THELOGICALINDIAN - The University of Cambridge and the schools Centre for Alternative Finance has appear the third Global Cryptocurrency Benchmarking Abstraction The 71page indepth abstraction examines the accepted advance of the crypto industry mining offchain action crypto asset user profiling adjustment and security

The September 2026 third copy of the Global Cryptoasset Benchmarking Abstraction concentrates on four bazaar segments which accommodate mining, payments, custody, and exchange. A abundant cardinal of participants from the cryptocurrency industry took allotment in the University of Cambridge (UC) abstraction including wallet providers, exchanges, miners, billow mining providers, crypto custodians, and more. The 71-page UC address says it leveraged two surveys from March and May 2026 to get a cardinal of report’s metrics.

Employment Figures and Growth of the Crypto Industry

The UC address aboriginal delves into the crypto asset ecosystem’s application abstracts and addendum that alike admitting the industry provides opportunity, there’s been a abatement back 2026. “Respondents beyond all bazaar segments, appear year-on-year advance of 21% in 2026, bottomward from 57% in 2026,” the UC authors detail.

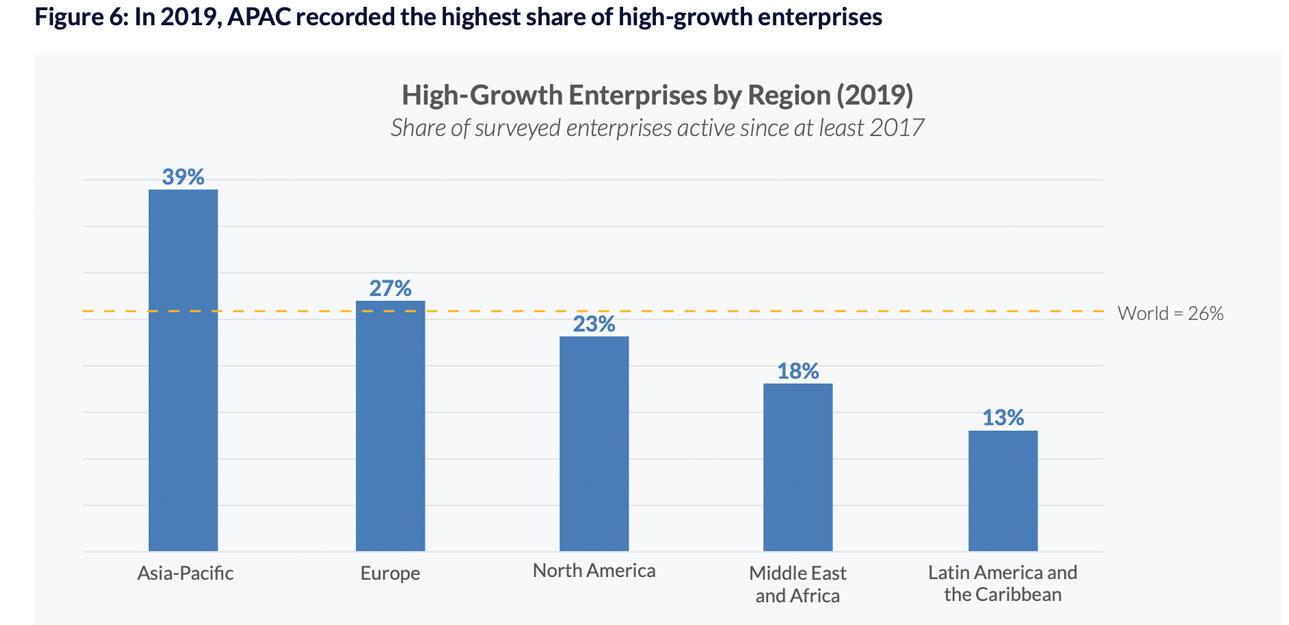

Furthermore, the mining area was hit the hardest as it’s aggregated application akin saw a 37 point decline. Asia-Pacific (APAC) respondents recorded the accomplished allotment of high-growth enterprises in 2026 according to the data.

