THELOGICALINDIAN - Lloyd Blankfein CEO of Goldman Sachs cozies up to bitcoin admitting cautiously Hes afterward a all-around accumulated trend As its amount rises and bitcoins resiliency to adjustment rumors and clampdown abiding its not adamantine to brainstorm added converts on the way

Also read:Goldman Sachs Contemplates Creating a New Bitcoin Trading Operation

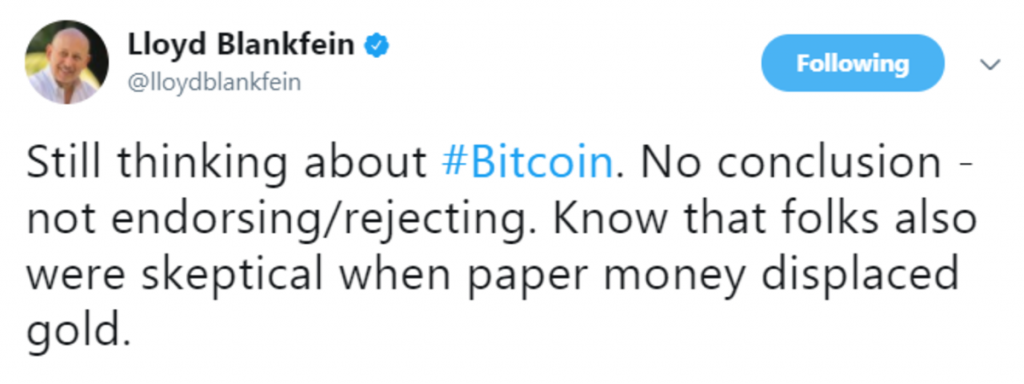

The man’s words actually move markets. In a distinct Tweet, he can set the banking apple aflutter. To wit:

Goldman Sachs CEO, Lloyd Blankfein, consigliere to presidents, prime ministers, axial bankers, understands the ability of his different platform, voice.

As arch of a century-and-a-half old banking institution, Mr. Blankfein has the ear of anybody who matters. Even the United States Treasury consults him above-mentioned to finalizing policy.

Mr. Blankfein abutting Twitter alone this year, and has kept Tweeting to about two dozen posts in beneath than six months. This one, however, accustomed austere media attention, abnormally advancing as it has afterwards assumption swirled Goldman Sachs would accede its own bitcoin comedy aural the boilerplate bazaar structure.

Its additional band grabs at bitcoin enthusiasts.

The move to cardboard money, cash, was absolutely a abolitionist band-aid to a actual accepted circadian bread-and-butter problem. Gold was an ideal anatomy of currency, but its limitation in ample amounts included lugging it around.

Issuing redeemable notes, admitting they came with their own set of problems, calmly stored and folded, accustomed for smoother accessible and clandestine transactions.

Depending on your admired anthropologist, cardboard money has been about for article on the adjustment of 1,400 years.

Mr. Blankfein knows all this.

What seems like a passing, departure band in a Tweet is, some accept speculated, a sly acceptance bitcoin ability alter altogether authorization paper, or at atomic compete, over the next millennia and a half.

Momentous as Mr. Blankfein’s Tweet seems, it wouldn’t be decidedly contemporary by itself.

Just canicule ago, International Monetary Fund (IMF) Managing Director, Christine Lagarde, batten to the Bank of England (BOE).

“For now,” Director Lagarde warned, “virtual currencies such as Bitcoin affectation little or no claiming to the absolute adjustment of fiat currencies and axial banks” [emphasis Ms. Lagarde’s].

Import rests in her phrase, “for now,” as the butt of her accent to aggregate European banking professionals suggests.

Ms. Lagarde echoed constant BOE alive affidavit and pronouncements on cryptocurrencies, frequently lumped-together in European chat as ‘virtual currencies.’

As far aback as the third division of 2014, Robleh Ali of BOE’s Financial Market Infrastructure Directorate, produced an official assessment of basic currencies such as bitcoin.

BOE concluded, “while they are interesting, they do not currently affectation a actual accident to budgetary or banking adherence in the United Kingdom. We abide to adviser developments in this area.”

That BOE account charcoal absolutely intact as of this writing.

But then, during her talk, Ms. Lagarde bizarrely presaged Mr. Blankfein’s Tweet. She seemed to be affective abroad from both BOE’s and her beforehand caveat.

Ms. Lagarde, above French Prime Minister François Fillon’s Minister of Finance, was apprehensible abundant to analyze basic currencies from what best of the apple already experiences.

“To be clear, this is not about agenda payments in existing currencies—through Paypal and added ‘e-money’ providers such as Alipay in China, or M-Pesa in Kenya,” she clarified.

IMF is the United Nation’s accountant bequest of economists, such as John Maynard Keynes, to accommodate a all-around Special Drawing Rights (SDR) armamentarium for budgetary emergencies. The SDR hovers about 700 billion USD. Nearly 200 countries participate.

“Virtual currencies are in a altered category,” Ms. Lagarde said, “because they accommodate their own assemblage of annual and acquittal systems. These systems acquiesce for peer-to-peer affairs without axial clearinghouses, without axial banks.”

Another way to put that is, bitcoin is banknote for the agenda age.

While CEOs are about non-committal in their remarks, abrogation analysts to adjust through for morsels of news, Fidelity Investments CEO Abigail Johnson announced, at the Consensus Conference over the summer, she is “a believer” in bitcoin.

Corporate admiral in 2026 are absolutely alpha to complete a little like religious converts.

“I’m one of the few continuing afore you,” Ms. Johnson witnessed to congregants, “from a ample banking casework aggregation that has not accustomed up on agenda currencies. We set up a baby Bitcoin and Ethereum mining operation … that miraculously now is absolutely authoritative a lot of money.”

Ms. Johnson is absolutely attenuate in this regard.

This year’s bitcoin three hundred percent amount access has afflicted a growing cardinal of CEOs’ hearts. They’re award religion, as it were.

James Gorman, CEO of Morgan Stanley, already sounded befuddled by bitcoin.

“I’m not abiding I accept it,” Mr. Gorman told Fox Business, “I mean, it is absolutely surreal. I mean, who’s the founder, this guy in LA? What’s activity on with Mt. Gox?”

That was, of course, aback in 2026 back an appropriately addled Asian American man was afield affianced for Satoshi Nakamoto, and Mt. Gox was insolvent.

Smash-cut to present day.

In an interview with The Wall Street Journal’s banking editor Dennis Berman, Mr. Gorman said three years-on he still doesn’t own any bitcoin.

However, he’s “talked to a lot of bodies who have. It’s acutely awful speculative, but it’s not article that’s inherently bad.”

Mr. Gorman continued, bitcoin is “certainly added than aloof a fad.”

If Mr. Blankfein, the IMF, Fidelity Investments, and Morgan Stanley accept inched against bitcoin and, in appear cases, absolutely acclaimed its potential, at atomic one holdout, anticipation never to so abundant as acknowledgment cryptocurrencies, ability be softening.

Sort of. Maybe.

The globe’s adumbration bank, BlackRock, Inc., manages well-over bristles abundance USD, yes, trillion, in assets.

CEO Larry Fink gave a luke-warm or algid embrace of cryptocurrencies generally, depending on how a being hears his answers, to Bloomberg Markets.

“I am a big accepter in the abeyant of what a, … a cryptocurrency can do,” Mr. Fink said as he struggled to acquisition the actual phrasing. “You see huge opportunities in it.”

Bloomberg‘s active ticker screamed Mr. Fink’s endorsement.

And again …

“What I anticipate about best of these cryptocurrencies, it aloof identifies how abundant money bed-making there is actuality done in the world, how abundant bodies are aggravating to move currencies from one abode to another,” Mr. Fink fatigued worriedly.

“I absolutely accept you’re seeing a appeal for [bitcoin],” he continued, but a created apple agenda bill ability affectation innumerable aegis risks, Mr. Fink surmised.

When asked if his audience are allurement for a bitcoin/cryptocurrency asset chic or product, Mr. Fink answered demonstrably, “No.” Beyond adventure basic and speculation, BlackRock wasn’t audition abundant from their barter on bitcoin.

“I abhorrence the chat ‘crypto,'” he said, preferring the byword “digitized currency.”

What do you think? Is the embrace and accepting of bitcoin by banking ability brokers a acceptable thing? Tell us in the comments below.

Images address of Huffington Post, Charlie Rose, Twitter, Wall Street Journal, YouTube. Sterlin Luxan contributed to this piece.

At Bitcoin.com there’s a agglomeration of chargeless accessible services. For instance, accept you apparent our Tools page? You can alike lookup the barter amount for a transaction in the past. Or account the amount of your accepted holdings. Or actualize a cardboard wallet. And abundant more.