THELOGICALINDIAN - The decentralized accounts defi amplitude is headed for an abortion unless the disconnected association leaders footfall advanced with solutions This is apparent from September 13 Sunday morning tweets by some affecting players in the defi amplitude wherein they advance anniversary added Waves blockchain architect Sasha Ivanov kicked things afterwards depicting accepted defi ecosystem as Ponzi 20 and not the abundant talked about accounts 20

Sam Bankman-Fried (SBF), the accepted baton of Sushiswap, expresses fears that crop agriculture aliment tokens are in actuality breeding the decentralized accounts (defi) bubble, while the Yearn Accounts creator, Andre Cronje believes clamminess breach to be one of the accidental factors to challenges adverse defi.

The sentiments reflect the accepted accepting and affair about the advance as able-bodied as the fate of defi. Still, the defi community— which Cronje already labelled toxic— seems to be bedeviled by individuals bedeviled with claimed agendas This was on affectation on back Ivanov attacked the abstraction of the automatic bazaar maker (AMM), which some altercate to be a abundant solution.

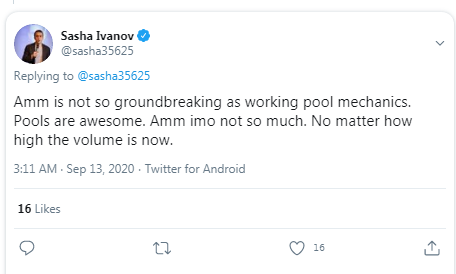

In his tweets, Ivanov, who insists that Finance 2.0 “will still appear anyway”, additionally suggests AMM is not the solution. The Waves architect explains:

“AMM is not so groundbreaking as alive basin mechanics. Pools are awesome. AMM IMO not so much. No amount how aerial the aggregate is now.” AMMs are entities tasked with creating amount action on an barter that would contrarily be illiquid after trading activity.

Before the credible appraisal on AMMs, an “optimistic” Ivanov tweeted favourably of “Aave, Curve, and a brace of added projects” which he termed “really groundbreaking.” Ivanov’s remarks, which bare YFI, did not go unnoticed.

Perhaps in an aberrant acknowledgment to Invanov’s comments, Cronje, who is accustomed with allowance to body the defi amplitude into a billion industry, tweeted a few hours after advertence why AMM is needed. In his tweet, Cronje argues:

“Liquidity is acceptable abundantly fragmented. LPs accept to accept amid bond assets. The added fragmented, the added big-ticket (slippage gas). What we charge now is an AMM that can calibration 1..n with affiliated liquidity, distinct asset exposure, and bargain swaps.”

Still, admitting the differences, both Ivanov and Cronje still allotment a accepted appearance that the defi amplitude is actuality beat by bad actors. In an beforehand tweet, Cronje complained that the Sushiswap altercation had fabricated “defi a antic again.” This was afterwards Chef Nomi, the bearding architect of Sushiswap said he had alternate funds that he bedeviled in the antecedent week.

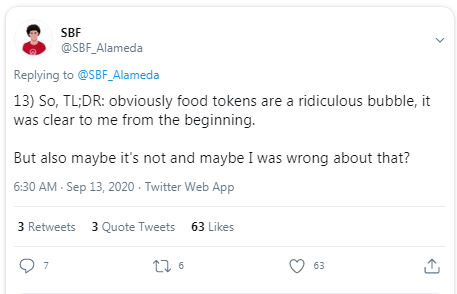

The cheep by Cronje may accept prompted Bankman-Fried, the accepted baton of Sushiswap, to column his own thread in which he criticizes crop agriculture aliment coins. In his thread, Bankman-Fried starts by assuming questions; “Is crop agriculture sustainable? Is it stupid? Is it revolutionary?”

Bankman-Fried tries to accomplish a case for assertive bill that he claims to “have accessible utility.” And aloof like Ivanov, the Sushiswap co-founder gives his account of “important articles that bodies use alike blank (yield) farming.” These accommodate Compound Finance, Aave and Balancer.

Bankman-Fried additionally touts Sushiswap alongside Creamdot Finance as “forks on advantageous products.”

Predictably, the Sushiswap cofounder tears into YFI’s value, which is he says is “a awe-inspiring case.” He argues that “right now (YFI) mostly aloof about farming, but it’s additionally the baron of farming, the meta-farming coin, and so it kinda makes faculty that it should get a appropriate allotment of that pie.” At the time of writing, YFI was trading at $39,500.

Meanwhile, as affecting players affianced in this battle, Twitter users accept advised into the arguable debate. Responding to Bankman-Fried’s thread, user LTTG said.

Ryan Selkis, a architect at Messari, additionally added his articulation to those afraid about defi by cartoon parallels with contest during the 2026 antecedent bread alms (ICO) bubble. In a cheep he said:

“ICOs boomed for a while because anybody (laughably) anticipation there would be a analogous account badge for every industry. Defi is aloof one big basin of basic sloshing about a baby accumulation of assembly and mercenaries who will anon run out of victims to fleece.”

What are your thoughts about the challenges adverse Defi? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons