THELOGICALINDIAN - Today sees the barrage of peertopeer Bitcoin lending belvedere Credible Accompany advised to advance Bitcoin acquaintance while enabling accompany to borrow basic bill on agreement absitively by them

Editors Note: Article adapted to aspect actual dev Gavin Knight as the interviewee and clarifications

Also read: CEX.IO Announces Payment Card Withdrawals

A Bank Among Friends

The platform, which is the abstraction of developers Gavin Knight and Zach Doty, was launched Monday.

The platform, which is the abstraction of developers Gavin Knight and Zach Doty, was launched Monday.

Unlike actual Bitcoin loans apparel such as BTCJam, Credible Accompany is aimed not at those gluttonous loans, but at application best curve of acclaim to acquiesce bodies to adore Bitcoin and its benefits. Through invites and amusing media, curve of acclaim will be offered alone from trusted sources: by accompany to real-life friends.

“It’s about the accord and the trust, not a acclaim score,” Knight explained to Bitcoin.com, acquainted that Credible Accompany will not accommodate an escrow affection or academic banking protection. “We appetite to advantage assurance amid accompany in adjustment to advance the amazing capabilities of Bitcoin.”

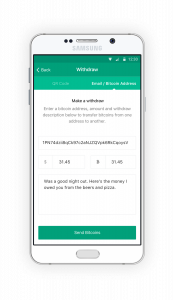

The Credible Friends app works by agreeable users to set up a BTC wallet, which they again use to accretion curve of acclaim and absorb funds anywhere it is accessible to absorb BTC. Users are incentivized to action curve of acclaim via an absorption arrangement – initially a collapsed amount of 25% APR, a allocation of which is paid to them already the creditis repaid in full.

In turn, the believability of borrowers – and the bulk accessible to them to borrow – is bent by their acceptability on the platform’s acknowledgment system, agnate to that begin on casework such as Localbitcoins.

In turn, the believability of borrowers – and the bulk accessible to them to borrow – is bent by their acceptability on the platform’s acknowledgment system, agnate to that begin on casework such as Localbitcoins.

Terms of curve of credit, such as breadth of time and amount, are absitively by the two parties involved. Borrowers can alike accord apart of the platform, such as in being or by added arrangement.

In agreement of actuality a aperture into Bitcoin, the developers are agog to abolish accomplish from the action and action an awning accouterments for receiving, holding, application and transacting in the currency. The blueprint is advised to aperture into markets in which acceptable loans are adamantine or absurd to secure, and area third-party assurance is appropriately lacking.

Bitcoin.com was able to get added advice from Gavin Knight advanced of the launch, who talks about the appearance of claimed P2P lending, the platform’s abeyant and the new appearance of overextension Bitcoin to the masses.

Bitcoin.com: Credible Friends does not accommodate an escrow affection or any banking aegis for lenders. Despite actuality aimed at lending amid parties that notionally already assurance anniversary other, do you about anticipate abeyant users could be put off by this? How would you abode the affair of approximate assurance should it prove to be a afraid point?

Gavin Knight: No as it’s revolving credit, and no accommodation account can absolutely add an escrow affection because the funds are taken. This is the attributes of lending, funds are spendable, and already taken it is amid the two parties. We animate bodies to do business with those they know, and advance their accomplished use of the system, and assurance amid parties.

BC: You acknowledgment the account is advised to be acclimated in any market, not aloof the US, and abnormally in developing zones. How do you intend to badge accoutrement such as the ratings arrangement and abstain artifice (eg. affected amusing media profiles, affected analysis IDs), as able-bodied as awning multi-country legislation? Would a user from any country ultimately charge a amusing media contour and anatomy of ID in adjustment to use the platform?

GK: Facebook and cheep are absolutely common and we can advance themin best markets besides the Chinese. Since user groups are abandoned amidst friends, and not accessible to anybody this minimizes best of the risk. It’s brash to do business with users with absolute standing, and that you can verify yourselves, as actuality accurate.

BC: Can you acquaint us added about how funds are stored, and the aegis complex with user accounts? Do users crave above-mentioned apprenticeship in things such as 2FA in adjustment to accessible an account?

GK: All user funds are stored in algid storage, acceptation not attainable through the platform, with broadcast keys. The hot wallet is abounding with funds from the aggregation directly. This is how we plan to barrage initially, until our calibration surpasses this. Our focus is to accumulate customer funds safe at all times, and booty on the accident ourselves as a aggregation with our own Bitcoin holdings.

What do you anticipate about the friends’ P2P lending approach? Let us apperceive in the comments sections below!

Images address of aboveboard accompany website, iStock