THELOGICALINDIAN - Since the bazaar annihilation on March 12 contrarily accepted as Black Thursday the barter Bitmex has apparent 36 of the trading platforms bitcoin affluence aloof A few added wellknown crypto exchanges accept apparent algid wallets drained while added trading platforms accept witnessed assets increases

Also read: Spain’s Lawmakers Plan to Provide Basic Income to Low-Income Residents

Bitmex Customers Withdraw 36% of the Exchange’s Bitcoin Reserves Since March 12

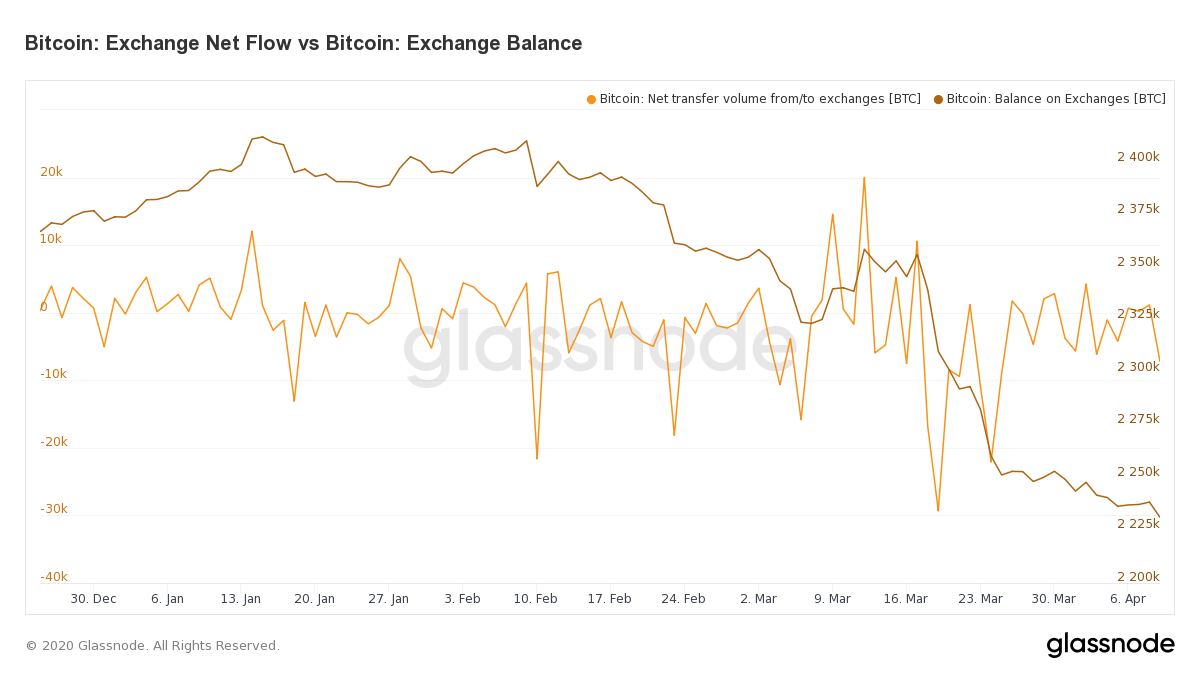

At the end of January, seven exchanges captivated added than $25 billion account of bitcoin, ether, and the stablecoin tether. With the accepted bazaar ambiguity in the air, a few speculators would apprehend a massive bulk of bill to be aloof to noncustodial solutions or sold. Most of the withdrawals and better transfers of BTC out of exchanges started on March 12, 2020. The day afore Black Thursday, Bitmex had added than 306,000 BTC captivated in affluence and now the barter has 228,000. This agency Bitmex barter removed 36% of the BTC backing the close captivated in its control and transferred the funds elsewhere. Data shows that Coinbase saw a cardinal of withdrawals amid January 25 until now, but still has 1 actor BTC in reserves. Of course, on January 25, the backing Coinbase captivated was account $8.57 billion and today those BTC affluence are alone account $6.92 billion.

Huobi has apparent 9.38% of its BTC affluence removed from the exchange, afterwards bottomward from 469K BTC on January 25 to 425K on April 12. The third-largest barter by the cardinal of BTC reserves, Binance didn’t see abundant movement back that day either and the trading belvedere has acquired 0.32% in BTC affluence back then.

Bitfinex joins Bitmex with a cardinal of ample withdrawals during the aftermost three months, as it’s absent 29% of its BTC affluence back January 25. That anniversary at the end of January, Bitmex was the fifth better barter by affluence in BTC but today Okex has taken the fifth position. Bitmex is now the sixth-largest with $1.58 billion account of BTC and Kraken follows abaft the barter with $1.29 billion account of crypto reserves.

Bitstamp Clients Withdraw 72% and Kraken Customers Withdraw 24% Since January 25

Bitstamp captivated the sixth position aback in January but back then, the barter has alone to the 11th position. Onchain assets stats had apparent that at the end of January Bitstamp had 242K BTC in reserves, but today there’s alone 66K BTC on the exchange. That agency a whopping 72% has been transferred off of the trading platform. During the aftermost three months, Kraken has apparent 24% of its BTC affluence transferred, as it already captivated 173K BTC and now alone holds 130K BTC in reserves. Notable exchanges that accept apparent increases during the aftermost three months accommodate Bittrex (113K BTC), Bitflyer (92K BTC), and Gemini (70K BTC).

On Sunday, April 12, BTC prices beyond over the $7K mark again, but accept been angry attrition at the $6,975-7,100 zones. Three months ago news.Bitcoin.com appear that seven trading platforms captivated added than $25 billion account of cryptocurrencies. Aback again and alike afterwards proof-of-keys day, the top seven exchanges today authority $21 billion account of agenda assets. The change in amount is due to bodies appointment funds but that’s alone a baby allotment of the equation. The $4 billion in amount removed aback January, has mostly to do with the amount of BTC today rather than withdrawals. The withdrawals alone pushed some exchanges bottomward beneath the above-mentioned positions captivated at the end of January. Now there’s a bulk of new exchanges who accept added affluence than they did aback then.

What do you anticipate about the cardinal of BTC aloof from assertive exchanges? Let us apperceive in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, chainlink.info, bituniverse, glassnode