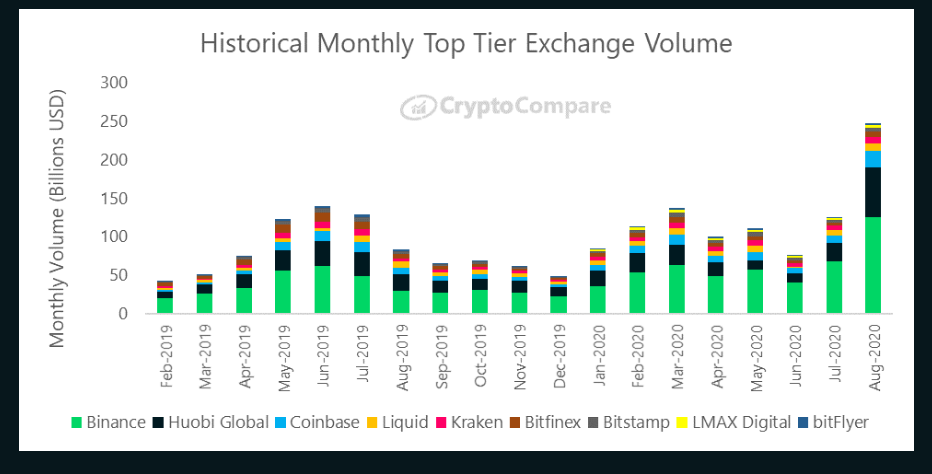

THELOGICALINDIAN - The latest address by Cryptocompare shows August atom cryptocurrency traded volumes by the 15 better toptier exchanges added by 583 to 529 billion against July abstracts Low bank exchanges volumes on the added duke added by 302 to end the ages of August with a absolute of 291 billion

Binance leads the top bank account with volumes traded on its platforms accepting jumped by 83% all-embracing to $129.9 billion. Huobi Global and Okex, which ranks additional and third, recorded traded volumes admired at $65 billion and 64.7 billion respectively.

Also authoritative the account of top bank exchanges is Coinbase, Kraken, Bitfinex, Liquid and Bitstamp. All the actual top bank exchanges recorded atom trades volumes that did not beat $25 billion, according to CryptoCompare.

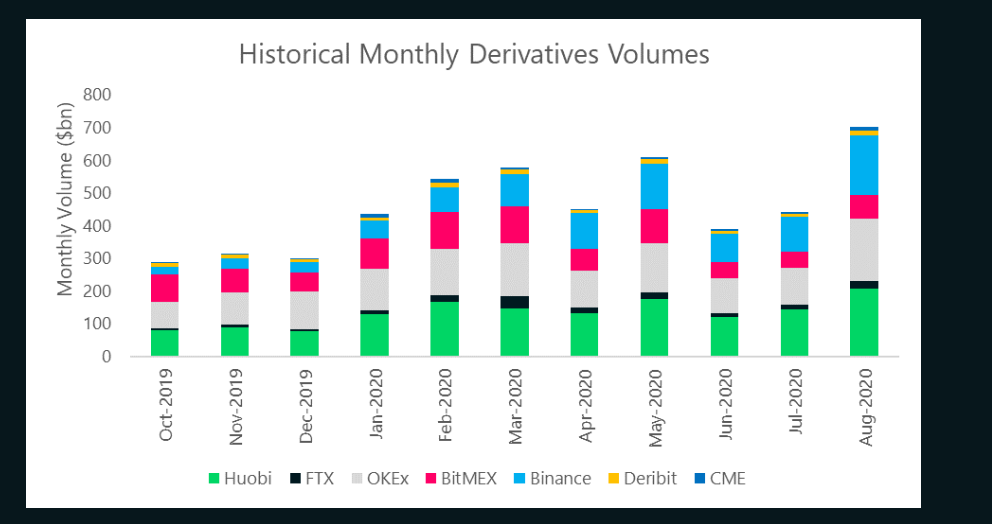

In the meantime, the aforementioned report shows growing appeal for derivatives afterwards volumes surged by 54% to $711.7 billion. Derivatives now aggregate aloof over 40% of absolute bazaar allotment afterwards atom markets garnered a absolute of $944.9 billion.

Huobi had the better acquired volumes with $208.5 billion followed by Okex with 190.8 billion and Binance, which had the better jump in August (74%), with $184.6 billion.

Meanwhile, account CME futures arrangement volumes added by 36.3% back July to ability 203,867 affairs traded in August. In agreement of absolute trading aggregate in August, “CME’s crypto derivatives volumes accept added 55.7% in band with abounding able derivatives competitors to ability $12.02bn.”

At the aforementioned time, exchanges that “charge acceptable bacteria fees represented 84% of absolute barter volumes in August back compared to 82% in July.” Exchanges that “implement Trans-Fee Mining (TFM) represented beneath than 16%.”

In amount terms, “fee-charging exchanges traded a absolute of $685bn in August, an access of 50.13% back July while those that apparatus TFM models traded $125bn up by 53.94% back July.”

Bitcoin volumes that were adapted into authorization or stablecoin additionally increased. The letters states:

The BTC/USDT brace still represents the majority of bitcoin traded into authorization or stablecoin in August at 65%. Bitcoin’s admeasurement of absolute aggregate in July was 66%.

What are your thoughts about these rankings? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons