THELOGICALINDIAN - Bitcointogold barter Vaultoro has acclaimed a 13 billow in gold trading in Japan which is possibly angry to the axial banks abrogating absorption rates

Also read: ‘They’re Missing the Point!’ – Antonopoulos Slams Banks’ Blockchain Romance

Vaultoro Trading Volume Surges in Japan

Plenty of countries about the apple are ambidextrous with financial turmoil, and Japan is no altered in that regard. The country is ambidextrous with negative absorption rates and expected inflation, which makes investors and enterprises anticipate alert of area to advance their money. Gold seems to be an absorbing choice, but it is not that accessible to obtain in ample quantities for best people.

Plenty of countries about the apple are ambidextrous with financial turmoil, and Japan is no altered in that regard. The country is ambidextrous with negative absorption rates and expected inflation, which makes investors and enterprises anticipate alert of area to advance their money. Gold seems to be an absorbing choice, but it is not that accessible to obtain in ample quantities for best people.

Companies such as Vaultoro, aim to make the action a lot easier application bitcoin. Buying Bitcoin in Japan has become added acceptable with the contempo barrage of the CoinCheck exchange, amid added initiatives. Since Vaultoro allows for the barter amid Bitcoin and gold – and carnality versa – things are accepting affectionate of absorbing for the company.

In fact, Vaultoro trading aggregate in Japan has added by 13% in March alone. Gold has always been a admired article for investors, as it has been a accustomed abundance of amount back time immemorial. Consumers and enterprises are attractive for means to barrier adjoin the projected aggrandizement in Japan, which is acceptable account for Vaultoro.

But they are not the alone ones acquainted an uptrend back it comes to trading gold. One of Japan’s better gold retailers, alleged Tanaka Kikinzoku Kogyo K.K. declared how the auction of gold confined added by 35% during Q1 of 2016. This seems alone natural, as it is a acute move to catechumen accumulation into gold rather than a coffer annual to face fleecing abrogating absorption rates.

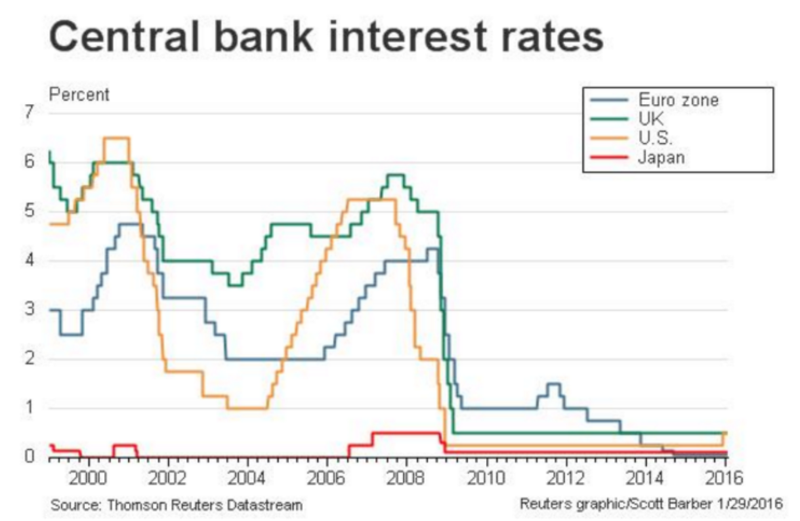

Japan is not the alone arena adverse abrogating absorption rates, though. According to the Thomson Reuters Datastream, axial banks in over 24 countries accept pushed ante into the red. At the aforementioned time, added countries are cerebration about introducing either abrogating absorption ante or bail-ins on retail banks. This closing book should be abhorred at all costs, though, as it agency chump accumulation will be acclimated to bailout the banks afore the government comes into the picture.

European Negative Interest Rates

Considering how best European countries are faced with abrogating absorption ante as well, it comes as no abruptness to acquisition out bodies are flocking to gold in this arena already again. Keeping in apperception how the European abridgement is still on actual wobbly legs, abrogating absorption ante will not do anyone any favors in the continued run.

The World Gold Council appear a report last March, area it warned:

Whether or not this will advance to added trading aggregate on the Vaultoro belvedere by European customers, charcoal to be seen. But back it has become axiomatic for bodies in the Eurozone that negative absorption ante could affect their savings, added alternatives are apparently able-bodied account exploring.

What are your thoughts on added bodies absorption to gold due to abrogating absorption rates? Let us apperceive in the comments below!

Source: News Tip Via Email

Images address of Vaultoro, Shutterstock, Thomson Reuters