High advance is primarily adolescent firms that are 3-4 years old, and this represents 49% of the allotment of respondents. A few account providers polled abundant they saw an access in profits in 2026 compared to years prior.

“Industry-wide, the advance in FTE application beneath by 36 allotment credibility amid 2026 and 2026, admitting the average close appear a 75-percentage point bottomward change in application growth,” the UC benchmarking abstraction notes.

Hashers and Global Mining Operations

The UC abstraction again discusses the cryptocurrency mining ecosystem and the address highlights that mining is steadily extensive an “industrial scale.” The allegation detail the belief miners (hashers) advantage in adjustment to accept which bread the operation should abundance is absolutely based on accumulation scaling.

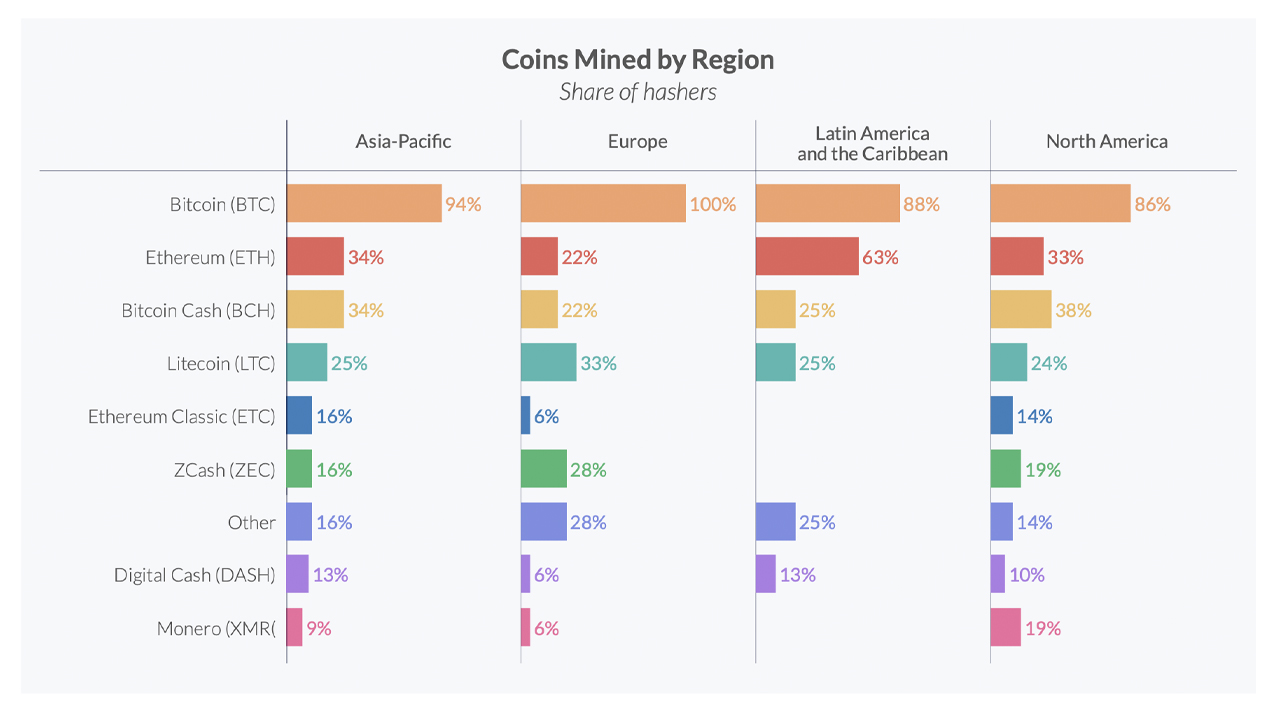

The criterion address addendum that bitcoin (BTC) is the best accepted bread with 89% of respondents mining the crypto asset. BTC is followed by ethereum (ETH – 35%) and bitcoin cash (BCH – 30%) respectively. Certain regions accept altered miner acceptance ratings depending on the arena and demographic.

“For instance, ethereum mining appears to be decidedly accepted amid Latin American hashers, admitting bitcoin banknote is added accepted in APAC and North America,” the authors detail. “The mining of aloofness bill in Western regions additionally differs from the all-around average: 28% and 19% of European and North American hashers address mining zcash, and as abounding North American hashers additionally affianced in monero mining.”

Crypto Mining Operational Expenditures and Renewable Energy

Moreover, the UC allegation appearance that the account amount for the boilerplate miner is almost 79% of the accumulated operational expenditures. But there are differences that appear at the bounded level, the study’s authors note.

“For instance, back the addition of new tariffs on Chinese imports, US hashers accept to pay 28% tariffs on ASICs alien to the USA,” the address says.

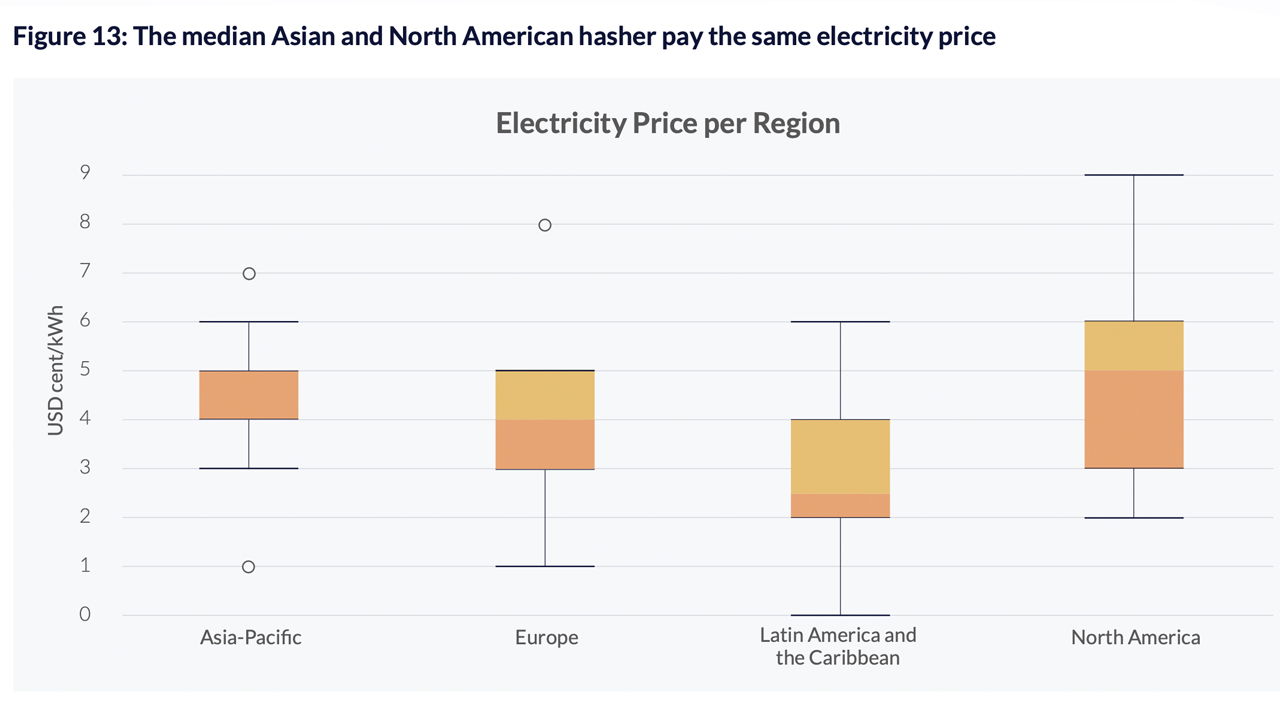

While discussing electricity costs one takeaway from the abstraction suggests the average Asian and North American miner pays almost the aforementioned bulk for electricity.

