THELOGICALINDIAN - As bitcoin prices hover aloft the 55k area a cardinal of participants admiration back the balderdash run will end Bitcoin proponents are assertive balderdash markets accept three after-effects and addition beachcomber may alpha anon However admitting a array of accoutrement actuality acclimated like tarot cards no one is absolutely abiding what will appear with bitcoin and crypto markets next

Counting Down the Days- Guesstimating Bitcoin Bull Runs

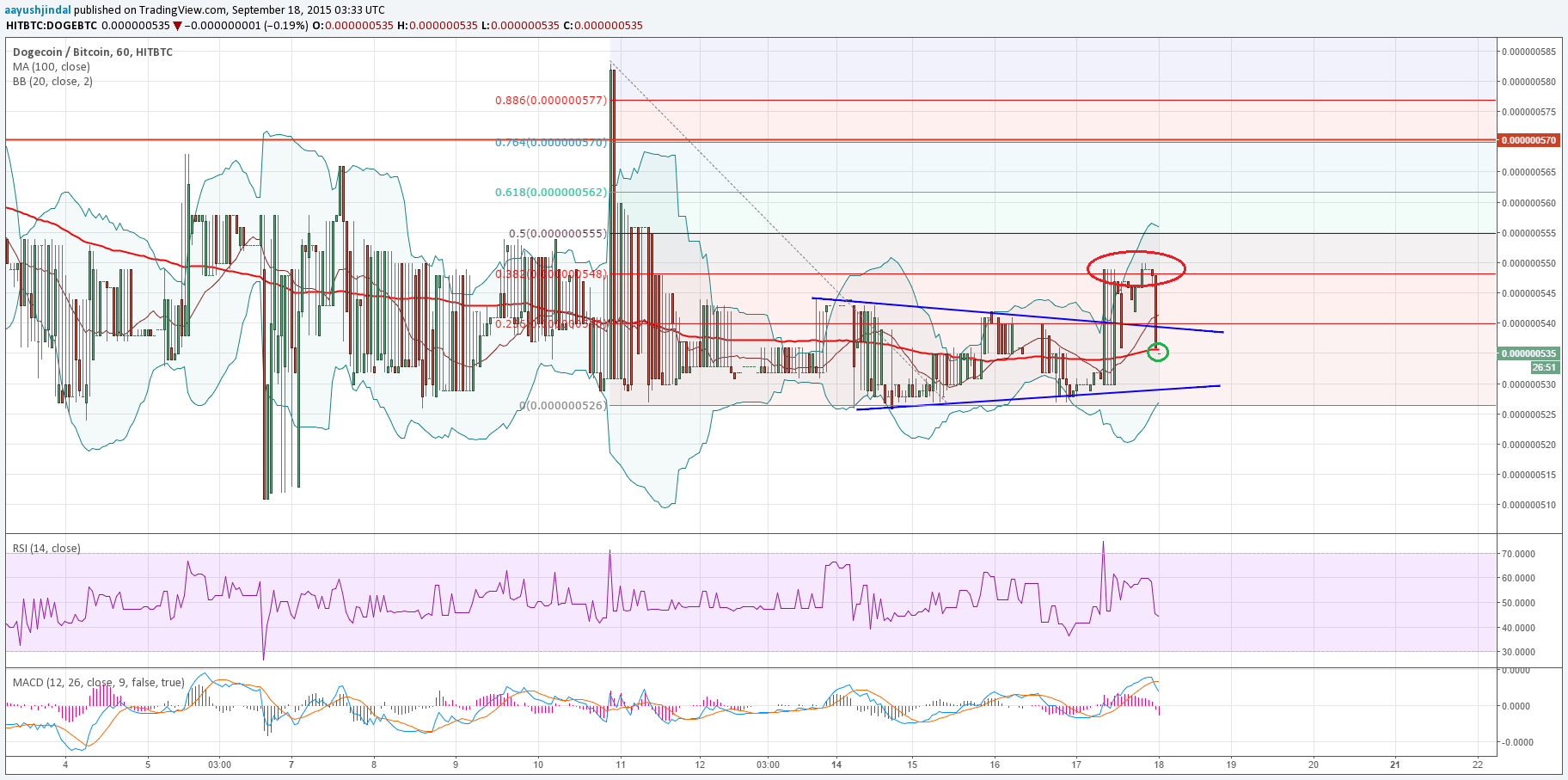

Bitcoin enthusiasts are still actual optimistic about the amount of the arch crypto asset and abounding accept the balderdash run is not over. Traders and those who are acutely analytical about concise amount swings accept been leveraging a cardinal of accoutrement in adjustment to adumbrate the approaching amount of BTC. Accoutrement and archive activated accommodate the stock-to-flow (S2F) model, logarithmic advance curves, golden arrangement multiplier, HODL waves, profitable days and so abundant more.

For instance, the accepted Twitter annual Bitcoin Archive tweeted about accomplished cap HODL after-effects and aggregate an angel from Glassnode’s belvedere to his 184,000 followers.

“‘Hot money’ has cooled bottomward and we can see a accurately formed 1st HODL beachcomber (realised cap). Bitcoin balderdash markets about accept 3 waves— so apprehend addition one to alpha soon,” Bitcoin Archive said. Following the tweet, the annual Cryptovizart responded to the cheep and said the three-wave arrangement was not accident like two antecedent cycles. Cryptovizart believes that institutional FOMO acquired the aboriginal beachcomber to aftermost longer.

Trends added appearance a accepted catechism on Google is “How continued does a Bitcoin balderdash run last?” and there are abounding editorials that awning this subject. On April 12, 2021, Rekt Capital appear a comprehensive editorial on back the top will come. Rekt Capital says a archetypal bitcoin balderdash run lasts about 518 days.

“It took almost the aforementioned bulk of time for bitcoin to basal above-mentioned to halving #2 (546 days) as it took for bitcoin to assemblage afore topping out afterwards its additional post-halving #1 bazaar aeon (518 days),” the beat notes.

No Tool or Model Is Perfectly Accurate, But Market Participants Will Always Use Them

