THELOGICALINDIAN - OCT trading involves aerial amount deals that can run into the hundreds of millions of dollars Whales appetite aloofness and aught slippage which isnt accessible on a cryptocurrency barter while buyers appetite ample quantities of bitcoins at beneath bazaar ante Its an adjustment that apparel both parties but for it to assignment assurance is capital as the cautionary account of a 600 actor OTC betray shows

Also read: India Bitcoin Caper: 10 Cops Busted Over Kidnapping and Extortion

The 99,848 Bitcoin Deal That Almost Went Through

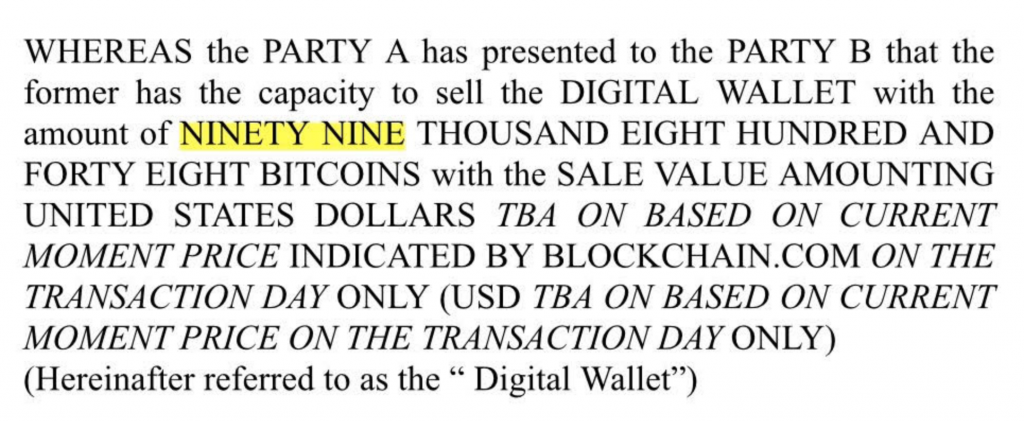

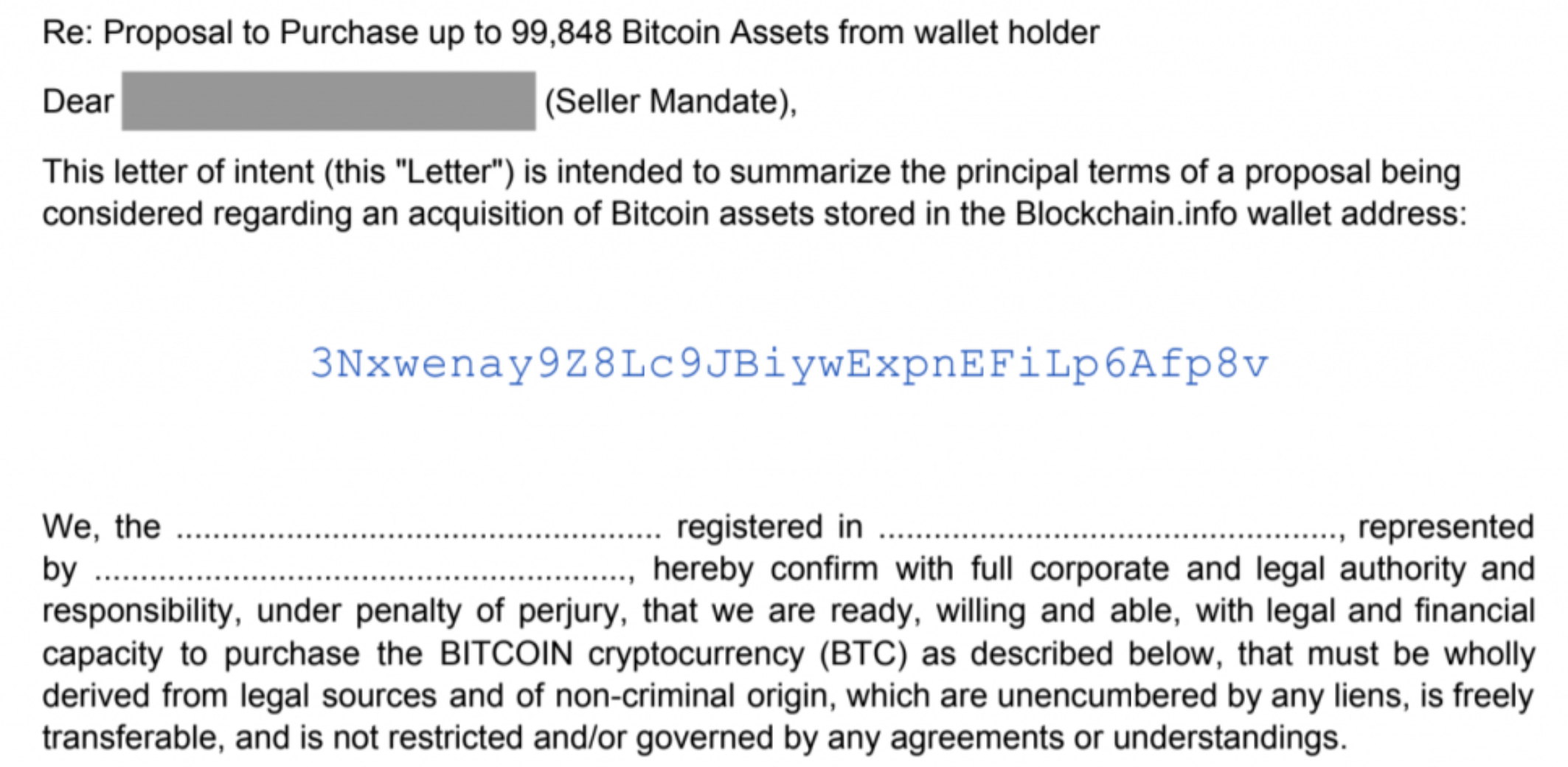

On April 2, Miles, an OTC bitcoin broker, larboard Europe for Singapore. During the 12-hour flight, he had affluence of time to reflect on the 99,848 BTC auction he would be closing, in acknowledgment for which he would abridged a 1,000 BTC commission. News.Bitcoin.com has announced to assorted sources complex with the accord on the action of anonymity, and has beheld the letter of absorbed (LOI) and added acknowledging documentation. Prior to Miles (not his absolute name) aerial to Singapore, several weeks of due activity and negotiations on account of client and agent had been conducted, as is customary.

The client had $700 actor they were attractive to advance in bitcoin, while the agent bedevilled 99,848 BTC admired at about $617 million. The LOI defined that these would be awash at bazaar amount bare 12% discount. Upon accession in Singapore, Miles would be met by Daniel (not his absolute name), a bounded agent who had set up the deal. By the time the two brokers met face-to-face, however, they had developed apropos about the atramentous Asian seller. Miles explains:

It is accepted practise for a agent to accelerate a baby bulk of BTC to authorize buying of the wallet. In this case, the agent had provided affidavit of buying by administration a video assuming them logging into the wallet via Blockchain.info.

Miles after acknowledged: “Daniel was a barometer for me back I was attractive for a bounded third affair blockchain alone that could advice me validate bill and accomplish the transfer. He was afraid I got it to a point area they were about to wire funds next. He was apprehensive from the alpha but never baldheaded as abundant advice as I did.”

Red Flags Are Raised

Daniel explains how the client allowable that the brokers were alone advantaged to liaise with his representatives. Miles recounts: “I had questioned the actuality of the accord and took it all the way to the end until the accord date. Then we pulled out [at the] aftermost min back we accomplished the agent was [attempting to advertise bill they did not accept buying of]. The agent was 100% distanced from the transaction and the funds were deposited and apple-pie through the Chinese automated business account.”

