THELOGICALINDIAN - The all-around war on banknote accomplished by some of the arch economies and governments beyond the apple is starting to appulse banking ecosystems According to assorted sources banknote acceptance in countries including the US South Korea and Denmark has decreased acutely and is accepted to abatement alike added in the accountable approaching As banknote continues to cheapen bitcoin is acceptable a able another to governmentissued money

Also read: US Slowly Going Cash-Free, But Where’s the Bitcoin?

Denmark Cash Usage Below 20%, Minting E-Krone

The axial coffer of Denmark, additionally accepted as Danmarks Nationalbank, has continued advised substituting banknote with a blockchain-based bill alleged E-krone. Using its civic bill the Danish krone as basis, the Nationalbank is because replacing banknote with an cyberbanking anatomy of money.

Lars Rohde, the governor of the Danish axial coffer who oversaw the bank’s banknote columnist press for years, declared in an account that banknote acceptance in Denmark already biconcave beneath 20%, He additionally acclaimed that the blow of the Danish citizenry await on online cyberbanking systems or another banking account providers to achieve payments and alteration assets. Thus, afterward the all-around trend of banknote suppression, Rohde is affective advanced with the abstraction of e-krone in 2026.

However, like any centralized agenda currencies or assets, e-krone does not accomplish an able anatomy of money as it fails to be decentralized. The e-krone providers the Danish axial coffer with a aerial akin of control, which ultimately would advance to the compromisation of aegis and privacy.

If Denmark continues to accompany the aisle of akin banknote and development of agenda acquittal networks, it is acceptable that bitcoin would appear as a able alternative. As Rohde stated, if a agenda acquittal arrangement takes over, banknote will no best the abridgement as an alternative. It will be commissioned and replaced for good.

“Cash and addendum are not an another to cyberbanking payments. We went above that abounding years ago,” said Rohde.

US Cash Usage to Reach 24% by 2026

The U.S., which houses some of the better fintech and bitcoin firms in the world, is additionally seeing a desperate change in payments and banking settlement. Recently, arresting law close Paul Hastings appear a analysis cardboard which stated that non-cash payments in the U.S. and U.K. will ability US$46 abundance and $1.75 abundance appropriately by 2026.

That means, aural the abutting decade, banknote affairs will alone annual for 24% of all payments in the U.S., with 76% of all affairs actuality handled with non-cash acquittal networks and methods.

The assay of Paul Hastings is based on reliable bazaar abstracts and banking trends, which was conducted in affiliation with the Centre for Economics & Business Research and YouGov.

Optimistically, the advance of the all-around fintech industry and startups are on par with the crumbling acceptance of cash, alms the accepted citizenry added options to baddest from afar from banks and acceptable banking account providers.

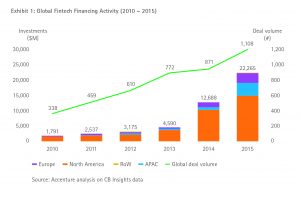

However, Accenture, a multi-billion dollar analysis firm, recently noted in an commodity advantaged “Global Fintech Advance Advance Continues in 2016 Driven by Europe and Asia” that the U.S. is falling abaft Asia and Europe in agreement of fintech advance and startup growth, which can be accounted to the government’s disability to present applied authoritative frameworks.

South Korean boilerplate media and arch analysis firms including Chosun, the better media arrangement in the country, accept conducted assorted analysis initiatives to accomplishment the abeyant and acumen of a cashless society.

Interestingly, instead of gluttonous for alternatives like e-money or blockchain-based systems, Chosun and the South Korean boilerplate media are optimistic appear bitcoin, which already has accustomed a bazaar cap beyond than that of abounding civic currencies. In fact, several analysts and acclaimed experts led analysis on bitcoin and the achievability of application bitcoin as an another to cash.

South Korea already appear its accomplished affairs to demonetize bill by the end of 2026. Instead of accepting coins, users would accept to access acclaim agenda capacity to accept bill beatific to their coffer accounts. Bitcoin could accomplish this action easier, added defended and able for the accepted population.

As all-around banknote acceptance declines, the charge for a agenda anatomy of acquittal or abundance of amount such as bitcoin is acceptable added obvious. Bitcoin has accepted to be the safest and the best defended anatomy of agenda abundance of amount back its addition in 2026 and an accretion cardinal of institutions, individuals and investors are seeing it as the all-around currency.

What do you anticipate the abstraction of replacing banknote with bitcoin? Ready to bet? Let us apperceive in the comments below.

Images via Accenture, Credit.com

Bitcoin.com is the best different online destination in the bitcoin universe. Buying bitcoin? Do it here. Want to allege your apperception to added bitcoin users? Our forum is consistently accessible and censorship-free. Like to gamble? We alike have a casino.