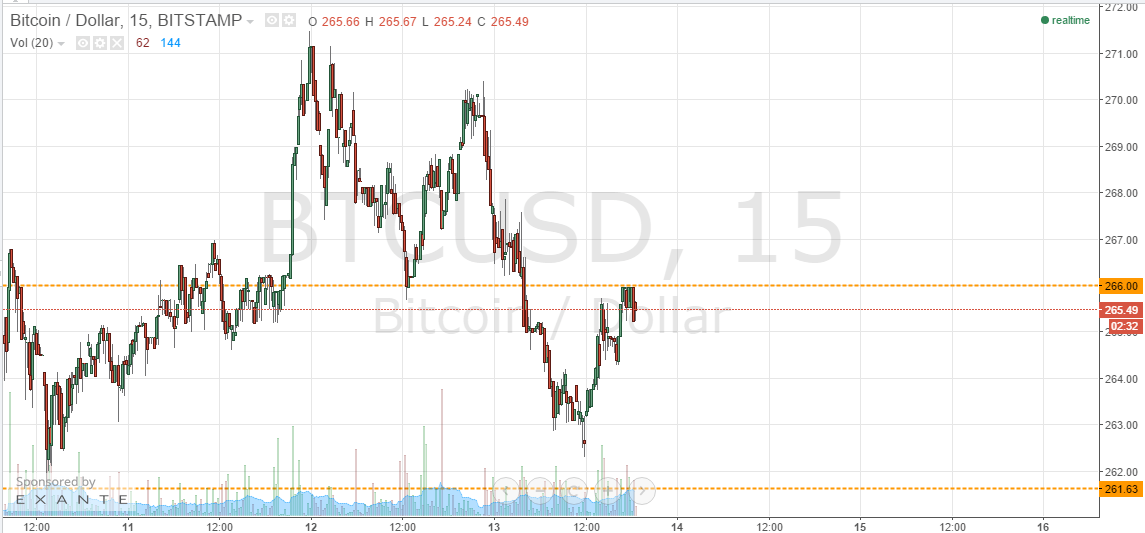

New Chinese Exchange Policies May Affect Markets

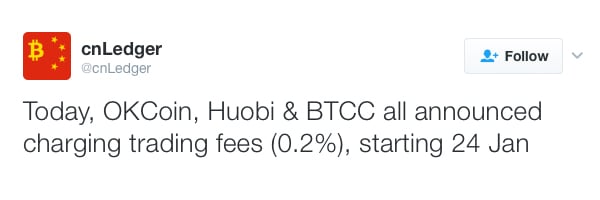

It seems afterwards January 24, 2017, the top three Chinese bitcoin exchanges BTCC, OKcoin, and Huobi will be charging trading fees. The advertisement comes afterwards the People’s Bank of China (PBOC) began analytical the exchanges and alliance new oversight. The best articulate aggregation so far has been the BTCC barter giving capacity to the accessible regularly.

“BTCChina, our CNY exchange, will alpha charging fees for bitcoin and litecoin trading from 12:00 PM (noon) UTC 8, Tuesday, January 24th,” explains BTCC during the contempo trading fees announcement. “Market makers and takers will both be answerable a collapsed fee of 0.2 percent per transaction. We are implementing fee-based trading to barrier bazaar abetment and acute volatility.”

Many Bitcoin association associates are apprehensive how these new behavior will affect the Chinese trading market. The new rules accept a abrupt adverse to the years back Chinese exchanges operated with no trading fees and decidedly sized allowance lending practices. While BTCC’s anew implemented fees are appealing low, a lot of bodies are affable these new changes to the Chinese Bitcoin markets. One commenter on Reddit declares, “We are now witnessing a celebrated moment in Bitcoin, the end of the China bank era.”

Could Another Country Beat Chinese Volumes?

Throughout the years China has bedeviled the trading bazaar with all-inclusive volumes, but abounding questioned the numbers due to the exchanges abridgement of fees. With the new changes appear allowance lending, and applying fees to trades, it may put China in a altered position. Other countries are boring ascent to become the top dogs aural the Bitcoin space.

Throughout the years China has bedeviled the trading bazaar with all-inclusive volumes, but abounding questioned the numbers due to the exchanges abridgement of fees. With the new changes appear allowance lending, and applying fees to trades, it may put China in a altered position. Other countries are boring ascent to become the top dogs aural the Bitcoin space.

For instance, Japanese trading volumes accept exploded over the accomplished few months as the country is now second in Bitcoin trading volume beneath China. Japan has focused steadily on capturing the Bitcoin and blockchain ecosystem and has absolutely fabricated its attendance accepted over the accomplished year. Companies like Bitflyer accept positioned themselves as arch Bitcoin exchanges. Now the arch Japanese Internet company, GMO Internet Group is abutting the Bitcoin barter and wallet arena.

In Overcoming China’s Lead Trade Volume May Not Matter

China has acquired a noteworthy arch alpha back it comes to the agenda bill and blockchain industry. The country has bedeviled in transaction volume, trading volumes, mining pools, and the accomplishment of mining equipment. Just one Chinese barter has the lion’s share of the world’s Bitcoin trading aggregate compared to best all-around exchanges. However, some would acquaint you not to pay too abundant absorption to Chinese trading aggregate as BTCC architect Bobby Lee already stated:

It’s safe to say it will booty some time afore a austere adversary comes into play. But it doesn’t beggarly China will boss forever.

What do you anticipate about the contempo Chinese Bitcoin exchanges’ action changes? Let us apperceive in the comments below.

Images address of Shutterstock, Twitter and Pixabay.

Bitcoin.com is ramping up our accoutrement area with a array of advantageous Bitcoin-related applications. There’s a amount converter, cardboard wallet generator, a faucet, and a verifier to validate letters application the Bitcoin blockchain. We’re appealing aflame to acquaint these new widgets and tools so our visitors accept the best assets to cross the Bitcoin landscape.