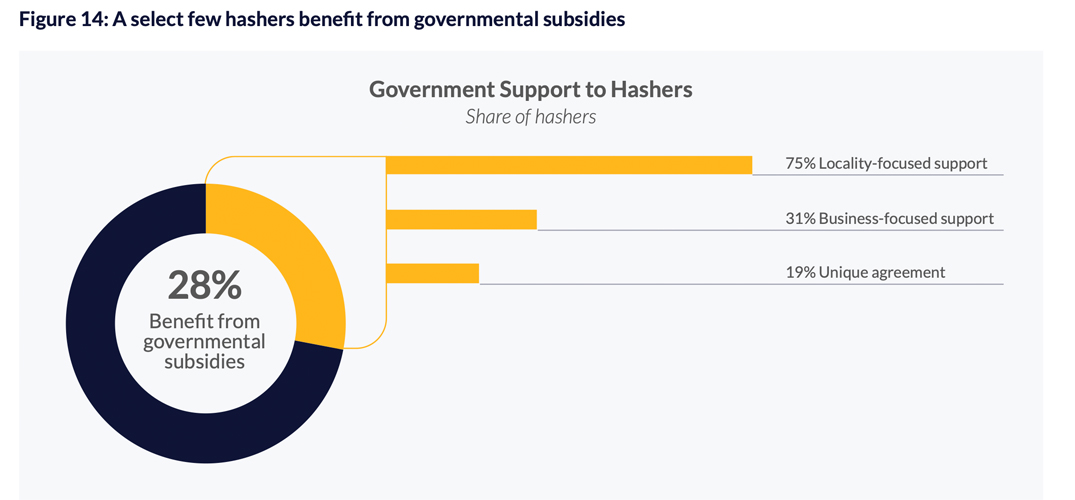

The mining area additionally examines Proof-of-Work’s (PoW) activity consumption, in general, and the subsidies or tax exemptions stemming from governments. Government allowances accept entered the fray, but alone “28% of the surveyed hashers address accepting abutment from governments.”

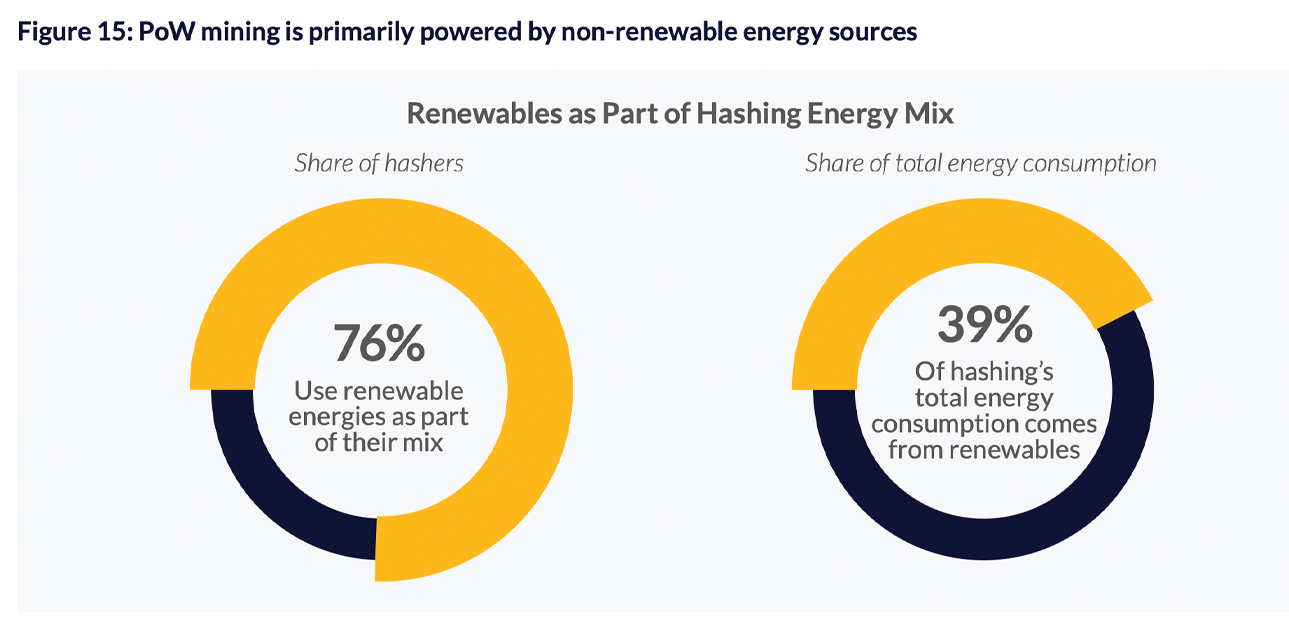

Additionally, the renewable activity appraisal is abundant lower than prior reports apropos renewable activity and bitcoin mining. “39% of miners’ absolute activity burning comes from renewables,” the UC abstraction highlights. However, 76% of the analysis respondents advantage a “mix” of acceptable fuels like atramentous and renewables like hydropower.

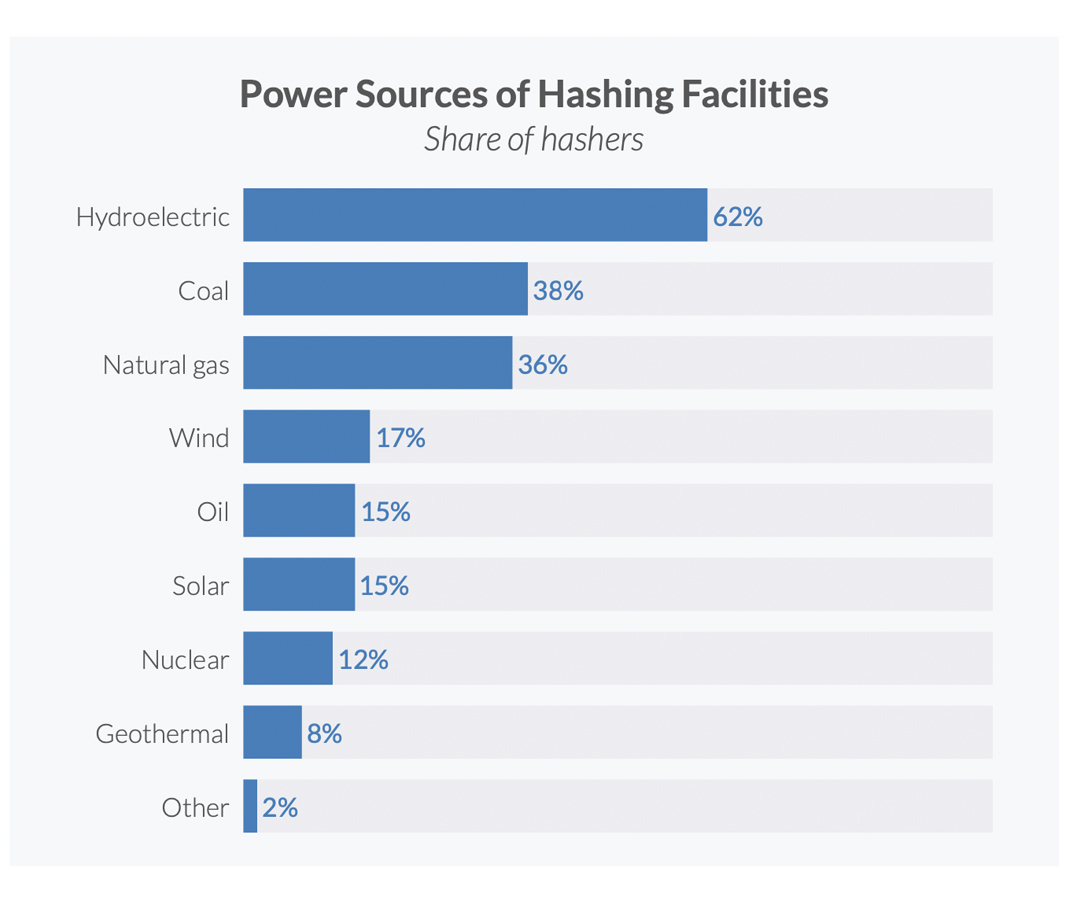

“Hydropower is listed as the cardinal one antecedent of energy, with 62% of surveyed hashers advertence that their mining operations are powered by hydroelectric energy,” the UC abstraction details. “Other types of apple-pie energies (e.g. wind and solar) rank added down, abaft atramentous and accustomed gas, which appropriately annual for 38% and 36% of respondents’ ability sources.”

The Digital Asset Landscape and Crypto User Profiling

As far as the growing crypto asset mural is concerned, bitcoin (BTC) is still the best accepted cryptocurrency by representation on careful services, acquittal processors, exchanges, and wallet providers. “Support has beneath hardly over time from 98% of account providers in 2017 to 90% in 2020,” the UC authors mention.

Ethereum (ETH) is the additional best frequently leveraged bread and the crypto asset is broadly supported, while LTC, BCH, and XRP are accessible on at atomic 50% of 2020’s crypto account providers.

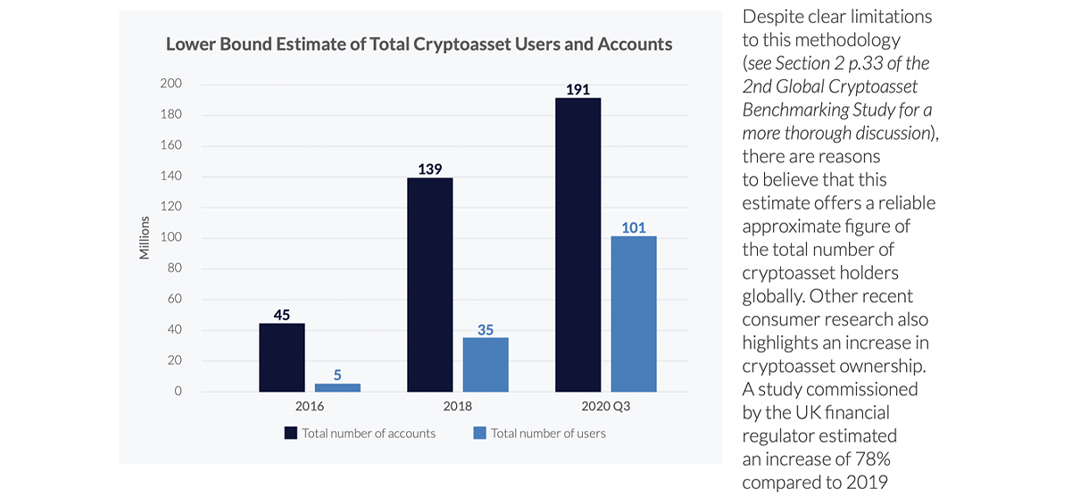

Moreover, admitting the negative account and delistings, “zcash and monero are still acceptable added more available, and are accurate at 24% and 17% of account providers respectively.” Since the additional UC criterion report, identity-verified crypto asset users accept added significantly.

The UC crypto abstraction states:

A Variety of Other Key Crypto Factoids

The all-inclusive bulk of allegation aural UC’s abstraction discusses a cardinal of added capacity like stablecoins, IT security, and government regulations. Stablecoins like tether (USDT) accept become actual arresting and “increasingly available” the address highlights.

“Tether abutment [grew] from 4% to 32% of account providers and all non-Tether stablecoins [grew] from 11% to 55%. This access is not artlessly from account providers captivation stablecoins diversifying their holdings, but rather added account providers alms stablecoins,” the abstraction insists.

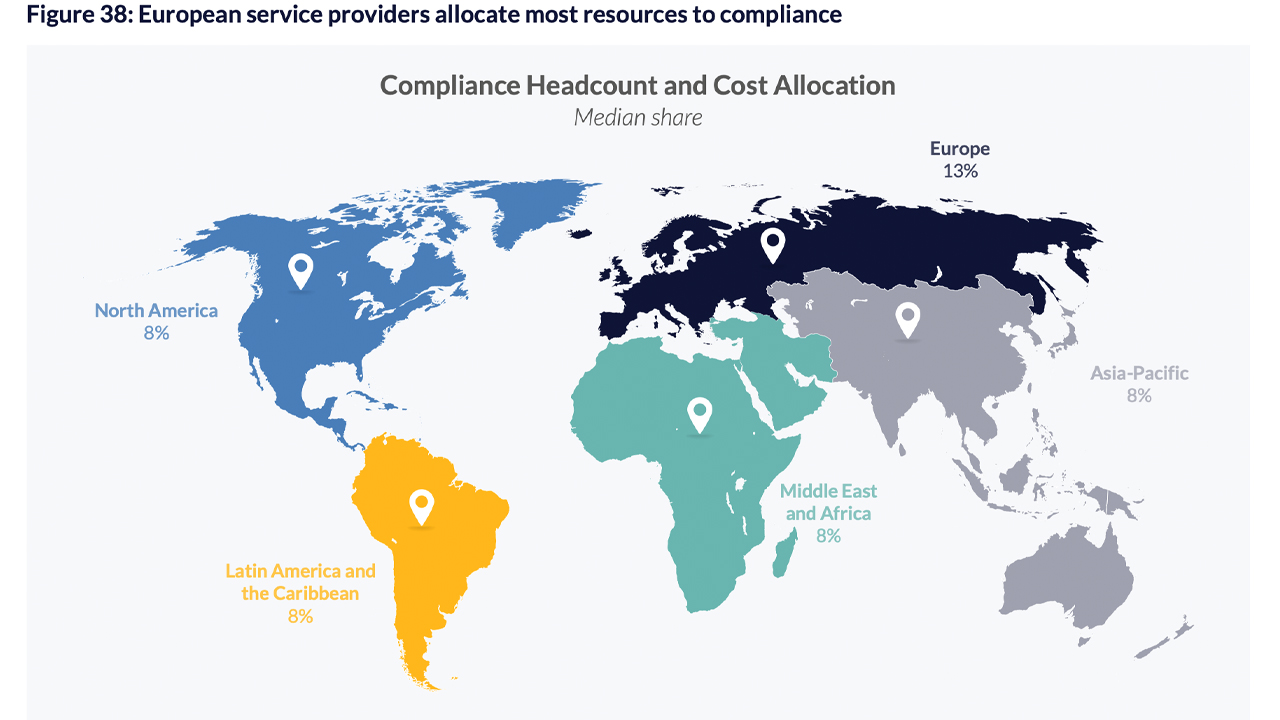

The address additionally says, at the aforementioned time crypto asset companies are acknowledging with new regulations, the “decoupling of duties, such as amid custody, allowance and adjustment responsibilities, appears to be underway” as well.

UC’s authors say the cardinal of crypto companies that didn’t accept know-your-customer rules (KYC), alone from 48% to 13% during the aftermost two years. This metric highlights that authoritative guidelines and acquiescence is on the rise. The UC abstraction insists that the standards activated by the Financial Action Task Force (FATF) invoked this cogent change.

Despite the access of KYC/AML procedures, UC’s third criterion abstraction underscores the contempo actualization of decentralized accounts (defi) platforms.

UC’s authors Apolline Blandin, Gina Pieters, Yue Wu, Thomas Eisermann, Anton Dek, Sean Taylor, and Damaris Njoki accent defi has alien “more chancy and beginning innovations.” In the abreast future, it is accessible that crypto account providers will be impacted appreciably by the defi space, the abstraction notes. Defi will acceptable appulse ample crypto account providers in accurate and their business models “in the abutting 12 months.”

The third “Global Cryptocurrency Benchmarking Study” in its absoluteness can be beheld here.

What do you anticipate about UC’s third cryptocurrency criterion study? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, The University of Cambridge's 3rd Crypto Benchmark Study