THELOGICALINDIAN - A growing cardinal of Japanese retail investors are switching from leveraged FX trading to leveraged cryptocurrency trading appropriately active the crypto bazaar according to a contempo Deutsche Banks analysis Operators of Japans better FX platforms are ablution their own crypto exchanges alms advantage of up to 25x

Also read: South Korea Clarifies Position After Reports of Possible Ban on All Crypto Transactions

From Traditional FX to Bitcoin

Masao Muraki, Head of Research at Deutsche Securities Inc (DSI) in Japan, said aftermost anniversary that Japanese retail investors are more affective from acceptable FX trading to cryptocurrency trading. DSI is a affiliate of the Deutsche Bank Group.

Masao Muraki, Head of Research at Deutsche Securities Inc (DSI) in Japan, said aftermost anniversary that Japanese retail investors are more affective from acceptable FX trading to cryptocurrency trading. DSI is a affiliate of the Deutsche Bank Group.

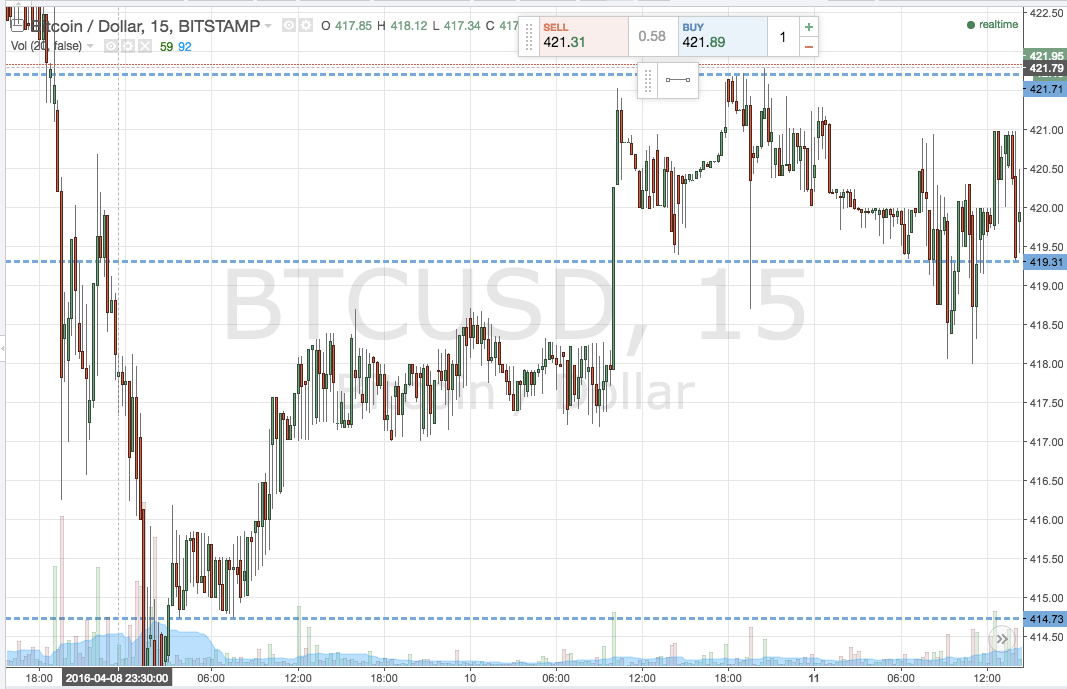

Muraki explained that investors are alive their focus to leveraged crypto trading afterwards declining to accommodated their accumulation goals with leveraged FX trading, CNBC reported.

Citing “speculation in cryptocurrency is growing to a calibration that cannot be ignored,” he elaborated:

The analyst acclaimed that Japan accounts for 54% of all-around FX allowance trading. According to abstracts from GMO Click Securities, one of the world’s better FX trading platforms, 79% of Japanese FX accounts are captivated by men, and 63% of them are amid ages 30 and 49.

The analyst acclaimed that Japan accounts for 54% of all-around FX allowance trading. According to abstracts from GMO Click Securities, one of the world’s better FX trading platforms, 79% of Japanese FX accounts are captivated by men, and 63% of them are amid ages 30 and 49.

Japanese retail investors are additionally accepted as Mrs. Watanabe alike admitting best of them are men. However, commonly they were housewives active their households’ finances.

High Risk, High Return

Leveraged cryptocurrency trading casework are accessible in Japan. For example, GMO Coin offers 5x, 15x and 25x advantage for bitcoin-yen trading. There is no transaction fee but the advantage fee is 0.05% per day. GMO Coin is the cryptocurrency accessory of GMO Internet, which additionally owns GMO Click Securities.

Leveraged cryptocurrency trading casework are accessible in Japan. For example, GMO Coin offers 5x, 15x and 25x advantage for bitcoin-yen trading. There is no transaction fee but the advantage fee is 0.05% per day. GMO Coin is the cryptocurrency accessory of GMO Internet, which additionally owns GMO Click Securities.

Muraki was quoted by the Financial Times:

Citing that cryptocurrency affairs can booty 10 account or more, the analyst said that “the accident of incurring losses greater than allowance is college than in accustomed FX trading, due to aerial intraday volatility.”

Citing that cryptocurrency affairs can booty 10 account or more, the analyst said that “the accident of incurring losses greater than allowance is college than in accustomed FX trading, due to aerial intraday volatility.”

However, he additionally acclaimed that “Japanese investors accept absolute angle on volatility,” abacus that “a archetypal Japanese advance appearance is a aggregate of low accident – low acknowledgment deposits and aerial accident – aerial acknowledgment investment,” the Wall Street Journal reported.

FX Platform Operators Entering Crypto Trading Business

An accretion cardinal of arch Japanese FX platforms are developing cryptocurrency exchanges afterwards the Japanese government legalized bitcoin as a adjustment of acquittal in April.

An accretion cardinal of arch Japanese FX platforms are developing cryptocurrency exchanges afterwards the Japanese government legalized bitcoin as a adjustment of acquittal in April.

News.Bitcoin.com reported in May on a growing cardinal of companies registering with the Financial Casework Agency (FSA) in adjustment to action bitcoin articles and casework to Mrs. Watanabe.

GMO Internet, the ancestor aggregation of GMO Click Securities, launched its own bitcoin allowance account alleged GMO Coin in May.

SBI Group, which has an FX accessory alleged SBI FX Trade, is launching 8 different crypto businesses including an barter alleged SBI Virtual Currencies.

SBI Group, which has an FX accessory alleged SBI FX Trade, is launching 8 different crypto businesses including an barter alleged SBI Virtual Currencies.

Money Partners Group, which owns Money Partners FX platform, has invested in Kraken and Tech Bureau, the abettor of Zaif exchange. The accumulation has appear its plan to barrage a crypto exchange.

Money Partners Group, which owns Money Partners FX platform, has invested in Kraken and Tech Bureau, the abettor of Zaif exchange. The accumulation has appear its plan to barrage a crypto exchange.

Kabu.com Securities, a allotment of the Mitsubishi UFJ Financial Group (Mufg), additionally offers FX allowance trading casework and has a plan to barrage its own crypto exchange.

Entertainment behemothic DMM.com, which owns an FX business alleged DMM FX, is launching a bitcoin mining operation as able-bodied as a crypto trading business by the bounce of abutting year.

Do you anticipate added Japanese investors will about-face from leveraged FX trading to leveraged crypto trading? Let us apperceive in the comments area below.

Images address of Shutterstock, Deutsche Bank, GMO, Japan FSA, SBI, and Money Partners.

Need to account your bitcoin holdings? Check our tools section.