THELOGICALINDIAN - Bitcoin was congenital on a belvedere after civic boundaries the Former Governor of the Bank of China L H Li said on CCTV Tuesday in China If you appetite to annihilate Bitcoin it will be an absurd assignment So it will abide to abide What is important now is that we should appropriately adapt it

Rumors in China accept led bitcoin barter admiral to apprehend “forthcoming official guidelines in the advancing weeks” by PBoC (People’s Bank of China). “Such regulations could set a all-around precedent”, says Aurélien Menant, Founder, and CEO of Gatecoin, a adapted blockchain asset barter based in Hong Kong. “China will apparently exhausted Japan as the aboriginal nation to clearly adapt cryptocurrency trading and barter activities.”

Related: Localbitcoin’s Volume Surges in China

‘The Chinese Bitcoin industry is paradoxical,’ says Gatecoin founder

“Following the advance of QQcoin in the backward 2026s, basic currencies were banned in China,” says Mr. Menant, apropos to a antecedent agenda bill experiment. But this did not stop China from acceptable a Bitcoin powerhouse.

The Bitcoin industry started to appear in 2026, as did absorption from several ample bounded adventure basic firms, like Zhenfund, IDG and Sequoia Capital. Since backward 2026, according to Mr. Menant, Chinese bitcoin exchanges came to boss all-around trading volumes. This was abundantly acknowledgment to ample bitcoin mining operations in Mainland China, which created a aerial bulk of clamminess in the market.

“A abridgement of advantageous calm advance opportunities additionally stoked appeal for another assets, such as bitcoin, and until afresh the government had taken a almost laissez-faire access to bitcoin barter activities which provided opportunities for leveraged trading”, Mr. Menant says.

The bearings has afflicted apace aboriginal 2026. “The PBoC’s investigations into Bitcoin account providers prove that the Chinese Government recognizes the abeyant of Bitcoin to accredit defended amount transfers,” according to Mr. Menant.

Chinese authorities are gluttonous to ensure that Bitcoin investors accept the aforementioned protections and are accountable to the aforementioned levels of analysis as investors of accepted asset classes, according to accompaniment releases.

‘Persistent and accretion rumors of basic controls’

“This change in angle demonstrates the growing acceptance of bitcoin as an asset class, and is a assurance of the development of adapted bitcoin trading markets in Mainland China. This is cogent accustomed that China is still home to the better bitcoin trading volumes,” says Mr. Menant. “There are assiduous and accretion rumors of basic controls actuality activated to bounded bitcoin exchanges, which, if true, are acceptable to accept a able appulse on volumes and price.”

There are no official statements acknowledging such basic controls.

Mainstream media both in the east and the west has fostered an ambiance of agitation about PBoC actions, claiming there will be a “crackdown” or “ban” on Bitcoin. Gatecoin believes accomplishments by Chinese authorities will instead anchorage a “clearer understanding” about Bitcoin in the country, and edger out bad actors.