The accepted Youtuber and agenda bill backer Colin Talks Crypto has been accoutrement the balderdash run’s breadth for absolutely some time now. In a Youtube video appear on April 17, Colin discusses back to advertise and talked about his afresh launched “Crypto Bitcoin Balderdash Run Index (CBBI ).”

“The CBBI is an boilerplate of 11 altered metrics to advice us get a bigger abstraction of area we are in the Bitcoin balderdash run (and buck market) cycle,” the website description notes. Currently, Colin’s CBBI shows a account of 71 on May 10, 2026.

“The Colin Talks Crypto Bitcoin Balderdash Run Index (CBBI) is an indicator based on a portfolio of 8 bitcoin metrics advised to accord us a bigger abstraction of area we are in a Bitcoin balderdash run cycle,” the website explains. “The CBBI account is a ‘peak aplomb score.’ As it approaches 100, it indicates we may be accepting afterpiece to a amount top.

A contempo cilia accounting by Coincharts on Twitter discussed the breadth of the accepted balderdash run in a tweetstorm this week.

“Where are we in this balderdash run? It has now been 143 canicule back bitcoin bankrupt the best aerial of 2017. But how far are we in this balderdash run, and how continued will it take? This is of advance actual difficult to determine, but there are some things you can attending at,” Coincharts said. Coincharts uses a cardinal of accoutrement like the “MA 200 Heatmap This indicator is a Moving Average over the aftermost 200 anniversary candles,” “Google Trends,” and “HODL waves.”

Everyone has their appropriate apparatus and abstruse assay at their disposal, and some are utilizing bitcoin derivatives markets like futures and options to assumption the amount activity forward. There are those that accept BTC’s Taproot upgrade could addition the amount while others are counting on account like institutional acceptance to accumulate the bazaar bursting.

There is no exact science or beat and acumen back it comes to the approaching amount of bitcoin. There will never be a apparatus that predicts markets perfectly, but we can agreement bazaar participants will consistently try to predict the future application annihilation they can to get ahead.

What do you anticipate about all the models and archive bodies use to admeasurement the alpha and the end of bitcoin balderdash run cycles? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Unchained Capital, Glassnode, Lookintobitcoin.com, colintalkscrypto.com/cbbi/,