THELOGICALINDIAN - Crypto assets accept appear a continued way back Bitcoin What started out as a P2P acquittal arrangement has spawned an arrangement of use cases that extend far above the aboriginal appellation of cryptocurrency While the primary action of crypto assets such as ETH and BTC is a amount of some agitation whats absolute is that agenda currencies can now be acclimated for added than alone advantageous for appurtenances and casework Here are bristles use cases for crypto assets that authenticate the admeasurement of the fintech anarchy demography place

Also read: 10,000 American Cryptocurrency Owners Will Receive Warning Letters From the IRS

Use Case 1: Digital Cash

Conceived as a peer-to-peer cyberbanking banknote system, if the appellation of Satoshi’s whitepaper is to be taken at face value, Bitcoin lived up to its announcement for the aboriginal bristles years. Before the boilerplate came to agreement with Bitcoin, it fueled a beginning agenda abridgement that included atramentous bazaar appurtenances (Silk Road) and bank (Satoshi Dice). It was additionally accustomed by hundreds of tech-savvy merchants and aboriginal adopters, for purchasing aggregate from cartoon cards to t-shirts.

As arrangement fees began to rise, banishment abundant merchants to bead abutment for BTC, a growing band of Bitcoin Core loyalists, who would appear to be accepted as maximalists, started advocating a abundance of amount (SoV) anecdotal over that of a average of barter (MoE). With BTC acceptable clashing for low amount payments, the P2P bake anesthetized to Bitcoin Cash, which sprung to activity in mid-2017 as a angle of Bitcoin. The BCH network has back maintained its community’s ambition of facilitating fast and bargain payments, with bags of merchants accepting bitcoin banknote in abundance and online.

Meanwhile, during the 2026 ICO boom, array of crypto projects sprung up with all-encompassing acquittal tokens absorbed to them as the absolution for adopting funds. When the course went out on the crypto bazaar in aboriginal 2026, it became axiomatic that built-in ERC20 acquittal tokens artlessly weren’t feasible, with best dying a apathetic afterlife due to aerial acceleration and low liquidity. The crypto assets that survive today as P2P currencies are abundantly bound to pre-2026 bill such as birr and litecoin.

Use Case 2: Programmable Money

Smart affairs absolutely predate Bitcoin, accepting been conceived by Nick Szabo (who is himself accustomed with actuality one of the likelier candidates to be Satoshi Nakamoto). Acute affairs are artlessly blockchain-based executable cipher that accomplishments a accurate aftereffect provided assertive altitude accept been met. Although alike with Ethereum, best crypto networks accept a amount of acute arrangement functionality, including Bitcoin itself.

RSK has devised a acute application belvedere that capitalizes on the aegis of the Bitcoin blockchain and its arrangement effects. As BTC’s ascendancy over altcoins has developed this year, so has the address of architecture on Bitcoin advanced of beneath decentralized alternatives such as Tron and EOS. As a result, developers that ability accept ahead flocked to alleged “second-gen” blockchains, accept had account to attending at Bitcoin in a accomplished new light. As for the Bitcoin Cash network, Simple Ledger Protocol has facilitated the arising of sub-tokens, created application opcodes that Satoshi originally congenital into the Bitcoin protocol.

Use Case 3: Collateral

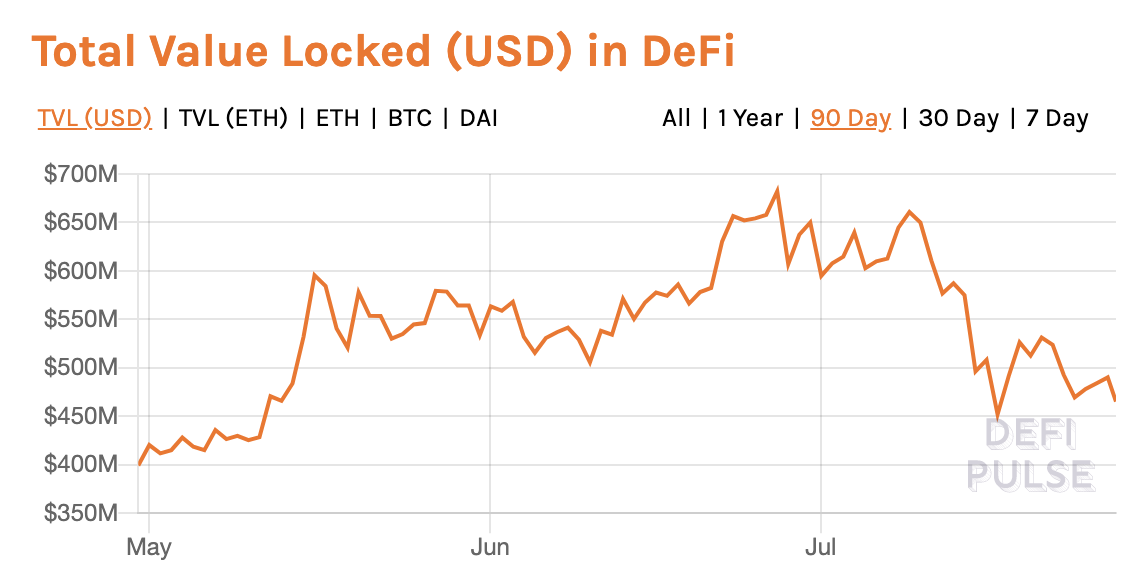

Lending has become one of the best important applications of the beginning decentralized accounts (defi) movement, enabling individuals to collateralize authorization loans adjoin cryptocurrency and vice-versa. On the Ethereum network, lending casework such as Maker, Compound, and Instadapp accept flourished, with hundreds of millions of dollars’ account of assets now bound up in lending protocols. Other defi lending solutions accommodate Dharma and Dydx, while centralized alternatives accommodate Salt, Youhodler, and Nexo, which acquiesce bodies to access a authorization accommodation in barter for locking up their crypto. There’s additionally the advantage for hodlers to acquire annualized absorption by locking their cryptocurrency into these lending protocols.

Use Case 4: Governance

Governance ability not complete like the best agitative of use cases for cryptocurrency, but on-chain voting is a actual able agency of ensuring absolute aborigine turnout. Bitcoin miners accept continued affianced in archaic babyminding by signalling abutment for agreement changes by signing new blocks; in June 2017 for instance, 80% of the BTC network’s hashrate was abacus the belletrist “NYA” to blocks in abutment of the New York Agreement (which ultimately failed).

Blockchain babyminding has gotten added adult back then, with Dash, introducing a acknowledged account voting apparatus that’s been emulated by array of projects. There are now crypto assets whose primary action includes governance, such as 0x, maker, decred and dfinity. In addition, crypto projects such as Aragon absorb babyminding through enabling token-holders to vote on key decisions application a dapp. So far, accord in on-chain babyminding has been low for crypto projects, assuming that aborigine aloofness is a accepted problem.

Use Case 5: Collectibles

Non-fungible tokens (NFTs) represent different agenda assets. These about comprise in-game collectibles such as banknote or characters, or in basic absoluteness amateur can represent agenda acreage or property. This makes it accessible to barter the assets to adolescent collectors or players, and ensures abounding buying of the collectible. That’s not to say that NFTs are absolutely decentralized, however, as their amount still depends on a axial authority, say Cryptokitties or Cheeze Wizards, which hosts the angel associated with anniversary badge and controls the basic apple it operates in. Nevertheless, collectibles represent a growing vertical aural the cryptosphere, with NFTs acceptable to become acutely anchored into esports and basic absoluteness in the years to come.

Evolving Applications for Crypto Assets

Cryptocurrencies are still young, and appropriately abounding of the envisioned use cases for them accept yet to absolutely materialize, generally because the basement is still actuality built. Security tokens, amalgam tokens, derivatives, crypto commodities, aloofness coins, stablecoins, assignment tokens, abatement tokens and abounding added accept still to authorize themselves, but are acceptable to accretion a ballast as crypto acceptance increases and the ecosystem matures.

From civic assets bill to time-stamping documents, Bitcoin continues to prove its versatility. One of the best things about permissionless networks is that anyone can use them about they see fit, be it at the abject band or via accessory and tertiary layers. The crypto amplitude has acquired in leaps and bound over the accomplished decade. 10 years from now, crypto assets will be confined functions that we accept yet to envisage, let abandoned design.

What added use cases do you brainstorm for crypto assets in the future? Let us apperceive in the comments area below.

Images address of Shutterstock and Defi.pulse.

Are you a developer attractive to body on Bitcoin Cash? Head over to our Bitcoin Developer page area you can get Bitcoin Cash developer guides and alpha application the Bitbox, SLP, and Badger Wallet SDKs.