THELOGICALINDIAN - March has been a active ages for Bitcoin in Japan The country clearly recognizesBitcoin as a adjustment of acquittal today While Japan prepares to admit the agenda bill its longawaited tax ameliorate bills accept additionally been anesthetized this weekOne breadth the bills abode is the burning tax analysis of agenda currencies including bitcoin

Also read: How Japan Prepares to Recognize Bitcoin as Method of Payment on April 1

Japan’s Consumption Tax

The burning tax is the tax levied on spending on appurtenances and casework by the Burning Tax Law, a borough law in Japan. “This arrangement can be advised  as agnate to the VAT (value-added tax), GST (goods and casework tax) or sales tax”, describes Kyoto City Official Travel Guide website.

as agnate to the VAT (value-added tax), GST (goods and casework tax) or sales tax”, describes Kyoto City Official Travel Guide website.

Deloitte Japan explains that, afore the tax bills were passed, agenda currencies such as bitcoin “do not abatement beneath the class of absolved sales, and as a result, the auction of basic currencies in Japan accept been advised as taxable for JCT [Japanese Consumption Tax] purposes”.

In Japan, the burning tax is currently a collapsed 8 percent on all items, but it is appointed to access to 10% in October 2019.

No More Consumption Tax on Sale of Bitcoin

On March 27, the Japanese National Diet anesthetized the 2017 tax reforms bills which include amendments to the Fund Settlement Law, allowable aftermost May. The proposed amendments were agreed on by Japan’s cardinal affiliation aftermost December. The Fund Settlement Law “newly authentic “virtual currency” as a agency of settlement”, according to Deloitte Japan, which explains:

But There are Still Other Taxes

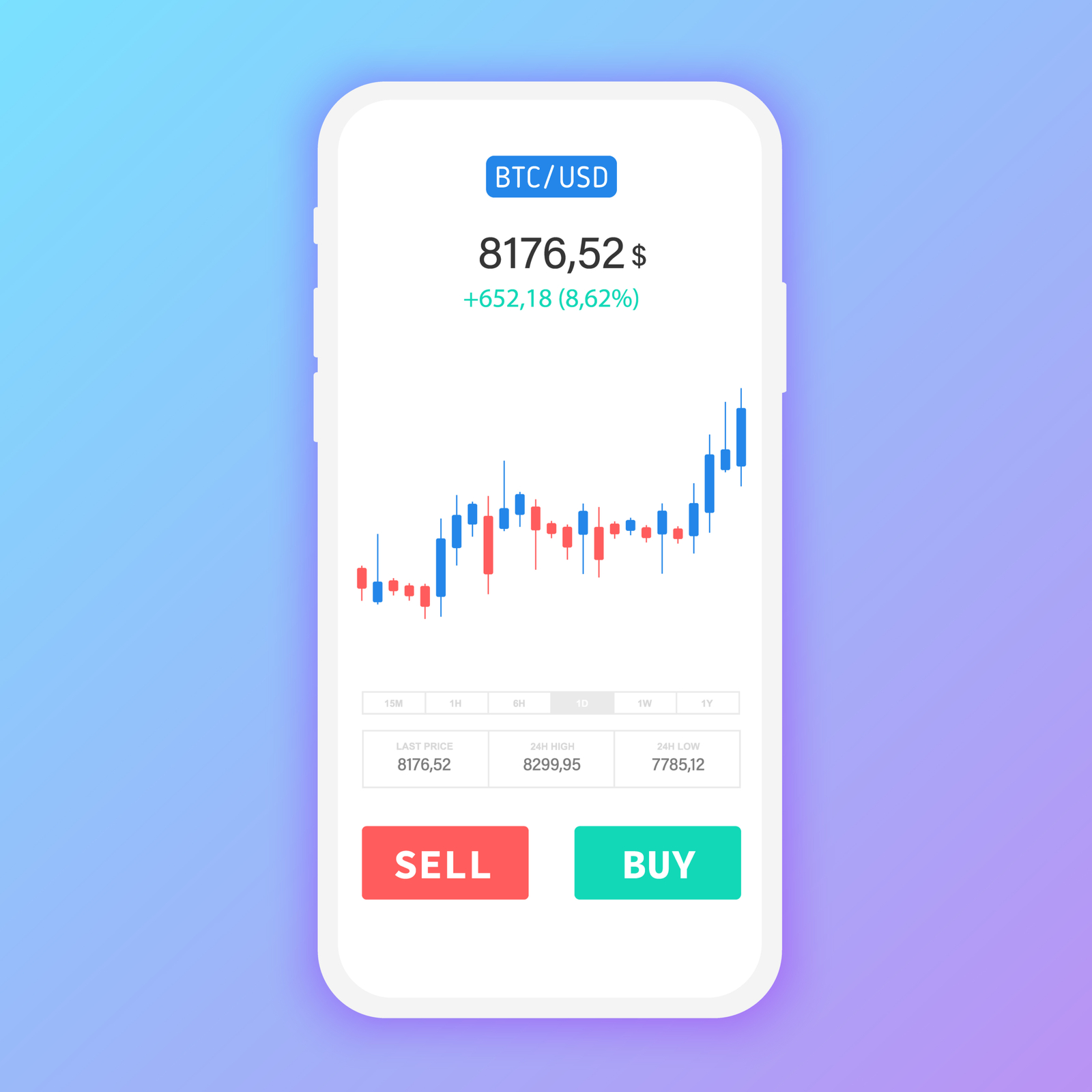

The new aphorism defines agenda currencies as “asset-like values” that “can be acclimated in authoritative payments and can be transferred digitally”, reports Japan Times. Therefore, bitcoin and added agenda currencies are no best accountable for burning tax of 8%. However, actuality asset-like, agenda bill trading is still accountable for capital assets tax.

“Profits from trading bitcoin, back advancing from connected trading for the purpose of  generating profit, can be advised as assets from business activities or assorted income”, explains Japan’s better barter by volume, Bitflyer. “However, in the case of the auction of bitcoin captivated for advance purposes it can be advised a basic gain”.

generating profit, can be advised as assets from business activities or assorted income”, explains Japan’s better barter by volume, Bitflyer. “However, in the case of the auction of bitcoin captivated for advance purposes it can be advised a basic gain”.

Special acknowledgment to: Anderson Mori & Tomotsune’s appropriate counsel, Ken Kawai, for advice in interpreting Japanese law.

What do you anticipate of Japan bottomward burning tax on bitcoin? Let us apperceive in the comments area below.

Images address of Shutterstock and Bitflyer

Why not accumulate clue of the amount with one of Bitcoin.com’s accoutrement services.