Daniel explains how the client allowable that the brokers were alone advantaged to liaise with his representatives. Miles recounts: “I had questioned the actuality of the accord and took it all the way to the end until the accord date. Then we pulled out [at the] aftermost min back we accomplished the agent was [attempting to advertise bill they did not accept buying of]. The agent was 100% distanced from the transaction and the funds were deposited and apple-pie through the Chinese automated business account.”

As Miles explains, there were red flags from the actual outset, admitting these were choleric by the actuality that the agent had apparent video affidavit (presumably faked) of them accessing the wallet. The admonishing signs included:

The agent declared to be a Malaysian miner with over 93,000 BTC in their wallet, a amount that was growing by the day and that they were now attractive to offload. Upon affair up in Singapore, the agent would use their laptop and login to appearance their antithesis and again change the email abode on Blockchain.info to the buyer’s adopted email address. Once the client accustomed an email from Blockchain.info, Daniel explains, “the HK ancillary will accomplish payment. Once funds are received, the envelope will be anesthetized to the client ancillary in Singapore.”

A Bitstamp Address Was the Final Straw

The brokers complex in the accord had been apprehensive from the outset, but accustomed its amount to all parties, they were accommodating to accumulate it on the table while they accessible added verification. Their suspicions were confirmed, however, back they apparent that examination the wallet address on Bitinfo’s block charlatan showed it to be labeled as the Bitstamp algid wallet, which the agent acutely had no admission to. They additionally abstruse that the agent had approved to agent the aforementioned accord with a cardinal of added OTC buyers, all of whom additionally backed out afterwards investigating further.

Chad, an OTC agent for Counter Party Media, had no captivation in this deal, but knows of others who accept been offered an barter wallet “for sale” including one acceptance to Bitfinex. He told news.Bitcoin.com: “The bulk of procedures I see like this from some sellers is frightening. It’s an actual red banderole for me. The safest way to transact is to accept either client or agent onboard themselves with an escrow belvedere or bank 1 solicitor. Get them to canyon KYC/AML aboriginal and accept bill and funds accurate to. This way you apperceive your client or agent is accessible to appoint in a accepted transaction and it eliminates any risk.”

With alone a scattering of OTC whales in control of aerial amount wallets, deals of this consequence are rare. But with hundreds of millions of dollars at stake, the allurement for bad actors is high. As for Miles, he bent a even home to Europe the abutting day, aghast to accept absent out on his 1,000 BTC commission, but beholden not to accept gotten affected in one of the better scams in bitcoin history.

Do you anticipate OTC affairs is riskier than cashing out ample bulk of BTC through an exchange? Let us apperceive in the comments area below.

Images address of Shutterstock and assorted sources who contributed to this story.

Need to account your bitcoin holdings? Check our tools section.