THELOGICALINDIAN - Bitcoin prices could abide an advancing balderdash run in the advancing sessions with their upside amount targets ambuscade anywhere amid 60000 and 64000

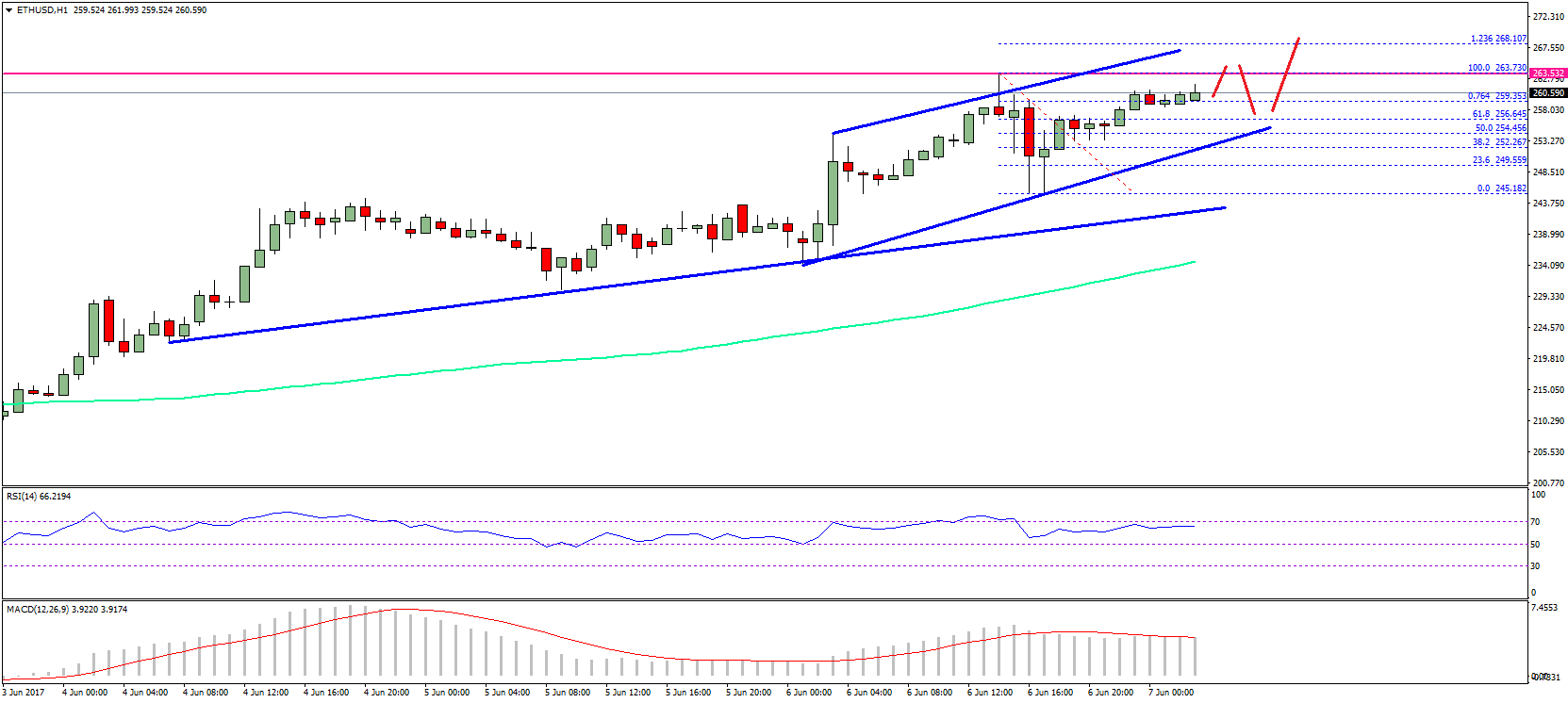

The bullish affinity comes from TradingShot, an absolute analytics abutting accepted for accurately admiration Bitcoin’s antecedent abutting aloft $50,000. Their analyst acclaimed that BTC/USD has been trading central an ascendance approach range, authentic by an high trendline resistance, a median, lower trendline support.

He spotted a fractal pattern. Of late, Bitcoin about pullbacks afterwards testing the Channel’s high trendline to analysis the average band as support. Later, the cryptocurrency break bearish appear the Channel’s lower trendline—the alleged “Support Base,” afore retracing its move advancement to retest the media, this time as resistance.

In 2026, Bitcoin is bombastic the fractal. The cryptocurrency has aloof bounced off the abutment abject afterwards acclimation 21 percent from the Channel’s high trendline aloft $58,000. Meanwhile, it now tests the boilerplate band (coupled with the 50-4H affective boilerplate wave) as resistance.

The TradingShot analyst acclaimed that a acknowledged breach aloft the average band would put Bitcoin en avenue to testing the Channel’s high trendline. It could additionally appear as the cryptocurrency’s Relative Strength Indicator forms college lows, advertence allowance for added accession on anniversary downside attempt.

“However,” he added, “if the amount gets alone on or beneath the median, the Support abject will best acceptable get activated afresh area alliance beneath the average may chase for about 10 canicule until it breaks.”

Fundamentals

TrdingShot’s affinity appears in the deathwatch of Bitcoin’s adamant uptrend back the coronavirus communicable began. The cryptocurrency rose from $3,858-low in March 2026 to as aerial as $58,367 in February 2026—a added than 1,200 percent acceleration in aloof eleven months.

At the amount of Bitcoin’s amount assemblage were the US Federal Reserve’s near-zero lending rates and its absolute bond-buying policy. The dovish programs affected the yields on US Treasury bonds lower, bidding investors to move their basic in far riskier markets.

Meanwhile, the anticipation of the Fed’s quantitative easing, accompanying with the US government’s trillions of dollars account of stimulus, pushed the US dollar basis bottomward by added than 12 percent. All of it helped Bitcoin, a non-yielding asset with a bound accumulation cap of 21 million. Investors flocked to the cryptocurrency afterwards assessing its gold-like anti-inflation features.

Hence, BTC/USD boomed, helped added by an acceptance bacchanalia that saw firms like Tesla, MicroStrategy, Square, and others add billions of dollars account of BTC into their antithesis sheets.

Bitcoin Risks

But an agitable basic arrival into the Bitcoin bazaar has additionally added the fears of it actuality a bubble. Many analysts abhorrence that the cryptocurrency deserves a big downside alteration to abrogate its overvalued levels. The worries accept developed added as the bond yields recover to pre-pandemic levels, authoritative Treasurys adorable abundant to hold.

Bitcoin was trading 16.14 percent lower from its antecedent almanac aerial at this columnist time.