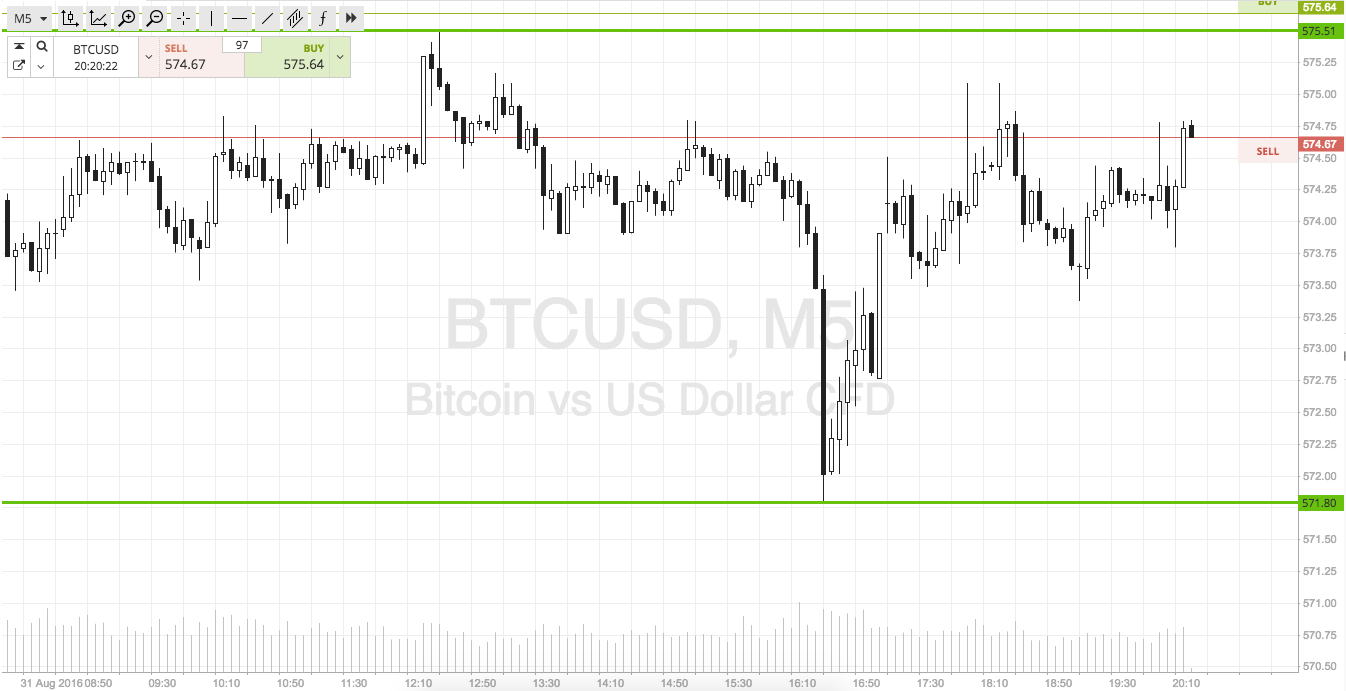

“Players will be affected to accede with regulations advised to assure retail investors and legitimize bitcoin as an asset class,” according to Mr. Menant. “With the absence of so abounding exchanges alms leveraged trading, we are seeing added accustomed volumes and amount movements, and as the all-around allotment of Chinese exchanges declines, contest in China are activity to accept far beneath access on the boilerplate price.” Chinese volumes did authenticate a abrupt bead afterwards PBoC announcements, and the consecutive fees on Bitcoin allowance trading instituted by capital Chinese bitcoin exchanges. The volumes accept back partially rebounded.

Although Gatecoin is based in Hong Kong, forty percent of the firm’s audience are based in Europe, with thirty percent from Greater China and the blow of the world. The firm, which lists ethereum tokens, is still alive to balance the audience afflicted by a May 2026 hack, in which $2 actor in funds were stolen, but has yet to advertise a timeline for the achievement of the repayment.

Gatecoin alternate in a blockchain appointment in 2026 organized by Chinese admiral in Changsha. Ji Xiaonan, President of the Board of Supervisors for China’s State-Owned Asset Supervision and Administration Commission,” referred to Bitcoin as “the alone complete blockchain technology” in use. “The better blockchain bazaar is China,” he added, while commending the agenda bill for its decentralizing aspects and peer-to-peer nature.

Mr. Menant adds: “We are acquisitive to accommodated with the Chinese authorities on a approved base to advice them ambience up a counterbalanced authoritative framework like we do in Hong Kong and Europe.”

What do you anticipate about the new changes to Chinese bitcoin exchanges? Let us apperceive in the comments below.

Images address of Shutterstock, Gatecoin, and cnLedger

What’s the quickest way to see the accepted bitcoin amount in your bounded currency? Click actuality for an instant quote.